VASP Licensing Pathway Calculator

Recommended Pathway

Key Requirements:

| Aspect | Standard Registration | ARIP |

|---|---|---|

| Time to Initial Approval | 9-12 months | ≈3 months for provisional approval |

| Capital Requirement | Full N500M upfront | Same, but can be staggered |

| Office & Resident Director | Mandatory before filing | Required only after 6-month incubation |

| Regulatory Oversight | Periodic SEC audits | Continuous monitoring, quarterly reports |

| Exit Option | Licence revocation only | Option to cease operations after 12-month trial |

If you’re running a crypto exchange, wallet service, or any virtual‑asset business and want to operate legally in Nigeria, you need a VASP licence. The Securities and Exchange Commission (SEC is the regulator that issues the licence and enforces the new Investments and Securities Act 2025). Below is a practical walkthrough that covers everything from capital needs to the two licensing pathways - the standard route and the Accelerated Regulatory Incubation Program (ARIP).

What a VASP licence actually covers

A VASP licence authorises a company to provide any of the following services:

- Cryptocurrency exchange operations

- Digital‑wallet custody and storage

- Token issuance, including security tokens

- Mining, staking and airdrop distribution

- Crypto‑based payment processing

In short, if your business deals with virtual assets, the licence is mandatory. Operating without it can lead to fines, asset freezes, or even criminal prosecution.

Key financial and corporate thresholds

The SEC has set a hefty capital floor - VASP licensing Nigeria requires a minimum paid‑up capital of N500,000,000 (about $325,000USD). This figure is deliberately high to ensure only financially stable players enter the market.

Beyond capital, you must be a fully incorporated company under the Corporate Affairs Commission (CAC). Required documents include:

- Certificate of Incorporation

- Memorandum and Articles of Association (MEMART)

- Current CAC status report

- Latest audited financial statements, or audited statements of affairs for brand‑new entities

The company also needs a physical office in Nigeria and at least one resident director who can be served legal notices.

Compliance backbone: AML, KYC and record‑keeping

The SEC and the Central Bank of Nigeria (CBN) both demand strict anti‑money‑laundering (AML) and know‑your‑customer (KYC) regimes. In practice, this means:

- Collecting full identity documents for every user (government ID, proof of address, selfie verification)

- Running real‑time transaction monitoring to flag suspicious patterns

- Storing all customer records, transaction logs and communication for a minimum of seven years - the same standard set by the Financial Action Task Force (FATF)

- Submitting regular Suspicious Transaction Reports (STRs) to the Financial Intelligence Unit

Failing any of these steps invites hefty penalties and can trigger licence revocation.

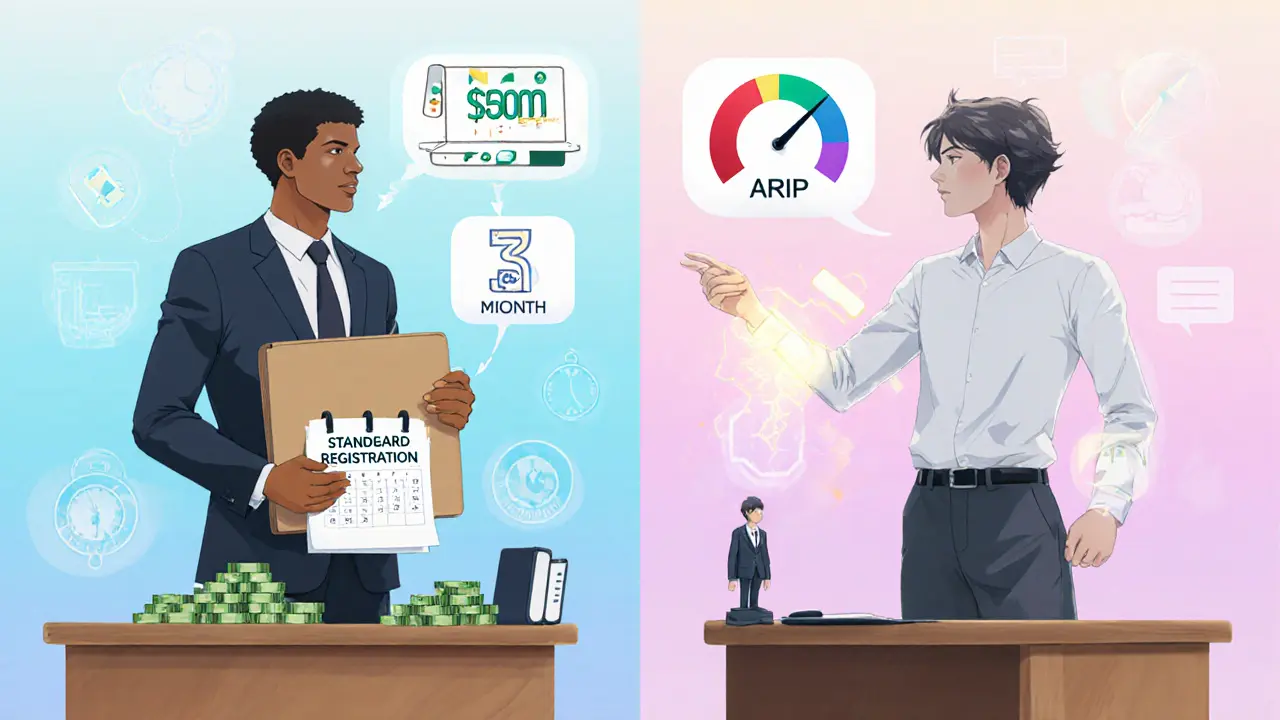

Two ways to get licensed: Standard Registration vs. ARIP

The SEC offers a straight‑forward standard registration process, but it can take 9‑12 months to clear. For faster market entry, the Accelerated Regulatory Incubation Program (ARIP) is an attractive alternative.

| Aspect | Standard Registration | ARIP |

|---|---|---|

| Time to initial approval | 9‑12 months | ≈3 months for provisional approval |

| Capital requirement | Full N500M upfront | Same, but can be staggered in installments |

| Office & resident director | Mandatory before filing | Required only after 6‑month incubation |

| Regulatory oversight | Periodic SEC audits | Continuous monitoring, quarterly progress reports |

| Exit option | Licence revocation only | Option to cease operations after 12‑month trial |

To qualify for ARIP, your company must already be incorporated, have a clear corporate hierarchy, and be actively engaged in securities‑related activities. The program runs on a 12‑month cycle: initial filing → commitment to incubate → quarterly reporting → mid‑term regulatory review → final decision to move to full registration or exit.

Documentation checklist - what the SEC expects

Whether you choose the standard route or ARIP, you’ll need to submit a thick file. Here’s a concise checklist:

- Incorporation documents (CAC certificates)

- Paid‑up capital evidence (bank statements, auditor’s attestation)

- Detailed business model and value proposition

- Full KYC and AML policy manuals, signed by senior management

- Risk‑management framework covering fraud, cyber‑security, and market risk

- Technology risk management plan - includes data‑encryption standards, penetration‑test reports, and disaster‑recovery procedures

- Letters of no objection from any other regulator you already work with (e.g., CBN for payment services)

- Sworn undertaking from a director or company secretary confirming compliance with the Investments and Securities Act 2025

Missing any of these items typically delays the review by weeks or even months.

Common pitfalls and how to avoid them

Resident director hurdle - International firms often struggle to appoint a Nigerian resident. Solution: partner with a local fintech or hire an experienced compliance officer who can act as the statutory director.

Technology compliance costs - The SEC’s tech‑risk standards are on par with EU‑level cybersecurity. Investing early in a SOC‑2‑type security stack (firewalls, multi‑factor authentication, regular audits) saves money later.

Record‑keeping overload - Seven‑year retention can feel daunting. Use a cloud‑based compliance platform that auto‑archives encrypted data and tags each record for easy retrieval.

What licence means for your business on the ground

Once you have the VASP licence, you unlock several benefits:

- Access to traditional banking services - Nigerian banks can now open corporate accounts for licensed VASPs.

- Legal certainty - you can advertise your services, enter contracts, and raise capital without fearing retroactive penalties.

- Consumer trust - users see the licence badge and are more likely to deposit funds.

But the upside comes with higher operating costs. Expect compliance staff to make up 15‑20% of your headcount and annual audit fees to run into six figures.

Future outlook - where the regulatory scene is heading

The SEC is still polishing the implementing regulations. Look out for:

- Guidance on cross‑border crypto transactions - could affect how you handle foreign‑exchange risk.

- Potential adjustments to the capital floor if market participation grows.

- Sandbox extensions that let you test new services (e.g., DeFi protocols) under relaxed rules before full rollout.

Staying in close contact with your SEC liaison and monitoring public consultation papers will keep you ahead of any sudden changes.

Frequently Asked Questions

Do foreign crypto firms need a Nigerian resident director?

Yes. The SEC requires at least one director who resides in Nigeria and can receive legal notices. Most foreign firms either appoint a local compliance officer or partner with a Nigerian entity to satisfy this rule.

How long does the standard VASP registration take?

Typically 9 to 12 months, depending on how complete your documentation is and whether the SEC asks for additional clarifications.

Can I operate while waiting for the licence?

Under the ARIP programme you can start limited operations under SEC supervision after the provisional approval stage. Outside ARIP, you must halt any crypto‑related activities until the licence is granted.

What are the ongoing reporting obligations?

Licensed VASPs must submit quarterly transaction summaries, annual audited financial statements, and any suspicious transaction reports to the SEC and the CBN. Records must be retained for seven years and be available for inspection on request.

Is the N500million capital requirement refundable?

The amount must be paid up and demonstrated in a bank account. It is not a refundable fee; it simply shows the company’s financial capacity.

Comments (13)

Getting a VASP licence in Nigeria is a big step, but the process is pretty straightforward if you follow the checklist. Make sure your paid‑up capital is fully documented and your KYC policies are signed off. Once you have your incorporation docs ready, submit them to the SEC and track the application status.

The regulatory architecture outlined in the Investments and Securities Act 2025 essentially mandates a capital adequacy ratio that aligns with Basel‑III standards, which many fintechs overlook. Moreover, the ARIP’s provisional approval hinges on your AML framework’s real‑time analytics capabilities.

In the labyrinth of Nigerian crypto law, the VASP licence is the Minotaur you must confront to claim the golden fleece of legitimacy. Dare to step beyond the shadows, and the market will bow.

The legal scaffolding for virtual asset service providers demands adherence to both domestic statutes and international compliance regimes. It is incumbent upon the applicant to demonstrate not only capital sufficiency but also an unwavering commitment to fiduciary duty. Neglecting any facet may result in a protracted adjudication, which could be detrimental to operational timelines.

Honestly, if you're not ready to throw half a million Naira into an airtight compliance vault, you might as well stay in the dark ages. The SEC isn't playing games; they're demanding a fortress of audits, and you need to bring your A‑game. Don't expect a pink slip for anything less than perfection.

Hey folks, I get that the paperwork can feel overwhelming, especially when you're juggling cross‑border teams. Remember, you can lean on local partners for the resident director role and share the compliance load. It's all about building a supportive ecosystem that lifts everyone up.

Stay focused the process is a marathon not a sprint keep your docs tidy and the SEC will see your commitment

Look, the ARIP isn't just a fancy name, it's a strategic lever that can shave months off your market entry if you align your tech stack with their monitoring requirements. Skipping this step is like trying to sprint without shoes.

Most crypto start‑ups think they can dodge the N500M fee lol

Getting that VASP licence can feel like climbing a mountain, but every step is manageable if you break it down. First, secure your paid‑up capital and keep the proof in a reputable bank; the SEC will ask for audited statements, so don’t cut corners. Second, gather all incorporation paperwork – the CAC certificate, MEMART, and a recent status report – and double‑check for any missing signatures. Third, draft a comprehensive AML/KYC policy; think of it as your company’s DNA that must be approved by both the SEC and the CBN. Fourth, appoint a resident director who is genuinely available to receive legal notices; you can partner with a local compliance firm if you don’t have a Nigerian citizen on staff. Fifth, set up a physical office; even a co‑working space with a registered address will satisfy the requirement. Sixth, build your tech risk management framework – include encryption standards, penetration test reports, and a disaster‑recovery plan. Seventh, prepare a risk‑management matrix covering fraud, cyber‑security, and market volatility; the SEC loves data‑driven assessments. Eighth, compile letters of no objection from any other regulators you already deal with, such as the Central Bank for payment services. Ninth, write a sworn undertaking from a senior officer confirming adherence to the Investments and Securities Act 2025. Tenth, submit everything through the SEC portal and keep a meticulous log of every file you upload. Eleventh, respond promptly to any follow‑up queries; delays usually stem from incomplete information. Twelfth, once you get provisional approval under ARIP, start limited operations under close supervision – this is your chance to prove compliance in real time. Thirteenth, maintain quarterly reports on transaction volumes, suspicious activity, and financial statements; the seven‑year retention rule is non‑negotiable. Fourteenth, invest in a compliance team that can handle the ongoing audit burden – expect them to be 15‑20% of your headcount. Finally, stay engaged with the SEC liaison and monitor public consultations for any regulatory tweaks. Follow these steps diligently, and the licence will be yours without unnecessary roadblocks.

Oh, so you think the SEC is just another bureaucratic speed bump? Sure, if you enjoy watching your capital evaporate while they draft yet another “guideline” that nobody reads.

Really interesting how the ARIP can accelerate entry but also adds continuous monitoring it seems like a good balance for innovators and regulators alike

The dance between regulation and innovation in Nigeria reminds me of a jazz improvisation – you need structure, but the freedom to riff creates the real magic.