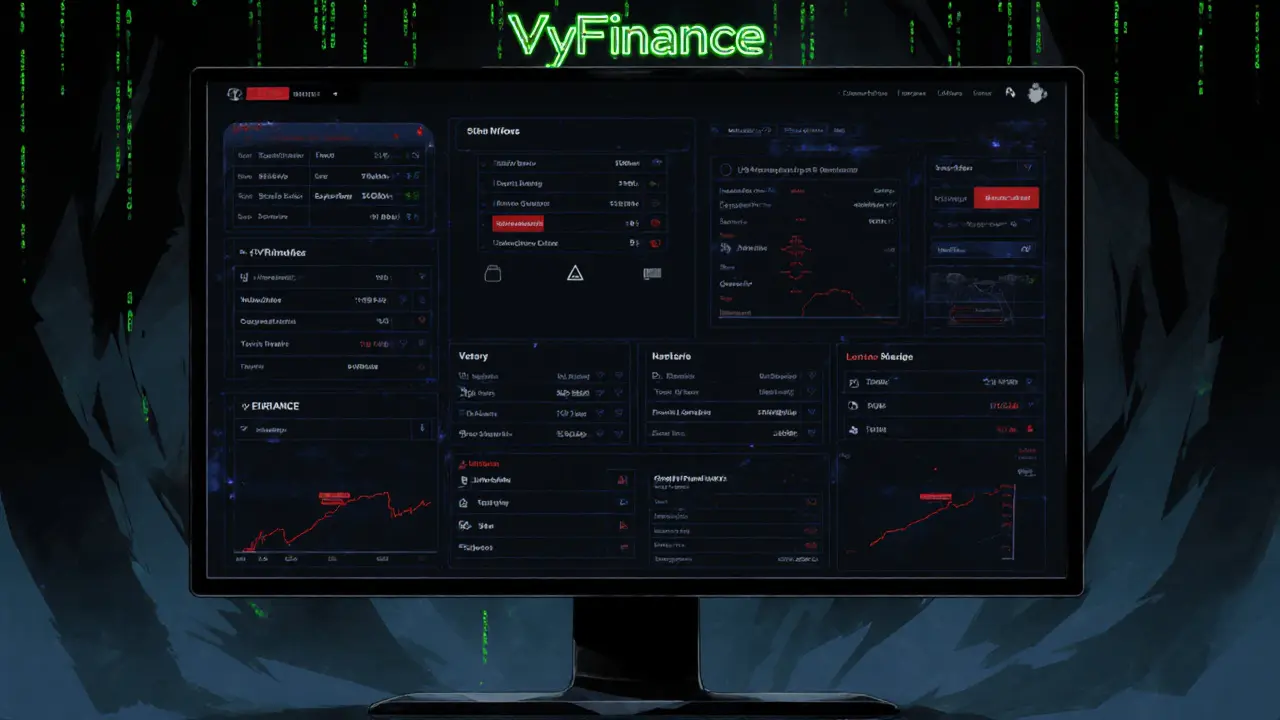

VYFI Token – Overview and Insights

When working with VYFI token, a deflationary utility token on the Binance Smart Chain that distributes fees to holders and powers a small governance layer. Also known as VYFI, it acts as a bridge between DeFi yield farming and community voting, rewarding participants automatically.

How VYFI Connects to the Wider Crypto Landscape

The cryptocurrency environment treats VYFI as one of many utility tokens that rely on transparent tokenomics to attract liquidity. Its supply model, automatic staking rewards, and fee‑burn mechanism are classic examples of tokenomics principles that aim to create scarcity while encouraging long‑term holding. Because VYFI runs on the Binance Smart Chain, it benefits from fast transaction finality and low gas fees, which are crucial for high‑frequency traders and liquidity providers.

Underlying this token is the blockchain technology that records each transaction in an immutable ledger. The BSC smart‑contract architecture allows VYFI to implement automatic fee redistribution without a central operator, a feature that aligns with DeFi’s trust‑less ethos. Smart contracts also enable the token to support occasional airdrop campaigns, where new tokens are sent to existing holders as a reward for community engagement.

Regulatory trends across regions—like Brazil’s new crypto tax rules or Iran’s exchange restrictions—shape how investors approach tokens like VYFI. While these policies don’t target VYFI specifically, they influence market sentiment, liquidity flows, and the legal framing of token sales. Understanding the intersection of tokenomics, blockchain infrastructure, and regulatory climate helps you gauge VYFI’s risk profile and growth potential.

Below you’ll find a curated set of articles that break down VYFI’s price charts, compare it with other BSC tokens, explain how to claim any upcoming airdrops, and walk you through the steps to safely trade it on decentralized exchanges. Dive in to get practical tips, real‑world data, and actionable strategies for making the most of VYFI in today’s fast‑moving crypto world.

- February 27, 2025

- Comments 16

- Cryptocurrency