By now, you’ve probably heard the horror stories: someone logs into their exchange account one morning, and their entire balance is gone. No warning. No chance to react. Just empty wallets and a sinking feeling. In 2025, exchange security isn’t optional-it’s the difference between keeping your money and losing it forever. And the stakes have never been higher. Criminals stole over $2.14 billion from exchanges by June 2025 alone, up 17% from the same period in 2022. That’s not a glitch. That’s a targeted, evolving war-and you’re on the front line.

Why Your Exchange Isn’t Safe (Even If It Looks Like It Is)

Most people assume if an exchange is big, popular, or has a fancy website, it’s secure. That’s a dangerous myth. Binance, Coinbase, Kraken-they all got hacked at some point. The difference isn’t whether they were breached, but how they responded. Exchanges with strong security don’t prevent all attacks. They prevent them from costing you money. The biggest mistake users make? Thinking security is the exchange’s job alone. It’s not. Your private keys, your 2FA setup, your withdrawal settings-those are yours. And if you skip them, you’re handing attackers a free pass. In 2025, the most common breach isn’t a hacker cracking a server. It’s you. Or someone who tricked you. A phishing link. A fake support agent on Telegram. A deepfake voice call that sounds exactly like your exchange’s customer service rep. According to Chainalysis, 83% of 2025 breaches started with compromised signing processes-not blockchain exploits. That means your password, your phone, your email-those are the weak spots.What Real Exchange Security Looks Like in 2025

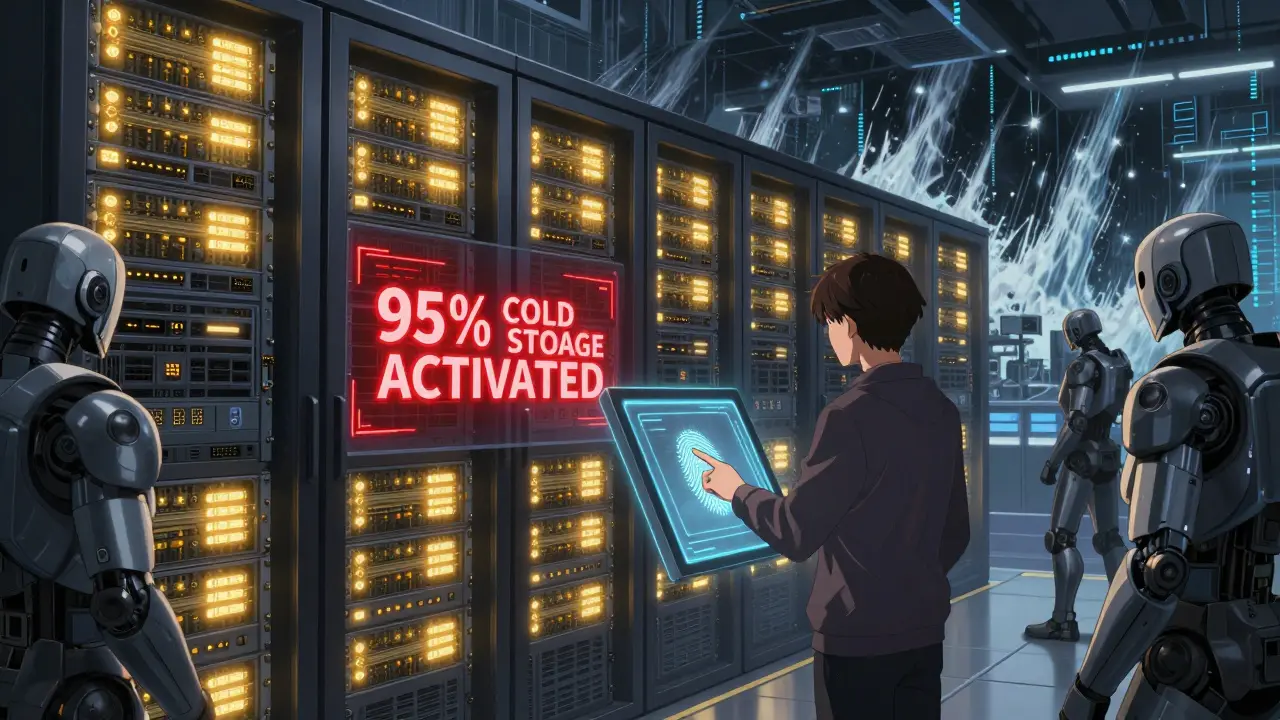

Top exchanges don’t just use one layer of security. They stack them. Think of it like a bank vault with motion sensors, biometric locks, armed guards, and a hidden backup location. Here’s what actually works:- Cold storage: 95-98% of user funds are kept offline, disconnected from the internet. Only a tiny fraction stays hot for withdrawals. If an exchange doesn’t publicly say how much they keep cold, walk away.

- Hardware Security Modules (HSMs): These are physical devices that generate and store encryption keys. They’re tamper-proof and certified to FIPS 140-2 Level 3 standards. If an exchange uses them, they’re serious about protection.

- Multi-Party Computation (MPC): Instead of one person holding a key, multiple people (or systems) must approve a transaction. Most exchanges now use 5-of-9 or 3-of-7 thresholds. Even if one device is hacked, the thief can’t move funds.

- Next-gen firewalls and DDoS protection: Exchanges face constant attacks trying to crash their systems or distract staff during a breach. Leading platforms now handle over 2.4 Tbps of attack traffic-enough to knock out small countries’ internet.

Your Personal Security Checklist (Do This Today)

You don’t need to be a coder to protect yourself. Here’s what you do in under an hour:- Turn on biometric 2FA: No SMS. No email codes. Use WebAuthn or FIDO2 with a security key (like YubiKey) or your phone’s fingerprint/facial recognition. SMS 2FA fails 78% of the time in 2025. Biometric 2FA? 99.98% effective.

- Enable withdrawal whitelisting: Only allow transfers to addresses you’ve pre-approved. This stops hackers from draining your account even if they get your password. Most users disable this within 30 days because it’s “inconvenient.” Don’t be one of them.

- Set IP restrictions: If you only ever trade from your home or office, lock withdrawals to those IP addresses. Binance users who did this prevented over $47,000 in theft attempts in 2025.

- Verify transaction signing addresses: Before approving any transaction, check the destination address on-screen. Hackers often swap addresses in the background. Kraken’s video tutorials show how to spot this-92% of spoofing attempts are caught this way.

- Disable auto-login and saved passwords: If your browser remembers your exchange login, delete it. Use a password manager instead, and never reuse passwords across sites.

Insurance: The Last Line of Defense

Even the best security can fail. That’s why insurance matters. Coinbase now covers up to $500 million per customer. Kraken offers $250 million aggregate. Binance bumped theirs to $1 billion after SEC pressure. That doesn’t mean you’ll get every dollar back instantly, but it means you won’t be wiped out. But here’s the catch: insurance only applies to custodial exchanges. If you’re using a decentralized exchange like Uniswap, there’s zero insurance. Your funds are only as safe as the smart contract code-and history shows those can be exploited. The $600 million Poly Network hack in 2021? That was on a DEX. No one to call. No refund. Just code.What to Avoid Like the Plague

Some “security features” are traps. Don’t fall for them:- Exchanges with no KYC: MEXC, Gate.io, and others with minimal identity checks have 42% more account takeovers than compliant platforms. Why? Because bots and scammers love them. They’re the wild west.

- Telegram “support”: If someone from “exchange support” messages you on Telegram offering to fix your account, block them. In August 2025, deepfake scams using cloned voices stole $8.3 million from Ledger users by convincing them to install malware.

- Clipboard hijackers: These apps swap crypto addresses when you copy-paste. Always double-check the full address before sending. Even a single wrong character means your money is gone.

- Sharing recovery phrases: Never, ever type your seed phrase into a website, send it via chat, or store it in the cloud. If someone else has it, they own your funds.

What Happens When You Get Hacked

If you notice something wrong-unauthorized login, weird withdrawal, strange email-act fast. Don’t panic. Don’t log in again. Don’t reply to messages.- Immediately contact your exchange’s official support via their website-not through links in emails.

- Change your password and 2FA on every device.

- Check your email and phone for signs of compromise. Did someone reset your email password? Did they enable forwarding? Lock those down.

- Report the incident to your exchange and file a report with your local cybercrime unit.

The Future: Security vs. Usability

The biggest challenge exchanges face isn’t hackers-it’s users. People hate complexity. They disable withdrawal whitelists. They reuse passwords. They click links. They trust voice calls that sound real. That’s why the SEC introduced mandatory Security Scorecards in October 2025. Now, every registered exchange must publicly show: cold storage percentage, insurance coverage, and breach history. Coinbase’s Proof of Reserves+ system lets you verify your funds in real time using Merkle trees. It’s not perfect, but it’s transparency-and transparency saves money. Meanwhile, AI-powered social engineering is rising. Voice cloning can now mimic support agents with 92% accuracy. In Q3 2025, $147 million was stolen this way. The only defense? Always verify through official channels. Call the number on the website. Don’t trust the number in the message.Final Reality Check

You can’t out-hack a hacker. But you can make yourself a harder target. Most people treat crypto like cash-carry it around, leave it in your pocket. But crypto isn’t cash. It’s a digital asset that needs locks, alarms, and backup plans. The best security isn’t the most expensive exchange. It’s the one you use correctly. Enable 2FA. Whitelist withdrawals. Don’t trust strangers. Verify every address. And if you’re not doing those three things? You’re not protected. You’re just waiting for the next headline.Are centralized exchanges safer than decentralized ones?

Yes, for most users. Centralized exchanges (like Coinbase or Kraken) hold your keys, but they also offer insurance, customer support, and advanced security tools like cold storage and withdrawal whitelists. Decentralized exchanges (like Uniswap) don’t hold your keys-you do. That means no insurance, no support, and no safety net if you make a mistake. If you’re not experienced with wallets and smart contracts, CEXs are the safer choice.

Is SMS 2FA still safe for crypto exchanges?

No. SMS 2FA was broken years ago. In Q2 2025, 78% of account takeovers succeeded because attackers hijacked phone numbers through SIM-swapping. Biometric 2FA using FIDO2 or WebAuthn is the only reliable option. Use a security key like YubiKey or your phone’s built-in fingerprint or face ID. It’s free, fast, and nearly impossible to bypass.

What should I do if I lose my 2FA device?

Most reputable exchanges let you set up backup codes during 2FA setup. Print them or store them in a password manager. If you didn’t, contact support immediately with proof of identity. Some exchanges require a 7-14 day waiting period to prevent fraud. Don’t wait until it’s too late-set up backups now.

Can I get my money back if my exchange gets hacked?

It depends. If the exchange has insurance (like Coinbase or Kraken), you’re likely to be reimbursed, though it may take weeks. If they don’t, or if you used a small, unregulated exchange, you probably won’t get anything back. Always check the insurance policy before depositing funds. If it’s not clearly stated, assume there’s none.

How often should I review my exchange security settings?

At least once every three months. Security threats evolve fast. New scams appear monthly. Check your withdrawal addresses, IP restrictions, and 2FA methods. If you’ve added new devices or changed locations, update your settings. The biggest breaches happen because users set it and forget it.

Is it safe to store crypto on an exchange long-term?

Only if you’re actively trading. Exchanges are high-value targets. Even the best ones can be breached. For long-term holding, move funds to a non-custodial wallet you control-like a Ledger, Trezor, or a hardware wallet with MPC. If you’re holding for years, treat your exchange like a checking account: keep only what you need for trading. The rest belongs offline.

Comments (25)

Also deleted all saved passwords from my browser. Took 5 minutes. Worth it.

Yeah sure, use a YubiKey. Meanwhile, I’m over here trying to explain to my grandma why she shouldn’t click ‘claim your free BTC’ on Facebook. The real problem isn’t your 2FA-it’s that people treat crypto like a lottery ticket and not a fucking digital vault.

Do it. Now.

Is it progress? Or are we merely outsourcing our responsibility to machines that don't care if we lose everything?

I keep my seed phrase on a brass plate. Buried under my garden. No cloud. No photo. No backup. Just earth. And silence.

Perhaps true security is not in layers... but in letting go.

Like, you're literally handing your life savings to a 14-year-old in Ukraine who can SIM-swap your number faster than you can say 'gas fee'.

Also, if your exchange doesn't have $500M insurance, why are you even here? Go trade on Solana and cry into your ramen.

But honestly? I still check my balance every 2 hours. Like a nervous tic.

It’s not paranoia if they’re really out to get you.

It wasn't even a bad copy. The colors matched. The font was perfect.

Now I verify every message by going to the site directly. No exceptions.

And I never, ever trust a voice call. Even if it sounds like my mom.

Just remember: no legitimate exchange will ever DM you. Ever.

And if they do, block. Report. Walk away. Your money is worth more than your curiosity.

I don’t trust any exchange. I don’t trust the SEC. I don’t trust the ‘insurance’.

My crypto lives on a hardware wallet. In a safe. In a different state. And I’m the only one who knows the combo.

They can’t hack what they can’t find.

The human element-complacency, convenience, cognitive bias-is the vector of failure.

It is not the blockchain that is vulnerable. It is the user.

And until we redesign human behavior, no amount of MPC or HSM will save us.

That's it. No fluff. No jargon. Just do these four things and you're ahead of 90% of users.

Worth it.

Now I keep a printed list of all allowed addresses in my wallet. Paper beats hackers every time.

It's like locking your front door but leaving the back door wide open with a sign that says 'Hi, thief! I'm rich!'.

Use a password manager. It's free. It's easy. Do it.

Is autonomy worth the sleepless nights? The fear of losing a seed phrase? The guilt of not being 'good enough' at security?

Perhaps the real question is not how to protect your assets-but whether you should want to.

But crypto? Crypto says 'trust no one'.

And that's why it's the only real freedom left.

Even if you get hacked, at least you weren't lied to.

They told you it was risky. You just didn't listen.

Security is great, but if I have to read a whitepaper to send $10, I'm just gonna hold it in my wallet and forget about it.

Usability > perfection. Always.

You were warned. Again and again.

There is no such thing as a victim in crypto. Only negligence.

Started using a YubiKey after my friend lost $22k to a phishing scam.

Worth every penny.

And yes, I printed my backup codes. On paper. In a drawer. Not in the cloud.

We shrug and say 'oh well, crypto is risky'. But if your car got stolen, you wouldn't say 'oh well, driving is risky'.

Why are we so soft on this?

Because we don't see it as real money. We're wrong.

Some people hoard their crypto like gold. Others give it away too easily.

The balance is in knowing when to move, when to store, and when to trust-but never blindly.

It had my name, my logo, even the right colors.

I almost clicked.

Then I noticed the font was .5pt off.

That's how they get you. Not with big hacks. With tiny lies.

My 2FA is biometric. My withdrawal list is locked. My seed phrase is on a metal plate.

And I still check my balance every night before bed.

It's not paranoia. It's love. I love my money. And I'm not letting it go without a fight.

Until global regulatory alignment occurs, users must remain their own auditors.

Verify cold storage percentages independently. Cross-reference insurance policies. Never rely on marketing language.

I tell my friends: if you can't find the insurance info on their website, don't deposit.

And always use a VPN. Not because you're hiding-but because you're smart.

It is no longer sufficient to secure endpoints. One must now secure the human cognitive architecture.

This is not a technical problem. It is a civilizational one.