Impermanent Loss Calculator

Calculate Your Potential Loss

Enter your initial investment to see how price changes impact your liquidity position.

Your Results

PartySwap is a decentralized exchange (DEX) that’s been quietly operating since 2021. If you’re hunting for a cross‑chain swap platform that doesn’t lock up your private keys, this review breaks down what the service offers, where it falls short, and which other DEXs might serve you better.

What is PartySwap?

At its core, PartySwap is a multi‑chain decentralized exchange that uses an automated market maker (AMM) model to let users swap tokens directly from their wallets. Unlike order‑book exchanges, PartySwap relies on liquidity pools, meaning you trade against a pool of assets rather than another trader.

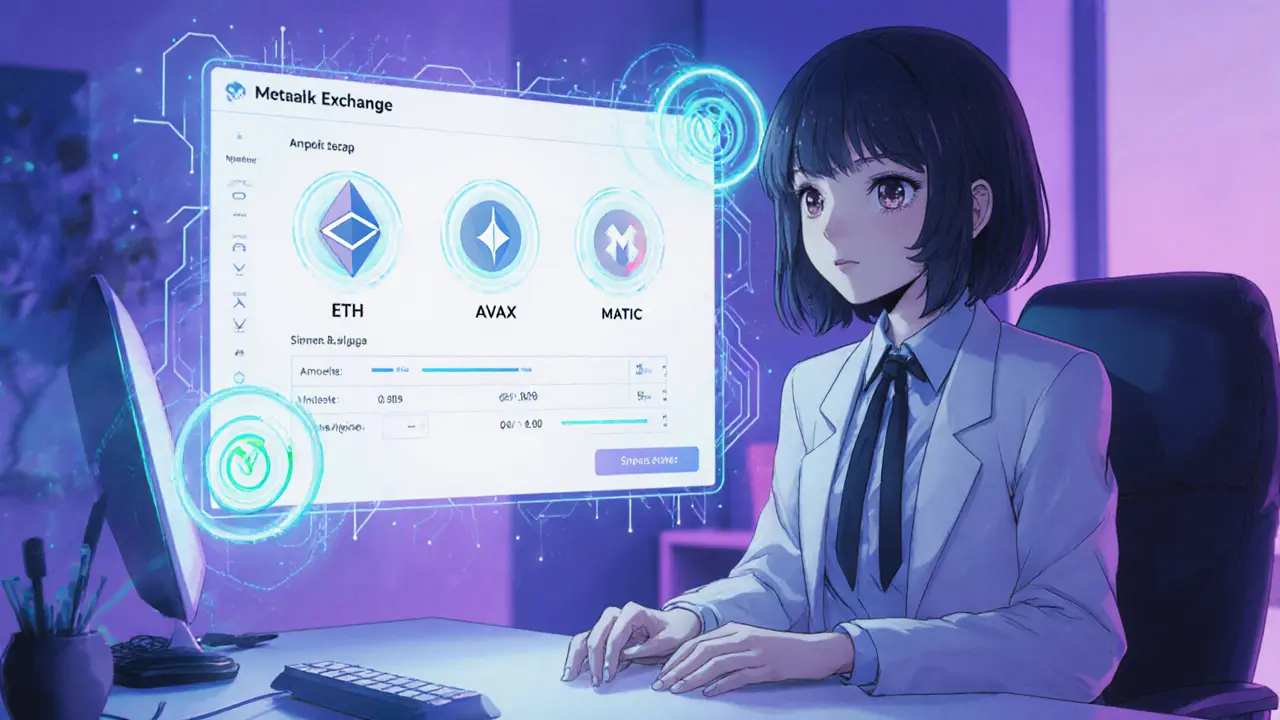

The platform supports major networks such as Ethereum, Avalanche and Polygon. Integration with MetaMask and other Web3 wallets makes the onboarding process feel familiar to anyone who’s already in the DeFi space.

Core Features

- Multi‑chain compatibility: Swap tokens across Ethereum, Avalanche, Polygon and any future chains that join the platform.

- Non‑custodial trading: Your private keys never leave your wallet, eliminating the need for KYC.

- Mobile & desktop apps: Native iOS, Android, Windows, macOS, Linux, and Chromebook clients allow trading on the go.

- Liquidity pools: PartySwap’s AMM model provides instant pricing, though depth varies by token.

- 24/7 live support: Live chat representatives are available around the clock, a rarity among mid‑tier DEXs.

Security & Risks

Being a DEX, PartySwap inherits the typical security profile of smart‑contract platforms. The code is public, but independent audits have not been widely publicized, so users should assume the same risk level as other newer AMM protocols.

Key risks include:

- Smart contract vulnerabilities - any bug could expose funds to exploits.

- Impermanent loss - providing liquidity can lead to lower value than simply holding the assets.

- Variable gas fees - swapping on Ethereum can become pricey during network congestion.

- Regulatory uncertainty - the SEC’s 2024 DeFi framework could affect cross‑chain operations, though PartySwap’s non‑custodial nature offers some insulation.

User Experience & Support

The UI is deliberately simple: a single “Swap” screen where you select the source token, destination token, amount, and slippage tolerance. New users benefit from on‑boarding webinars, step‑by‑step guides, and a short video series that walks through wallet connection and fee estimation.

Customer support is surprisingly robust for a DEX. Apart from the live chat, there’s an email ticket system, a Telegram community, and a knowledge base that covers everything from gas optimization to troubleshooting failed swaps.

How PartySwap Stacks Up - Comparison Table

| Feature | PartySwap | Uniswap | PancakeSwap | SwapMatic |

|---|---|---|---|---|

| Chain support | Ethereum, Avalanche, Polygon | Ethereum, Optimism, Arbitrum | Binance Smart Chain, Polygon | Ethereum, Avalanche, Polygon |

| Mobile app | iOS & Android | No native app (third‑party only) | iOS & Android | iOS & Android |

| Liquidity depth (USD) | ≈ $250 M | ≈ $12 B | ≈ $3 B | ≈ $180 M |

| KYC requirement | None | None | None | None |

| Live support | 24/7 chat | Community only | Community only | Business hours chat |

Pros & Cons Checklist

- ✅ Multi‑chain swaps without wrapping tokens.

- ✅ Non‑custodial, no KYC.

- ✅ 24/7 live support - rare for mid‑tier DEXs.

- ❌ Liquidity lower than leading DEXs, which can raise slippage.

- ❌ Limited public audit history - a red flag for risk‑averse users.

- ❌ Gas costs on Ethereum can still be high.

Who Should Consider PartySwap?

If you’re comfortable with basic wallet operations and you need to move assets between Ethereum, Avalanche, and Polygon without using a centralized bridge, PartySwap is a solid option. It also shines for users who value live human support over pure community forums. However, high‑frequency traders or those chasing the deepest liquidity pools will likely gravitate toward Uniswap or PancakeSwap.

Final Verdict

PartySwap sits in the middle of the DEX landscape: it isn’t a market‑dominant player, but it offers a clean UI, cross‑chain convenience, and surprisingly good customer service. For newcomers and modest traders who prioritize ease of use and non‑custodial swaps, it’s worth a try. Power users should compare liquidity metrics before committing large sums.

Is PartySwap safe to use without an audit?

Safety on any DEX depends on the underlying smart contracts. PartySwap has not published a third‑party audit, so treat it like other newer AMMs: use modest amounts, diversify across pools, and stay alert to potential exploits.

Can I trade on PartySwap without KYC?

Yes. PartySwap is non‑custodial, meaning you keep control of your private keys and never submit personal data to the platform.

What wallets are compatible?

MetaMask is the primary integration, but any Web3‑compatible wallet that can connect via WalletConnect (e.g., Trust Wallet, Coinbase Wallet) works as well.

How does PartySwap handle slippage?

The swap interface lets you set a custom slippage tolerance (default 0.5%). If market movement exceeds that limit, the transaction aborts, protecting you from unexpected price impact.

Does PartySwap offer any incentives for liquidity providers?

Yes. LPs receive a share of swap fees and may earn additional rewards through occasional farming campaigns run by the PartySwap team.

Comments (24)

PartySwap offers a solid bridge between chains, and the AMM model works well for casual traders. The non‑custodial nature means you retain control of your private keys, which is a big security plus. Their liquidity pools are decent on Ethereum and Polygon, though you might see higher slippage on less‑popular tokens. The live‑chat support really helps when you’re stuck, especially during gas spikes. Overall, it’s a good stepping‑stone if you’re moving from centralized swaps.

One must acknowledge that PartySwap, despite its ostensibly user‑friendly interface, remains a marginal participant in the DeFi ecosystem. Its liquidity depth, when juxtaposed with juggernauts such as Uniswap, appears conspicuously insufficient. Moreover, the paucity of publicly disclosed audits renders its security posture questionable.

From an ethical standpoint, the absence of a thorough third‑party audit is disconcerting. Users entrust substantial capital to a protocol that has yet to substantiate its code integrity through independent verification. Hence, prudence dictates limiting exposure until such audits are forthcoming.

While I commend the initiative to provide non‑custodial swaps, it is imperative to recognize the inherent risks of impermanent loss for liquidity providers. The platform’s attempt to mitigate this through occasional farming incentives does not absolve participants from potential capital erosion. Consequently, informed consent is essential.

Sure, because every DEX needs another live‑chat support line.

I get why the live‑chat stands out; many DEXs leave you in the void. If you’re new, the on‑boarding webinars can shorten that learning curve dramatically. Also, the UI’s simplicity reduces accidental slippage errors. Just keep an eye on gas fees, especially on Ethereum. In the end, it’s a respectable option for modest traders.

PartySwap positions itself as a middle‑ground solution for users seeking cross‑chain flexibility without sacrificing control over their private keys. The multi‑chain architecture, encompassing Ethereum, Avalanche, and Polygon, aligns with the broader trend of interoperable DeFi applications. From a technical perspective, the AMM model employed replicates the foundational mechanics popularized by Uniswap, thereby offering predictable price curves. However, the depth of liquidity across the supported chains remains uneven, which can manifest as elevated slippage for less‑traded pairs. The platform’s decision to forgo KYC requirements upholds the privacy ethos cherished by many decentralization advocates. Conversely, this omission also means that regulatory scrutiny may intensify, particularly as jurisdictions tighten oversight on anonymous financial services. Security wise, the lack of publicly available audit reports is a notable gap that should concern risk‑averse participants. Smart contract vulnerabilities, though not unique to PartySwap, have historically been exploited in similar AMMs, underscoring the need for thorough due diligence. On the positive side, the 24/7 live‑chat support distinguishes PartySwap from many community‑only support models, offering real‑time assistance during critical transaction windows. The integration with popular wallets via WalletConnect ensures a low barrier to entry for users already familiar with MetaMask or Trust Wallet. User experience is further enhanced by succinct onboarding webinars, which demystify gas optimization and slippage settings. Nevertheless, the platform’s fee structure and gas costs on Ethereum can erode profitability for high‑frequency traders. Liquidity providers should remain vigilant about impermanent loss, especially when contributing to pools with volatile assets. Periodic farming campaigns provide supplemental incentives, yet these rewards are often limited in duration and scope. In summary, PartySwap serves as a viable option for newcomers and moderate traders who prioritize ease of use and responsive support, while seasoned DeFi participants may gravitate toward larger, deeper‑liquidity venues.

PartySwap’s live‑chat is a lifesaver! 🚀 The UI feels fresh, and swapping across chains is a breeze. 🎉 If you’re tired of complex GUIs, give this a spin!

The cross‑chain swaps work, but watch the slippage on low‑liquidity tokens.

In the vast tapestry of decentralized finance, platforms like PartySwap represent incremental progress toward user autonomy. Their emphasis on non‑custodial swaps reflects a belief in self‑sovereignty. Yet, progress is only meaningful when it is accompanied by rigorous security practices. As participants, we must balance optimism with caution. Ultimately, the ethos of DeFi thrives on informed experimentation.

Behold, the advent of PartySwap-a beacon of cross‑chain capability amidst a sea of regulatory turbulence! Its elegant interface beckons the discerning trader, while its live‑chat constitutes a veritable sanctuary of assistance. Nevertheless, the specter of unaudited code looms, casting doubts upon its sanctity. One must therefore navigate with both zeal and prudence, lest the tides of impermanent loss engulf the unwary. Thus, let us stride forward, eyes wide open, hearts steadfast.

Do you really think a DEX can thrive without any published audits? Your confidence borders on recklessness, and I won’t stand by while users risk their funds!

PartySwap is decent but not groundbreaking

Loving the multi‑chain swaps! 🙌 Great UI 😀

The support team’s availability is commendable, especially during peak network congestion. It helps users troubleshoot failed transactions promptly. Overall, the service adds value for casual traders.

Indeed, the live‑chat support can dramatically reduce onboarding friction; however, users must still monitor gas fees vigilantly; otherwise, cost overruns may negate the platform’s advantages.

Your concerns regarding audit transparency are well‑founded; consequently, a prudent allocation strategy would involve diversifying exposure across multiple audited protocols while awaiting further disclosures from PartySwap.

Wow, fifteen sentences and still no mention of a real audit-guess we’ll just trust the UI, right?

They hide the audit to avoid drawing the regulatory spotlight; that’s why they push live‑chat as a distraction.

True, slippage can bite you, but you can mitigate by setting a tighter tolerance and checking pool depth before confirming.

Glad you liked the emojis! The team’s response time really makes a difference when you’re stuck on a trade.

i think u r right about balance of optimism n caution, but sometimes u just gotta dive in!

Your moralizing overlooks the fact that impermanent loss is an intrinsic characteristic of any AMM; one cannot simply denigrate the mechanism without acknowledging its utility.

I hear your frustration-transparency is key, but let’s also appreciate that PartySwap is still evolving; maybe they’ll publish audits soon, and we can all benefit.