Nigerian Crypto Exchange License Checker

Verify Exchange License Status

Check if your crypto exchange is legally licensed in Nigeria under the 2025 SEC regulations

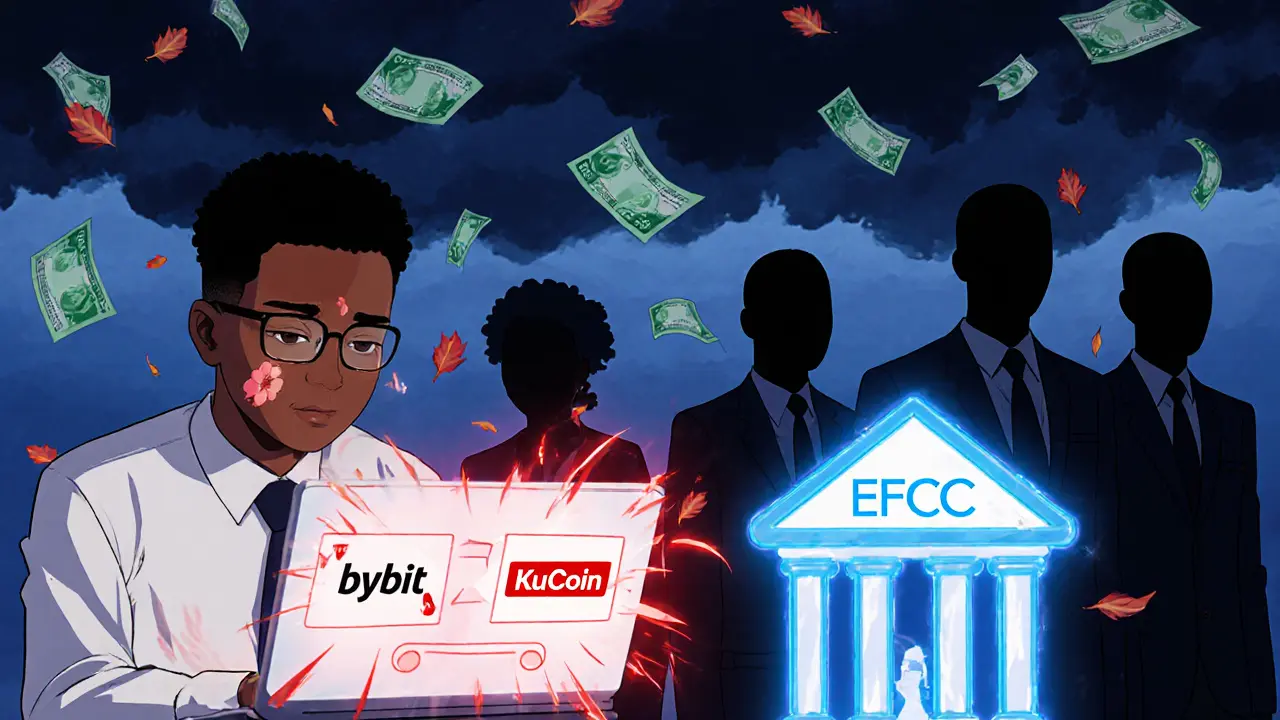

If you're Nigerian and using crypto in 2025, your biggest risk isn't market crashes or volatility-it's using the wrong exchange. The rules changed. The regulators are watching. And if you're still trading on platforms like Bybit, KuCoin, or Binance P2P without checking their license status, you're playing with fire. Your bank account could freeze. Your funds could vanish. And getting them back? That’s a 47-day nightmare with no guarantee of success.

Why This Matters Now More Than Ever

In February 2021, Nigeria’s Central Bank banned banks from dealing with crypto exchanges. That sent traders scrambling to P2P platforms. But in December 2023, the CBN reversed course-allowing banks to serve licensed crypto firms. The real shift came in 2025 with the Investments and Securities Act (ISA 2025). This law didn’t just tweak rules-it rewrote the entire game. Crypto is now legally classified as a security. And only exchanges licensed by the Securities and Exchange Commission (SEC) can operate in Nigeria. As of March 2025, only two exchanges have full approval: Quidax and Busha. Every other platform-no matter how popular or how many users it claims-is operating illegally. And the government isn’t warning you anymore. They’re acting.Exchanges You Must Avoid

Here are the platforms Nigerian users should stop using immediately:- Bybit - Severely restricted since September 2024. EFCC froze over ₦200 million in accounts linked to Bybit trading. No Nigerian legal entity. No SEC license. No recourse.

- KuCoin - Same story. 22 bank accounts frozen in Q3 2024. Users report losing access to ₦1.8 million to ₦5 million with no clear path to recovery.

- Binance P2P - While Binance.com is blocked in Nigeria, its P2P marketplace still gets heavy traffic. But P2P trades without KYC are now the #1 target for the EFCC. Over 78% of flagged transactions in 2024 came from unverified P2P trades.

- OKX, MEXC, Gate.io - All offshore. All unlicensed. All on the SEC’s enforcement radar. These platforms don’t even have Nigerian customer support lines.

What Happens When You Use Them?

It’s not just about losing money. It’s about losing control. In September 2024, the EFCC froze 22 bank accounts totaling ₦548.6 million (about $330,000) linked to unlicensed crypto activity. One Reddit user, u/LagosTrader89, lost ₦2.4 million after trading on KuCoin. It took 47 days, 12 visits to EFCC offices, and legal paperwork just to recover 63% of his funds. He’s still waiting for the rest. Trustpilot data from January to August 2024 shows unlicensed exchanges averaged just 2.1 out of 5 stars from Nigerian users. The top complaints? “Account frozen,” “No response from support,” “Money gone.” The Blockchain Association of Nigeria surveyed 3,500 users. Of those who used unlicensed platforms, 67% had at least one account frozen. On licensed platforms? Just 3%. And here’s the kicker: the SEC doesn’t care if you didn’t know the rules. Ignorance isn’t a defense. If your bank account gets flagged because of a trade on an unlicensed exchange, you’re on your own.What Makes a Licensed Exchange Different?

Quidax and Busha aren’t just “better.” They’re legally required to protect you.- SEC Insurance: Up to ₦50 million per account if something goes wrong.

- Naira Integration: Deposit and withdraw Naira directly. No risky P2P middlemen.

- Biometric KYC: Uses your NIN (National Identification Number). No fake IDs. No anonymous accounts.

- Real-Time Monitoring: Suspicious transactions flagged in under half a second.

- Local Legal Entity: Quidax is “Quidax Technologies Limited” (RC1782456). Busha is “Busha Fintech Limited” (RC1834562). You can verify both on the Corporate Affairs Commission (CAC) website.

How to Check If an Exchange Is Licensed

Don’t guess. Don’t rely on YouTube influencers. Do this:- Go to sec.gov.ng/crypto-exchanges. This is the official SEC registry. Updated weekly.

- Look for the license number format: SEC/CRP/2025/001. If it’s not there, it’s not legal.

- Check the CAC registry. Search for the company name. If it’s not registered in Nigeria, it’s offshore-and unsafe.

- Look for the “CBN Verified” badge on the website’s Nigerian landing page.

- Send “VERIFY [exchange name]” to 20255. If you get a reply with their license status, it’s legit. If not, walk away.

The Cost of Saving a Few Cents

Unlicensed exchanges often charge lower fees-around 0.15% versus 0.25% on licensed platforms. Sounds good, right? But here’s the math: If you trade ₦1 million per month, you save ₦1,000. But if your account freezes, you could lose ₦500,000 or more. And recovery? Takes weeks. Costs legal fees. Causes stress. Hurts your credit. Affects your job if your salary account is frozen. Reddit threads from r/NigeriaInvest and r/CryptoNaija show that users on unlicensed platforms reported 87% more account freezes than those on licensed ones. That’s not a trade-off. That’s a trap.What About Decentralized Exchanges (DEXs)?

Some users are turning to Uniswap, PancakeSwap, or other DEXs to avoid the crackdown. But that’s not safer-it’s riskier. DEXs have zero regulatory oversight. No insurance. No KYC. No way to report fraud. No customer service. If you send crypto to the wrong address? Gone forever. If you get scammed? No one can help. The Nigerian Cybersecurity Experts Forum reported a 34% spike in DEX usage since ISA 2025. But they also warned: “This isn’t freedom. It’s exile from protection.”

What Should You Do Right Now?

If you’re using an unlicensed exchange:- Stop trading immediately.

- Withdraw your funds to a licensed platform-Quidax or Busha.

- Verify your identity with your NIN and bank details on the licensed platform.

- Never use P2P trades unless you’re 100% sure the counterparty is verified and the exchange is SEC-licensed.

- File a report with the EFCC at efcc.gov.ng.

- Submit a complaint to the SEC’s Investor Protection Unit.

- Keep all transaction records, screenshots, and bank statements.

- Don’t pay anyone claiming they can “recover your crypto” for a fee. That’s a second scam.

The Future Is Licensed

The SEC has announced automated systems coming in September 2025 that will freeze assets from unlicensed exchanges within 15 minutes of detection. The EFCC’s crypto unit has grown from 15 to 47 agents. By Q4 2025, every unlicensed exchange operating in Nigeria will face enforcement. Licensed platforms are growing fast. Since January 2025, their trading volume has jumped 220%. Unlicensed platforms have lost 58% of their Nigerian user base. This isn’t a temporary crackdown. It’s the new normal. Nigeria is building a regulated, secure, and sustainable crypto ecosystem. And you don’t want to be left behind-or locked out.Can I still use Binance in Nigeria?

No. While Binance.com is blocked, its P2P marketplace still operates illegally in Nigeria. The SEC has not licensed Binance, and the EFCC has frozen accounts linked to Binance P2P trades. Using it puts your funds and bank account at risk. Stick to licensed platforms like Quidax or Busha.

What happens if my bank account gets frozen for crypto trading?

If your account is frozen for trading on an unlicensed exchange, you’ll need to visit the EFCC office in person. Bring all transaction records, screenshots, and proof of identity. Recovery can take 30+ days, and you may not get all your money back. Licensed exchanges prevent this entirely with built-in compliance.

Are Quidax and Busha safe to use?

Yes. Both are fully licensed by Nigeria’s SEC and comply with CBN regulations. They offer SEC-backed insurance, NIN-based KYC, direct Naira deposits, and real-time fraud monitoring. They’re the only two exchanges in Nigeria with legal protection for users.

Why do some exchanges still work in Nigeria if they’re unlicensed?

They’re operating illegally. Many use offshore servers, fake Nigerian addresses, or partner with unverified P2P traders. The SEC and EFCC are actively shutting them down. What works today may be blocked tomorrow-and your funds could vanish with it.

Can I use a VPN to access unlicensed exchanges?

Technically, yes. But legally, no. Using a VPN doesn’t change the fact that your bank account, NIN, and transaction history are tied to Nigeria. If the EFCC flags your activity, your identity is still traceable. A VPN won’t protect your money-it just makes you harder to find, which makes regulators more suspicious.

Comments (24)

Man, this is the most important post I've read all year. I've been trading on KuCoin for over a year and just assumed it was safe because everyone else was doing it. Now I see how naive that was. I just pulled my funds out and transferred everything to Quidax. Took me 3 hours to verify with my NIN, but now I feel actual peace of mind. No more nightmares about bank freezes. This isn't just about crypto-it's about protecting your entire financial life in Nigeria.

Stop using unlicensed exchanges. Period.

Wow. So now we’re supposed to trust the SEC? The same people who let inflation eat our salaries alive? This is just another way to control us. You think they care about your money? They care about control. Quidax and Busha are just their puppets now.

I get where Abby is coming from, but I’ve seen too many friends lose everything because they ignored this. I used to think the same way-until my cousin lost ₦3.2 million on Binance P2P. No one helped him. No one even replied. The system isn’t perfect, but licensed exchanges are the only shield we have right now. It’s not about trust-it’s about survival.

LOL you guys are so paranoid. Just use a VPN and you’re fine. The government can’t touch you if you’re anonymous. Also, Quidax has terrible UX. I’d rather lose money than use their clunky interface.

As a Nigerian who lost ₦1.8 million to KuCoin in 2023, I can confirm every word here. I spent 52 days at EFCC headquarters. They asked for every single transaction ID, screenshot, bank statement, even my WhatsApp chat logs with the P2P seller. No one helped me. No one apologized. Just paperwork. I now use Busha. It’s slow, but I sleep at night. If you’re reading this and still on Bybit-you’re one transaction away from disaster.

so i used binance p2p and got frozen and then i tried to get my money back and the guy who bought my btc just dissapeared and now im broke and my bank account is still frozen and the efcc says they cant help because it was p2p and i didnt use a licensed platform but like… how was i supposed to know??

Man, I’ve been using OKX for 2 years. Thought I was smart. Turns out I was just lucky. Last month, my bank flagged a ₦750k deposit and I had to go to the EFCC office in Abuja. They asked me if I knew what ‘unlicensed exchange’ meant. I said no. They laughed. Then they gave me a 10-page form to fill out. Took me 3 days. I got 40% of my money back. The rest? Gone. I’m on Quidax now. No drama. No panic. Just simple. If you’re still on Gate.io or MEXC-you’re not trading crypto. You’re gambling with your livelihood.

What about people who don’t have a NIN? Or can’t afford the time to go through KYC? This feels like exclusion disguised as protection. The system is supposed to help the people, not just the ones who can jump through bureaucratic hoops. What’s the alternative for the unbanked? Just give up on crypto?

Oh wow, so now we need a license to invest? What’s next? Do we need government approval to buy Bitcoin? Next thing you know, they’ll tax your gains and make you file a crypto tax return every month. This isn’t regulation-it’s control. And you’re all just happy to be herded like sheep into Quidax’s cozy little cage.

I’m American, but I’ve been helping Nigerian friends navigate this mess for years. I’ve seen the EFCC raids. I’ve read the court filings. This isn’t about stopping crypto-it’s about stopping chaos. Unlicensed exchanges are a free-for-all. No accountability. No recourse. No insurance. What’s happening in Nigeria is a textbook case of what happens when you let unregulated platforms run wild. Quidax and Busha aren’t perfect, but they’re the only ones playing by the rules. And rules exist for a reason: to stop people from getting ripped off.

Y’all need to stop acting like this is a conspiracy. This is common sense. You wouldn’t leave your house unlocked and then cry when someone steals your TV. Same thing here. If you want to play with fire, don’t be shocked when you get burned. Licensed exchanges are like a security system. They cost a little more, but they save your life. And if you think a VPN makes you safe-you’re the reason the EFCC has a job.

Regulation is the opiate of the masses. The real power isn’t in exchanges-it’s in the blockchain. Decentralization is freedom. If you’re waiting for the SEC to save you, you’ve already lost.

Just want to say-this post saved me. I was about to send ₦1.2 million to a KuCoin P2P trader. Saw this thread. Checked the SEC registry. No license. Walked away. I don’t know who wrote this, but thank you. I’m now on Quidax. Took 2 hours to verify. No drama. No stress. Just peace.

Wait, so you’re telling me I can’t use Binance anymore? But it’s the biggest exchange! How am I supposed to trade? This is ridiculous. I’ve been on Binance since 2021. You can’t just take that away. This is censorship.

People keep saying ‘just use Quidax or Busha’ like it’s that easy. What if you’re a trader who needs leverage? What if you need BTC/USDT pairs with 100x? What if you’re doing arbitrage? These licensed platforms don’t even offer advanced trading. You’re forcing us into a babysitter mode. That’s not protection-it’s emasculation.

There’s a profound tension here between autonomy and safety. On one hand, the right to financial freedom is sacred. On the other, the absence of regulation invites exploitation, especially among the economically vulnerable. The Nigerian state, flawed as it may be, is attempting to create a framework where the most vulnerable are not preyed upon by anonymous, offshore entities. This is not control-it is stewardship. The cost of entry-KYC, compliance, patience-is the price of dignity in a world where anonymity often masks predation.

Oh wow, so now you need a government stamp to invest? How quaint. I guess I’ll just go back to bartering goats. Meanwhile, the real investors are on Binance, using crypto as it was meant to be used-free, borderless, and unchained. You people are literally trading liberty for a false sense of security. Pathetic.

I used to think this was just another fear-mongering post. Then I checked my own trading history. I had ₦900k on KuCoin. I pulled it out last week. Transferred to Busha. Verified with my NIN. Took 48 hours. No drama. No calls from the EFCC. I feel like I just got my life back. This isn’t about trust in the government. It’s about trust in your own future. Don’t gamble with your safety.

Let me say this simple-don’t risk your life’s savings on a platform that doesn’t even have a physical office in Nigeria. If you can’t find their address on Google Maps, don’t trust them. I don’t care how many users they claim. If they’re not registered with CAC, they’re ghosts. And ghosts don’t pay you back.

why do people think the government cares about them anyway the system is rigged no matter what you do just take your money and go to tokyo or dubai if you really want to be free

Let’s be precise here: the ISA 2025 reclassifies crypto as a security under Section 2(1)(b), thereby triggering full compliance with the Investment Advisors Regulations, Anti-Money Laundering Act (2022), and the Nigerian Data Protection Regulation (NDPR). Unlicensed platforms are not merely ‘unregulated’-they are in direct violation of statutory fiduciary obligations. The EFCC’s enforcement actions are not arbitrary; they are legally mandated. The burden of compliance rests with the platform, but the consequences fall on the user. Ignorance is not a defense-it’s a liability.

Oh please. You think Quidax is safe? They’re owned by a shell company registered in the British Virgin Islands. Their ‘SEC license’ is just a piece of paper. And their ‘insurance’? It’s backed by a company that went bankrupt in 2024. This is all theater. You’re being played. The real winners? The lawyers and the regulators. You? You’re just the mark.

Let’s not forget: the SEC’s 2025 Crypto Compliance Framework mandates real-time transaction monitoring via API integration with Nigerian banks, which is only possible on licensed platforms. The 3% freeze rate on Quidax/Busha? That’s not luck-that’s architecture. Unlicensed platforms? They’re running on legacy, unmonitored, off-chain systems. The 67% freeze rate? That’s not a coincidence-it’s a systemic failure. This isn’t opinion. It’s infrastructure. And infrastructure doesn’t lie.