Trading crypto on Ethereum used to mean paying $50 in gas fees just to swap tokens. Now, with SushiSwap v3 (Polygon), you can swap, stake, and earn rewards for less than a penny. That’s not hype-it’s reality. If you’re tired of high fees and slow transactions on Ethereum but still want full DeFi control, SushiSwap v3 on Polygon might be the switch you’ve been waiting for.

What Is SushiSwap v3 on Polygon?

SushiSwap v3 on Polygon is a decentralized exchange (DEX) built on the Polygon network, a layer-2 scaling solution for Ethereum. Unlike centralized exchanges like Binance or Coinbase, you don’t deposit your coins into a company’s wallet. Instead, you trade directly from your own wallet-MetaMask, Trust Wallet, or any Web3-compatible one-using smart contracts. No KYC. No middlemen. Just code. It’s a fork of Uniswap, but with a twist: SushiSwap adds extra incentives. While Uniswap gives all trading fees to liquidity providers, SushiSwap splits them. 0.25% goes to liquidity providers, and 0.05% goes to people who stake SUSHI tokens. That’s two ways to earn from the same trade. Polygon makes this all possible. It handles transactions off Ethereum’s main chain, slashing gas fees from dollars to fractions of a cent. That means you can rebalance your liquidity positions, add or remove funds from pools, or farm new tokens without worrying about getting wiped out by fees.How It Works: Liquidity Pools and Fee Sharing

SushiSwap doesn’t use order books. Instead, it uses liquidity pools. Imagine a jar filled with ETH and USDC. When you swap ETH for USDC, you’re taking from that jar. Someone else-maybe you-must have put ETH and USDC into the jar first. That’s a liquidity provider. You earn a share of the 0.3% trading fee every time someone swaps in that pool. On SushiSwap v3, you also earn SUSHI tokens if you’re in an active liquidity mining program. The platform runs something called the Onsen Program, which boosts rewards for new or low-liquidity tokens. If you add liquidity to a new project early, you can earn way more SUSHI than you would on Uniswap. Staking SUSHI gets you xSUSHI. Every time someone trades on SushiSwap, 0.05% of the fee goes to xSUSHI holders. You don’t need to provide liquidity to earn this part. Just hold and stake your SUSHI. It’s passive income built into the protocol. As of late 2025, SUSHI trades around $2.19 with a market cap of $574 million. That’s down from its 2021 peak, but the tokenomics are still solid. The fee-sharing model keeps demand steady. People aren’t just holding SUSHI-they’re staking it to earn more.Why Polygon? Speed, Cost, and Scale

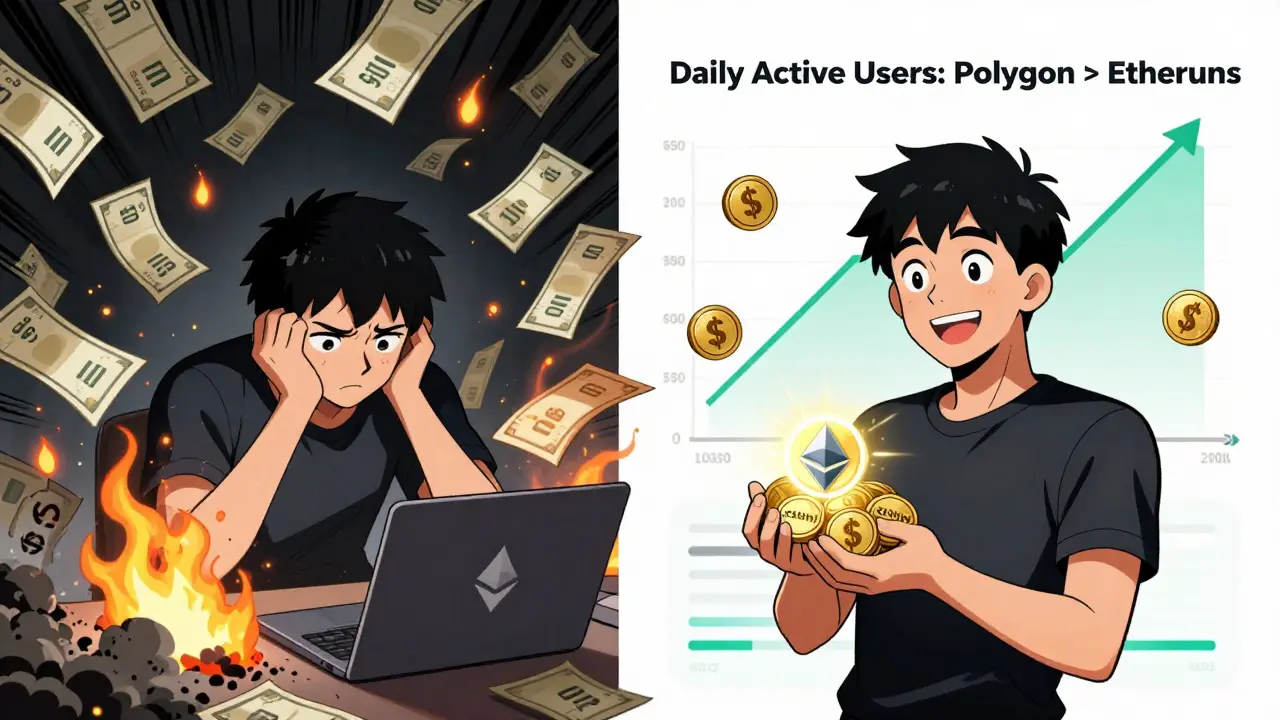

Polygon isn’t just a sidechain. It’s a full ecosystem of scaling solutions. SushiSwap v3 on Polygon means you get Ethereum-level security with near-instant transactions and gas fees under $0.01. Compare that to Ethereum mainnet, where a simple swap can cost $15-$30 during peak times. On Polygon, you can do 100 swaps for the price of one on Ethereum. That’s huge for active traders, liquidity providers, and yield farmers who need to move money fast. It also opens up access. On Ethereum, small wallets get priced out. On Polygon, someone with $50 can still farm rewards meaningfully. That’s why SushiSwap v3 on Polygon has more daily active users than its Ethereum counterpart in many months.Features You Actually Use

SushiSwap v3 on Polygon isn’t just a swap tool. It’s a full DeFi hub:- Swap tokens-over 1,200 tokens available, including new launches

- Liquidity provision-add pairs like WETH/USDC or MATIC/WBTC and earn fees + SUSHI

- Staking-lock SUSHI to get xSUSHI and earn 0.05% of all trading fees

- Onsen Program-higher SUSHI rewards for liquidity on new tokens

- Mobile and desktop apps-trade on the go with official SushiSwap apps

- Fiat on-ramps-buy crypto with credit cards via partners like MoonPay

- Margin and leverage-available through integrated protocols like Kashi

Real User Experience: What People Are Saying

Reddit and Discord users consistently praise SushiSwap v3 on Polygon for its cost efficiency. One user, active since 2022, said they saved over $2,000 in gas fees in 2024 just by switching from Ethereum to Polygon for daily swaps and farming. Another user, who farms new tokens through Onsen, reported earning 15% APY in SUSHI alone-on top of trading fees-on a newly listed token. That’s higher than most centralized exchange staking programs. But it’s not perfect. Some users report confusion over the reward structures. The Onsen Program changes every week. The tokenomics can feel complex if you’re new. And while Polygon is fast, it’s not Ethereum. Some traders worry about long-term security, even though Polygon uses Ethereum’s settlement layer. Trading volume on Polygon is strong, but not as high as Uniswap’s. You’ll find deeper liquidity on ETH for major pairs like WETH/USDT. But for smaller tokens and frequent trades? Polygon wins.How It Compares to Uniswap v3

| Feature | SushiSwap v3 (Polygon) | Uniswap v3 (Ethereum) | |--------|------------------------|------------------------| | Gas fees per trade | $0.001-$0.01 | $5-$30+ | | Fee split | 0.25% to LPs, 0.05% to xSUSHI | 0.3% to LPs only | | Token rewards | Yes (SUSHI via Onsen) | No | | Liquidity mining | Active programs in 2025 | No ongoing token rewards | | User base | Growing fast on Polygon | Dominant on Ethereum | | Mobile app | Yes | Yes | | Fiat on-ramp | Available | Available | If you care about earning extra tokens and keeping costs low, SushiSwap wins. If you only want the most liquid pools for big trades and don’t mind paying fees, Uniswap still leads.Is It Safe?

SushiSwap’s code has been audited multiple times by reputable firms like CertiK and PeckShield. The smart contracts are open-source and have been live since 2020. No major exploits have occurred on the Polygon version. But safety isn’t just about code. It’s about you. If you send tokens to the wrong address, they’re gone forever. If you don’t understand impermanent loss, you could lose money even if the price goes up. And if you stake SUSHI, remember: the token’s price can drop. Your rewards are in SUSHI, so if SUSHI falls 40%, your earnings drop too. Use small amounts first. Test the flow. Learn how to withdraw liquidity. Watch the reward rates on the Onsen dashboard. Don’t dump your life savings into a new pool.

Who Is This For?

This isn’t for people who just want to buy Bitcoin and hold. This is for:- Active traders who swap tokens daily

- Liquidity providers looking for extra yield

- Early adopters of new DeFi projects

- Users tired of Ethereum gas fees

- Anyone who wants to earn crypto without mining or staking on a centralized exchange

What’s Next for SushiSwap?

The team is pushing into cross-chain liquidity aggregation. They’re testing bridges to other networks like Arbitrum and Optimism. They’re also building better analytics tools so users can track reward efficiency in real time. The SUSHI token is still governed by holders. Proposals go to vote. If you hold SUSHI, you can influence what features get built. That’s rare in crypto. Analysts are split on price. Some predict $1.68 by end of 2025. Others say $3-$5 if adoption keeps growing. Either way, the token’s value isn’t just speculation-it’s tied to real usage. More trades = more fees = more xSUSHI rewards = more demand for SUSHI.Getting Started in 5 Steps

- Get a Web3 wallet (MetaMask recommended)

- Add the Polygon network to your wallet (use chainlist.org for the correct RPC)

- Buy MATIC or bridge ETH to Polygon using the official SushiSwap bridge

- Go to app.sushi.com and connect your wallet

- Swap, add liquidity, or stake SUSHI-start small, learn fast

Final Thoughts

SushiSwap v3 on Polygon isn’t the flashiest DeFi project. But it’s one of the most practical. It solves real problems: high fees, low rewards, and complexity. It doesn’t overpromise. It just delivers-slowly, steadily, and with clear incentives. If you’re looking for a DEX that rewards you for using it-not just for holding-it’s one of the best options today. The future of DeFi isn’t about bigger apps. It’s about cheaper, smarter, and fairer ones. SushiSwap v3 on Polygon is already there.Is SushiSwap v3 on Polygon safe to use?

Yes, but with caveats. The smart contracts have been audited and have no known exploits. However, DeFi is still high-risk. You can lose funds due to user error, impermanent loss, or token price drops. Always start with small amounts and understand how liquidity pools work before committing large sums.

How do I earn rewards on SushiSwap v3?

You earn two ways: First, by providing liquidity to trading pairs-you get 0.25% of every trade in that pool. Second, by staking SUSHI to get xSUSHI-you get 0.05% of all trading fees across the platform. You can also earn extra SUSHI tokens through the Onsen Program when you add liquidity to new or low-volume tokens.

What’s the difference between SushiSwap and Uniswap?

Uniswap gives 100% of trading fees to liquidity providers. SushiSwap splits them: 0.25% to LPs, 0.05% to xSUSHI stakers. SushiSwap also offers active token rewards through its Onsen Program, while Uniswap doesn’t distribute additional tokens. SushiSwap on Polygon also has much lower fees than Uniswap on Ethereum.

Do I need to bridge my crypto to use SushiSwap v3 on Polygon?

Yes, if your crypto is on Ethereum. You’ll need to use the official SushiSwap bridge or a trusted bridge like Polygon’s own bridge to move ETH, USDC, or other tokens from Ethereum to Polygon. Never use third-party bridges you don’t trust. Always verify the URL and check official channels.

Can I use SushiSwap v3 on my phone?

Yes. SushiSwap has official mobile apps for iOS and Android. You can swap, add liquidity, and stake SUSHI directly from your phone. Just make sure your wallet (like MetaMask) is connected and you’re on the Polygon network.

What’s the best way to start with SushiSwap v3?

Start by swapping a small amount of MATIC or USDC to get used to the interface. Then, try adding $20-$50 to a stablecoin pool like USDC/WETH. Watch your rewards over a week. Once you understand how fees and rewards work, consider staking SUSHI. Never invest more than you’re willing to lose.

Comments (13)

SushiSwap v3 on Polygon? LPs are getting fragmented fee streams with xSUSHI dilution-classic tokenomics theater. The 0.05% to stakers is just a veneer over structural inflation. You're not earning yield, you're subsidizing protocol capture.

bro i swapped 50 bucks of usdc for matic last week and got 0.003 gas fee 😭😭😭 i thought i was gonna get robbed but nope-sushiswap on polygon is like magic money printer with no cops 😎💰

Oh wow, another ‘low fees’ fairy tale. Let me guess-you also think Polygon is ‘Ethereum-level security’? Honey, it’s a permissioned sidechain with 100 validators. The only thing ‘decentralized’ here is the delusion. If you’re not running a full node, you’re not participating-you’re just renting access.

And don’t get me started on ‘Onsen Program’-it’s just a bait-and-switch for new tokens that’ll rug in 3 weeks. You’re not farming yield, you’re playing Russian roulette with a 90% chance of losing your principal.

And yes, I’ve seen the ‘$2000 saved in gas’ claims. That’s because you were doing 1000 micro-swaps on a chain designed for micro-swaps. Congrats, you optimized for noise, not value.

Real DeFi is on Ethereum. Everything else is just a liquidity vacuum with a cute UI.

you know what they don't tell you about sushiswap? the xSUSHI rewards are being siphoned into a black hole wallet that's connected to a shell company in the Caymans that's owned by the same people who ran the FTX algo. the audit? fake. the team? anonymous. the ‘on-sen’ program? a honeypot for retail. they want you to think you're earning, but you're just feeding the machine. the gas fees are low because they're not paying for security-they're paying for silence.

and if you think polygon is safe? think again. the validators are all controlled by polygon foundation, which is backed by a16z and coinbase. you're not on a decentralized chain-you're on a corporate playground with a crypto logo.

they're luring you in with ‘low fees’ so you'll trade more… so they can front-run you… so they can sell your data… so they can manipulate the SUSHI price… so they can dump on you while you're busy ‘staking’.

they're not building a dex. they're building a surveillance economy with better UX.

It’s interesting how people treat SushiSwap v3 on Polygon as some revolutionary breakthrough when it’s really just an incremental optimization layered on top of an already mature architecture. The fee-split model isn’t new-Uniswap v3 introduced concentrated liquidity, and SushiSwap just added a tokenomics layer to incentivize participation. But the real innovation here is behavioral: it’s the first DEX that makes micro-trading economically viable for users with under $100 in capital. That’s not trivial.

People complain about impermanent loss, but if you’re only providing liquidity to stablecoin pairs-USDC/WETH, USDT/MATIC-you’re minimizing that risk significantly. And the Onsen Program? It’s not a gimmick; it’s a mechanism to bootstrap liquidity for nascent projects that would otherwise be ignored. Without it, the entire DeFi ecosystem would be dominated by the top 20 tokens.

And yes, Polygon isn’t Ethereum. But it’s not supposed to be. It’s a scaling solution. Ethereum is the settlement layer. Polygon is the execution layer. That’s not a weakness-it’s a design choice. The security model is still anchored to Ethereum via fraud proofs and bridge validators. It’s not perfect, but it’s mathematically sound.

The real issue isn’t the tech. It’s the education gap. Most users don’t understand slippage, or how to calculate APY with compounding rewards, or the difference between staking and liquidity provision. They see ‘earn 15% APY’ and throw in their life savings. That’s not SushiSwap’s fault. That’s human nature.

So yes, it’s practical. Yes, it’s low-cost. And yes, it rewards participation. But it’s not a magic wand. It’s a tool. And like any tool, it’s only as good as the person using it.

I came into DeFi with $20 and a dream. I didn’t know what a liquidity pool was. I thought ‘staking’ meant putting money in a bank. But I tried SushiSwap on Polygon because the fees were under a penny. I added $10 to USDC/WETH. Got back $0.08 in fees after 48 hours. Then I staked my SUSHI. Got another $0.03. I didn’t get rich. But I learned. And now I’m teaching my mom how to swap. She’s 68. She uses the app. She doesn’t care about ‘decentralization.’ She just wants to know if her money is safe and if she can earn something without a middleman.

This isn’t for crypto bros. It’s for people who just want to be part of something fair. And honestly? That’s more valuable than any ‘Ethereum-only’ purity test.

they say low fees but they dont say who's paying for it. polygon is subsidized by venture capital. the real cost is your privacy. every swap you make gets logged. every wallet you connect gets mapped. they're building a financial profile of you so they can sell it later. and when the fed cracks down on crypto? you'll be the one holding the bag while the devs disappear into the metaverse

There’s a deeper philosophical question here: Is DeFi about maximizing returns, or about creating a system where participation is rewarded without extraction? SushiSwap v3 on Polygon doesn’t just reduce fees-it redistributes incentives. It turns passive holders into active participants. That’s not a feature. That’s a paradigm shift.

Uniswap treats liquidity as a transactional service. SushiSwap treats it as a social contract. The 0.05% to xSUSHI isn’t a bonus-it’s a recognition that the network’s stability depends on token holders who aren’t just speculators, but stewards.

And yes, Polygon isn’t perfect. But the idea that we must wait for Ethereum to scale before we can build meaningful applications is a luxury only the wealthy can afford. The rest of us need tools now. Not in five years. Not after layer 3 rollups. Now.

The real threat isn’t the technology. It’s the elitism that says only those who can afford $30 gas fees deserve to participate. That’s not innovation. That’s exclusion dressed up as security.

DeFi’s purpose isn’t to replicate Wall Street. It’s to replace it. And SushiSwap on Polygon is one of the few places where that’s actually happening.

Been using it since 2023. Stable. Fast. Fees are literally invisible. I swap, farm, and stake without checking my wallet balance after each transaction. That’s the real win.

you think this is about crypto? it's about control. every time you stake sushiswap you're agreeing to let them track your behavior. every time you swap you're giving them data. every time you use the mobile app you're letting them know where you are. they don't care about your money. they care about your patterns. they're building a financial surveillance system and calling it decentralization. the low fees are the bait. the data is the harvest.

and the 'audits'? they're paid for by the same people who built it. the code is open but the incentives aren't. you're not a user. you're a data point.

I’ve spent years in finance. I’ve seen bubbles, crashes, and revolutions. What SushiSwap v3 on Polygon represents isn’t just a better exchange-it’s the first time a decentralized protocol has made financial inclusion feel… human. No gatekeepers. No minimums. No judgment. Just code and consent. That’s revolutionary.

It doesn’t need to be the biggest. It doesn’t need to be the flashiest. It just needs to work for the people who’ve been left out. And it does.

If you’re still stuck on Ethereum fees, you’re not being cautious-you’re being nostalgic. The future isn’t about preserving the old system. It’s about building a better one. And this? This is it.

you think you're earning rewards but you're just feeding the machine. they pump the token, you buy in, they dump, you get stuck with sushis that lost 80% of their value. and you still think you're winning because you got 0.001 matic in fees. wake up. this isn't finance. it's a casino with a whitepaper

Thank you for the thorough and balanced analysis. The distinction between technical architecture and user behavior is often overlooked in crypto discourse. It is important to recognize that while the protocol offers demonstrable economic advantages, the onus of responsible participation remains with the individual. Prudent risk management, incremental engagement, and continuous education are not optional-they are foundational. This platform, like all DeFi tools, is neither inherently good nor evil. It is a mirror. What one sees in it reflects one’s own intentions and understanding.