XCAD DEX Trading Guide

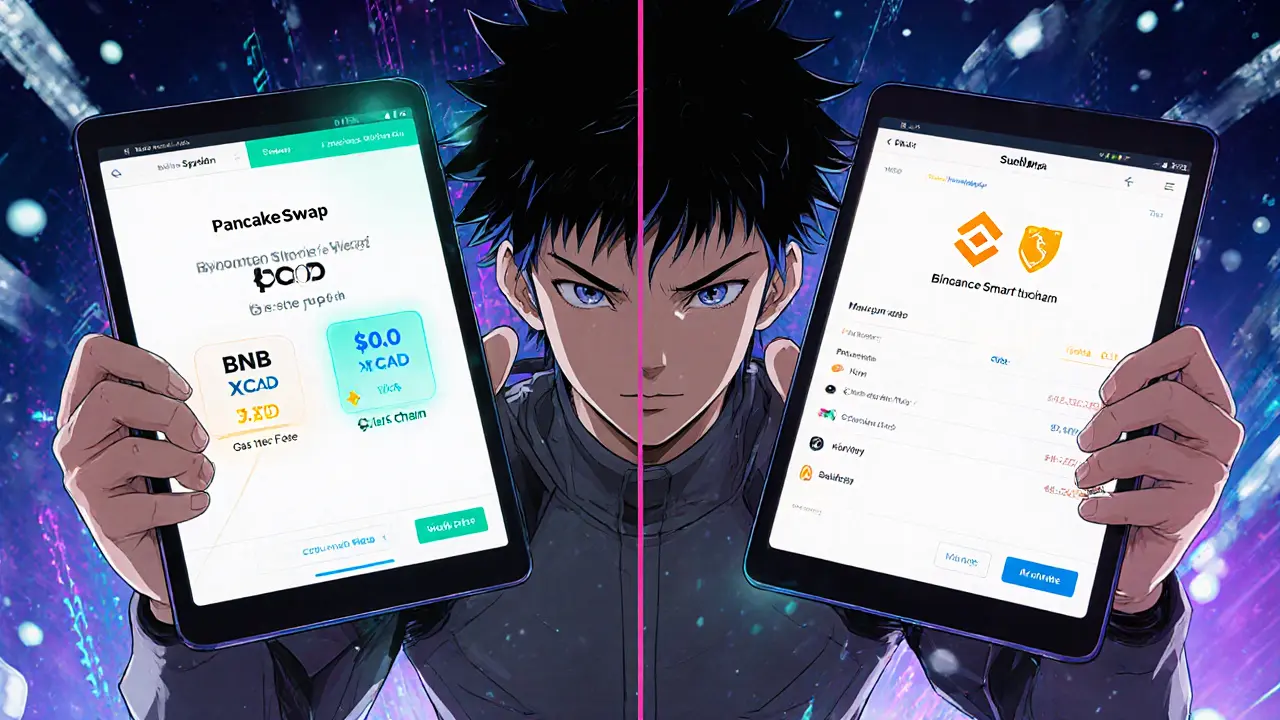

PancakeSwap (BSC)

Gas: ~$0.02

Best for low-cost trades

- Low fees

- Fast swaps

- Yield farming

SushiSwap (Multi-chain)

Gas: $3.5-$8

Rich ecosystem features

- Multi-chain support

- Staking opportunities

- Deep liquidity

Trade XCAD Step-by-Step

Trading Steps:

Ever wondered why "XCAD DEX" shows up in searches but you can’t find a dedicated platform? The short answer: there isn’t one. XCAD DEX lives in the ecosystem of existing decentralized exchanges (DEXs) that support the XCAD Network token. This review pulls together the steps, tools, and pitfalls you need to trade XCAD safely in 2025, compares the most popular DEXs, and gives you a quick checklist to avoid common mistakes.

Key Takeaways

- XCAD doesn’t have its own DEX; you trade it on PancakeSwap, SushiSwap, Apex, HyperLiquid, or any DEX that lists the token.

- MetaMask’s built‑in swap won’t work because XCAD lives on a different blockchain than ETH.

- Knowing the contract address and choosing a low‑gas chain (BSC or Polygon) saves money.

- Liquidity varies: PancakeSwap offers the deepest pools, while SushiSwap adds yield‑farm incentives.

- Always verify the contract on Etherscan or BscScan before confirming a trade.

What Is XCAD Network?

XCAD Network is a blockchain‑based platform that rewards content creators and viewers with the XCAD token. Launched in 2022, the token runs on the Ethereum mainnet but has bridge support to Binance Smart Chain (BSC) and Polygon, allowing cross‑chain swaps. The token’s utility includes staking for creator royalties, governance voting, and accessing premium video content.

As of October2025, XCAD’s market cap hovers around €120million with daily volumes ranging from €200k to €600k, depending on the DEX. Price volatility remains high-simulations predict a neutral scenario around €0.0207 by mid‑2026, but real‑world moves can swing ±30% in a single week.

Why There Is No Dedicated XCAD DEX

Most new tokens rely on existing DEX infrastructure instead of building a standalone exchange. Building a DEX requires liquidity, order‑book logic, and ongoing security audits-costs that outweigh the benefits for a token with a niche user base like XCAD. Instead, the XCAD team focuses on partnerships with established DEXs, ensuring broader exposure and lower friction for users.

In practice, this means you’ll always be interacting with a third‑party DEX. The key is selecting one that offers:

- Reliable liquidity for XCAD/ETH or XCAD/BNB pairs.

- Low‑fee bridges if you’re swapping across chains.

- Transparent contract verification.

How to Trade XCAD on PancakeSwap (BSC)

PancakeSwap is the leading DEX on Binance Smart Chain. It’s known for fast swaps, sub‑$0.001 gas fees, and a straightforward UI.

- Buy BNB on a centralized exchange (e.g., Binance) and withdraw to your MetaMask wallet.

- Switch MetaMask’s network to BSC (add RPC:

https://bsc-dataseed.binance.org/). - Visit pancakeswap.finance and click “Connect Wallet”.

- In the swap tab, select BNB as the “From” token and XCAD as the “To” token. If XCAD doesn’t appear, click “Import Token” and paste the BSC‑bridge contract address:

0x... (verify on BscScan). - Enter the amount, review the slippage tolerance (set to 0.5% for low‑liquidity pairs), and confirm the transaction.

- After the swap, add XCAD to your MetaMask token list using the same contract address.

Typical gas for a BSC swap is under $0.02, making PancakeSwap the cheapest route for small‑scale traders.

Swapping XCAD on SushiSwap (Multi‑Chain)

SushiSwap operates on multiple chains-Ethereum, Polygon, and BSC-offering deeper liquidity for XCAD/ETH pairs.

- Load ETH into MetaMask (or bridge your BNB to ETH via a trusted bridge).

- Navigate to sushi.com and connect your wallet.

- Select ETH as the source token. If XCAD isn’t listed, click “Manage Token List” → “Add Token” and paste the Ethereum contract address:

0x... (verify on Etherscan). - Set slippage to 1% (Ethereum gas spikes can cause higher price impact).

- Confirm the swap; expect gas fees between €3-€8 depending on network congestion.

- When the transaction completes, you’ll see XCAD in your wallet. Add the token if needed.

SushiSwap also lets you stake XCAD in its “BentoBox” vault, earning a modest 2‑3% APY while you hold the token.

Manual Contract Address Method (Any DEX)

If a DEX doesn’t list XCAD outright, you can still trade it by entering the contract address manually. This works on platforms like Uniswap, 1inch, or any DEX that supports custom tokens.

- Locate the verified contract on Etherscan (or BscScan for BSC). Verify the token symbol, decimals (usually 18), and the “Contract Address”.

- Copy the address and paste it into the DEX’s “Import Token” field.

- Double‑check the token name and logo to avoid phishing clones.

- Proceed with the swap as usual, keeping an eye on gas and slippage.

Remember: manual entry removes the safety net of built‑in token lists, so a single typo can send funds to a non‑existent address.

Comparing Popular DEXs for XCAD

| DEX | Primary Chain(s) | Typical Gas (USD) | XCAD Availability | Extra Features |

|---|---|---|---|---|

| PancakeSwap | Binance Smart Chain | 0.02-0.05 | Direct pair BNB/XCAD; bridge required for ETH | Yield farms, lottery, low fees |

| SushiSwap | Ethereum, Polygon, BSC | 3.5-8 (Ethereum); 0.03 (Polygon) | ETH/XCAD pair; Polygon bridge improves cost | BentoBox vault, staking, multi‑chain swaps |

| Apex | Ethereum (Layer‑2 Optimism) | 0.10-0.30 | Limited - must add contract manually | Order‑book UI, futures, PnL tracking |

| HyperLiquid | Solana, Arbitrum | 0.001 (Solana) / 0.05 (Arbitrum) | Supported via bridge; low latency | Spot + perpetuals, stable‑coin settlement |

For most casual traders, PancakeSwap wins on cost, while SushiSwap offers the richest ecosystem features. If you need advanced order types, Apex and HyperLiquid provide a hybrid experience closer to centralized exchanges.

Tips, Pitfalls, and Security Best Practices

- Verify the contract address on the official XCAD website or the token’s GitHub repo before any swap.

- Use a hardware wallet (Ledger or Trezor) for large purchases; it isolates private keys from browser attacks.

- Watch gas spikes on Ethereum-consider swapping during off‑peak hours (UTC02:00-04:00) to shave off up to 30% in fees.

- Set slippage tolerance low (0.3‑0.5%) on high‑liquidity pairs; raise it only if the price moves quickly.

- After swapping, confirm the XCAD balance in both the DEX interface and your wallet to ensure the transaction wasn’t front‑run.

Frequently Asked Questions

Is there an official XCAD DEX?

No. XCAD does not operate a dedicated decentralized exchange. The token is listed on third‑party DEXs like PancakeSwap, SushiSwap, and a few emerging platforms.

Which DEX offers the cheapest way to buy XCAD?

PancakeSwap on Binance Smart Chain typically has the lowest gas fees (under $0.05) for BNB‑XCAD swaps. If you already hold ETH, SushiSwap on Polygon can also be cost‑effective.

How do I find the XCAD contract address?

Visit the official XCAD website or the token’s page on Etherscan (Ethereum) or BscScan (BSC). The verified contract will be highlighted with a green check‑mark.

Can I use MetaMask’s built‑in swap to get XCAD?

No. MetaMask swaps only work between tokens on the same blockchain. Since XCAD lives on Ethereum while most cheap swaps happen on BSC, you must use an external DEX and bridge the assets.

Is it safe to add XCAD manually on any DEX?

It’s safe if you double‑check the contract address from an official source. Always verify the token’s symbol, decimals, and the green verification badge on the block explorer before confirming a trade.

Bottom line: while “XCAD DEX” isn’t a real platform, the token is fully tradable across today’s leading decentralized exchanges. Pick the chain that matches your existing assets, watch the gas, and keep the contract address handy. With the right DEX, you’ll be swapping XCAD in minutes, not hours.

Comments (22)

Ugh, the whole XCAD thing feels like a scam… you’re basically paying gas just to feed the whales, and the “low‑fee” claim on PancakeSwap is a joke when you consider the hidden bridge costs. Every time I try to swap, the slippage spikes, and before you know it you’ve lost a chunk of your holdings to arbitrage bots. It’s exhausting watching the price tank while you’re stuck waiting for a confirmation that never comes. Honestly, if you’re not ready to lose sleep over tokenomics, skip XCAD entirely.

Most people will tell you PancakeSwap is the cheapest route, but I’ve seen the *real* numbers on BSC after the recent fee hike – it’s not that cheap anymore. If you actually care about an honest trade, you should be looking at the emerging Layer‑2 solutions on Optimism for XCAD, even if the liquidity is thinner. It’s a trade‑off, but at least you’re not funneling all your capital through a single, over‑crowded DEX that’s built for meme coins.

Quick tip: always double‑check the XCAD contract address on the official site before importing it into any DEX. A typo can send your tokens straight to a black hole.

Yeah, because nothing says “I love crypto” like spending $0.03 on gas to move a token worth a few cents. 🤷♂️ But hey, at least you get to watch the price swing while you wait for the transaction to confirm.

One must contemplate: is the value of XCAD derived from its utility, or merely from the hype that surrounds it?-the answer may lie somewhere between market sentiment and genuine adoption; however, the latter appears scarce.-Thus, proceed with caution.

Actually, the fee structure you mentioned isn’t as black‑and‑white as it seems. While PancakeSwap’s gas is low on BSC, you have to account for the bridge fee when moving XCAD from Ethereum to BSC, which can sometimes eclipse the swap fee itself. Moreover, the price impact on low‑liquidity pairs can cause you to receive less XCAD than expected, especially during high volatility periods. It’s also worth noting that some users have reported hidden slippage settings in the “Advanced” tab that default to higher percentages, inadvertently increasing costs. If you’re trading larger volumes, consider splitting the order into smaller chunks to minimize price impact. Finally, always verify the token contract after the bridge transfer, because some bridges spawn wrapped versions with slightly different addresses.

If you thought SushiSwap was just a fancy restaurant, think again – it’s actually a decent place to get XCAD if you’re already on Ethereum and don’t mind the gas burn.

Remember to keep your private keys secure and consider using a hardware wallet for larger XCAD holdings; the extra step can save you from many common phishing attacks.

Trading XCAD on Polygon can be cheap, but make sure the bridge you use is reputable, otherwise you might lose your tokens.

Low fees are awesome! 😄

Just grab some XCAD on PancakeSwap and hold, the future looks bright.

I think the best move right now is to watch the market a bit longer before jumping in, especially with all the new DEXs popping up.

Be careful, many of these so‑called “bridges” are run by unknown entities that could potentially siphon funds without anyone noticing.

Stop whining about gas fees and actually read the gas tracker before you trade; knowledge is power.

For anyone dealing with large XCAD amounts, I recommend setting up a multi‑sig wallet; it adds an extra layer of security and prevents single‑point failures.

The moment I first saw XCAD’s price chart, my heart raced like a drum in a warzone. I imagined the possibilities of creators being truly rewarded, and the vision felt intoxicating. Yet, the moment I tried to buy on a DEX, the gas fees smacked me like a slap across the face. The slippage rates climbed higher than a mountain, and I felt my optimism dissolve into bitterness. It was as if the blockchain itself conspired to test my resolve. I scrolled through endless forums, chasing the thin thread of hope that a hidden liquidity pool might save me. Every “official” link led to a labyrinth of bridges, each demanding its own toll. My wallet trembled with every transaction, and my confidence wavered. I thought perhaps the token was a myth, a phantom whispered in crypto corridors. Still, the community’s fervor pulled me back, promising riches and fame for early adopters. I decided to stake a modest amount, hoping the BentoBox yields would cushion the blow. The staking rewards arrived, a tiny glimmer in the darkness, yet the market’s fickle nature persisted. Days turned into weeks, and my XCAD balance flickered like a candle in a storm. In the end, I realized that the true value lies not in price spikes, but in the belief of creators and fans alike. So I hold, I watch, and I wait for the day when the token’s purpose fulfills its promise.

When you dive into the sprawling ecosystem of decentralized exchanges, you quickly discover that each platform is like a bustling city with its own neighborhoods: PancakeSwap is the cheap‑eats alley where you can feast on low‑fee swaps, SushiSwap resembles a multicultural district offering diverse menus of staking and yield farms, while newer entrants like HyperLiquid feel like avant‑garde art installations that promise speed but demand acclimation; navigating these realms requires a map, a compass, and occasionally a seasoned guide-so strap on your MetaMask, check the gas tracker, and remember that the most rewarding journeys often involve a few detours.

Sure, everyone’s “expert” tells you to chase the hottest DEX, but most of them forget to mention the rug‑pull risk that lurks behind a shiny token contract.

Honestly, the best practice is to compare the total cost: bridge fees, gas, and slippage, before deciding which DEX to use for XCAD.

Oh great, another “XCAD miracle” post, as if we haven’t seen the same overhyped promises for the hundredth time-maybe the next DEX will finally deliver, but I won’t hold my breath.

For those on a tight budget, I recommend using the Polygon network via SushiSwap; the gas is minimal and the liquidity for XCAD is growing steadily, making it a practical choice for small investors.

Stay positive-XCAD has a solid roadmap, and with the right DEX strategy, you could see some nice gains in the coming months.