VyFinance review – Everything You Need to Know

When you hear VyFinance, a fast‑growing crypto exchange that blends trading tools with DeFi services. Also known as VyFin, it aims to give traders a one‑stop shop for spot, margin, and yield‑earning options. Crypto exchange platforms let users swap digital assets, manage wallets, and access market data are the foundation of any modern trading ecosystem, and VyFinance builds on that core with its own DeFi platform layer that offers staking, liquidity pools, and automated market making. Together these pieces create a service that VyFinance review can dissect into clear parts: user experience, tokenomics, security, and future roadmap.

Key Areas Covered in This Review

First, tokenomics describe how a project’s native token is allocated, minted, and used within its ecosystem drive incentives on VyFinance. The platform’s VYX token powers fee discounts, governance voting, and liquidity rewards, meaning its supply curve directly influences trader costs and network health. Second, security is non‑negotiable; VyFinance employs multi‑factor authentication, cold‑storage custodians, and regular third‑party audits. The link between strong security practices and user trust is clear: when a platform’s safeguards improve, trader confidence—and volume—tend to rise.

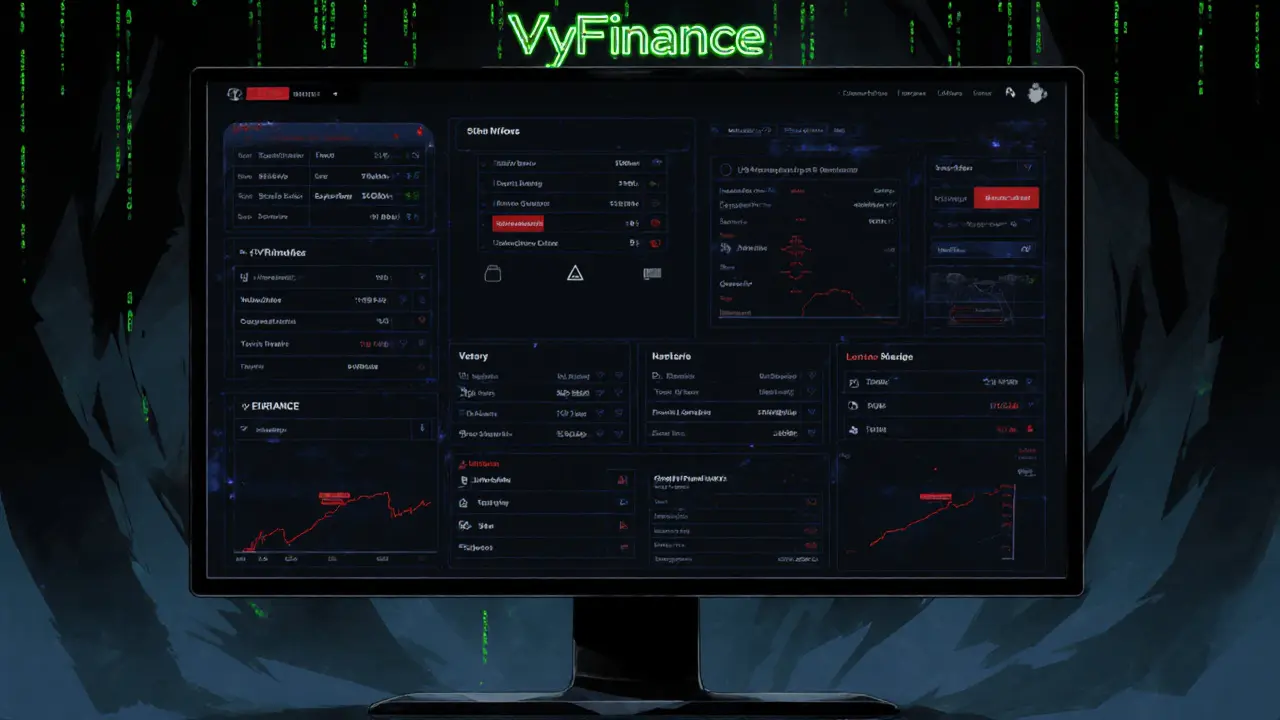

VyFinance also brings a handy UI that balances simplicity for beginners with advanced charting for seasoned traders. Its API endpoints let bots execute strategies, while the built‑in educational hub demystifies concepts like margin calls and impermanent loss. All these features fit into a larger picture: VyFinance encompasses a crypto exchange, requires robust tokenomics, and relies on security to attract a diverse user base. The platform’s roadmap includes cross‑chain bridges, which will let assets flow between Ethereum, BNB Chain, and Solana without leaving the VyFinance environment, further expanding its DeFi reach.

Below you’ll find a curated collection of articles that dive deeper into each of these topics. From a step‑by‑step tokenomics breakdown to real‑world security audits, the posts give concrete examples and actionable tips. Whether you’re checking if VyFinance’s fee structure beats the competition or looking for ways to earn yield on VYX, the following guides will give you the practical insight you need to decide if VyFinance fits your trading style.

- February 27, 2025

- Comments 16

- Cryptocurrency