Ethereum Staking Calculator

Staking Rewards Calculator

Calculate your potential annual rewards from staking Ethereum based on current rates (3.5%-5.2%) and ETH price.

Enter your ETH amount and current ETH price to see potential rewards.

There is no such thing as a 'Minter' crypto exchange for Ethereum. If you're searching for one, you're not alone - but you're chasing something that doesn't exist. The confusion comes from two mixed-up ideas: one is the old myth of Ethereum mining, and the other is a completely different blockchain called Minter Network - now rebranded as Bip Network. Neither has anything to do with trading Ethereum today.

Ethereum Doesn't Mine Anymore - Here's What Replaced It

Back in 2022, Ethereum changed how it works. It stopped using mining. That’s right - no more GPUs running 24/7, no more electricity bills climbing because of Ethereum rigs. On September 15, 2022, the network completed what’s called the Merge. It switched from Proof-of-Work to Proof-of-Stake. Mining is dead. Not just slowed down. Not just harder. Ethereum mining is impossible as of 2025. Any website, video, or ad telling you otherwise is either outdated or trying to sell you useless hardware.

What replaced mining? Staking. To become a validator on Ethereum now, you need exactly 32 ETH. At current prices (around $2,700 per ETH), that’s about $86,400. You don’t need a mining rig. You need a computer, an internet connection, and enough ETH to lock up. In return, you earn between 3.5% and 5.2% annually, paid in more ETH. The Ethereum Foundation’s Q3 2025 dashboard shows over 1.1 million validators running, securing the network with zero mining hardware.

And here’s the kicker: Ethereum now uses 99.95% less energy than it did before the Merge. Cambridge University confirmed this in their September 2024 audit. The network processes 15-20 transactions per second, with finality in just over 12 minutes. It’s faster, cheaper, and cleaner - but you can’t mine it. Period.

What Is Minter Network? (And Why People Get Confused)

The name 'Minter' comes from a different project - Minter Network, launched in 2018 by Russian developer Alexander Minin. It was a blockchain built to let anyone create their own tokens with a few clicks. Think of it like a simple tool for launching coins, not a trading platform. In 2023, it rebranded to Bip Network. It still exists, but it’s not connected to Ethereum. You can’t trade ETH on it. You can’t stake ETH on it. It’s a separate chain with its own token, BIP.

People mix them up because both names sound like they’re about creating or managing crypto. But Minter/Bip is for token creation. Ethereum is for decentralized apps, DeFi, and digital assets. They don’t talk to each other. If you see a site called 'Minter Exchange' offering ETH trading, it’s either a scam or a copycat. Check the domain. Check the team. Check the wallet addresses. Legit exchanges don’t hide behind misleading names.

Where to Actually Trade Ethereum in 2025

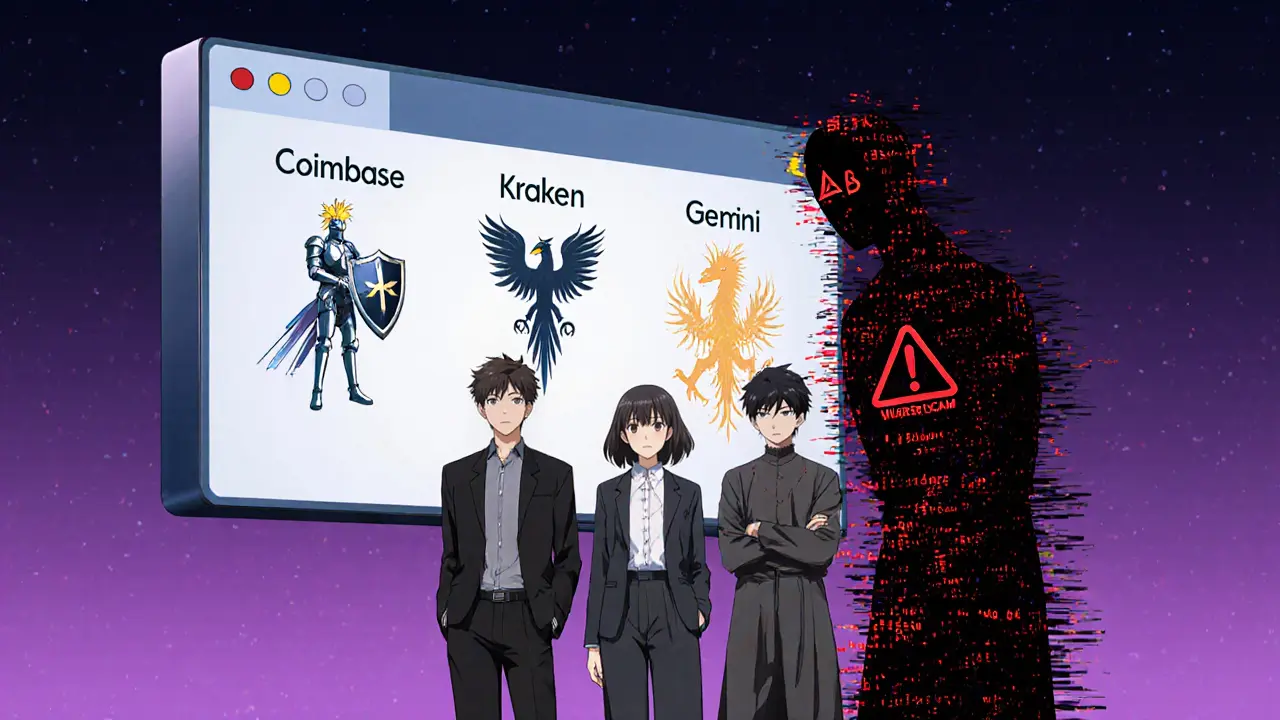

If you want to buy, sell, or trade Ethereum, you need a real exchange. Here are the top options based on performance, security, and user feedback in late 2025.

- Coinbase: Best for beginners. Charges 0.5%-4% in fees, but it’s simple, insured ($250 million), and compliant in all 50 U.S. states. Supports instant buys with bank transfers. Integrated MetaMask Swaps as of November 2025, letting users swap tokens without leaving the app.

- Binance: Lowest fees (0.1%-0.2%), 600+ cryptocurrencies, and the best mobile app. But it’s banned in 23 countries, including the U.S. Users report 92% satisfaction with speed - but 78% worry about future U.S. regulatory crackdowns.

- Kraken: Security-first. Mandatory 2FA, withdrawal whitelisting, and $42.7 billion monthly volume. Fees start at 0.16% for high traders. Problem? KYC verification takes an average of 58 hours. That’s slower than most banks.

- Gemini: Ultra-regulated. Approved in all 50 U.S. states. Flat 0.35% fee. No surprises. No hidden risks. Ideal for conservative users. But it lacks advanced charting tools.

- Uphold: Unique cross-asset trading. Buy ETH, then instantly trade it for gold, silver, or Bitcoin. Real-time reserve transparency - updated every 30 seconds. Trusted by experts like Nic Carter of Castle Island Ventures as a model for transparency.

Security matters more than fees. ZachXBT’s October 2025 audit found only Coinbase, Kraken, and Gemini have 100% proof-of-reserves with regular third-party audits. Binance covers 89.3% of assets - close, but not perfect. If you’re holding more than a few thousand dollars, choose an exchange that proves it owns your coins.

What About Decentralized Exchanges?

You don’t have to use a centralized exchange. Decentralized exchanges (DEXs) let you trade directly from your wallet. Uniswap leads the pack with 18.2% of all DEX volume, followed by Curve and Balancer. No KYC. No account. No middleman. But you pay gas fees in ETH, and you’re responsible for your own security. If you lose your private key, your coins are gone forever.

DEXs now handle 28.4% of all Ethereum trading volume. That’s up from 12% in 2023. For experienced users, they’re the future. For newcomers? Start with Coinbase or Kraken. Learn the basics. Then move to DEXs.

What’s Coming Next for Ethereum?

Ethereum isn’t done evolving. The Prague upgrade is scheduled for Q2 2026. One big change? The minimum staking requirement drops from 32 ETH to just 1 ETH. That means regular people can run validators without needing $86,000. This could open up staking to millions more users.

Developers are also shifting to Layer-2 networks like Arbitrum and Optimism. These handle transactions off the main chain, cutting fees and speeding things up. Over 72% of Ethereum developers now build on Layer-2s, according to Electric Capital’s October 2025 report. That’s where the real innovation is happening.

Regulation is still messy. The SEC says ETH is a security. The CFTC says it’s a commodity. The EU’s MiCA rules require all exchanges to track users spending over €1,000. In the U.S., it’s a legal gray zone. That’s why exchanges like Coinbase and Gemini are spending millions on compliance. It’s not just about trust - it’s about survival.

What Should You Do Right Now?

If you’re looking to trade Ethereum:

- Forget 'Minter' or 'Ethereum mining' - those are dead ends.

- Use a reputable exchange: Coinbase for ease, Kraken for security, Binance for volume (if you’re outside the U.S.).

- Never store large amounts of ETH on an exchange. Use a hardware wallet like Ledger or Trezor.

- Start staking if you have 32 ETH - or wait for the Prague upgrade to stake with just 1 ETH.

- Watch for Layer-2 solutions. They’re where the future of Ethereum trading is happening.

And if you see a site offering 'Minter Exchange' or 'Ethereum mining software' - close it. Block it. Report it. This isn’t just outdated tech. It’s a trap.

Is there a crypto exchange called Minter for Ethereum?

No. There is no exchange called 'Minter' for trading Ethereum. The name comes from Minter Network (now Bip Network), a separate blockchain for creating tokens. It has no connection to Ethereum trading. Any site using 'Minter' to promote ETH trading is misleading or fraudulent.

Can I still mine Ethereum in 2025?

No. Ethereum stopped mining entirely after the Merge on September 15, 2022. All mining hardware is now useless on the Ethereum network. Any service claiming to mine Ethereum is either scamming you or referring to Ethereum Classic (ETC), a completely different blockchain.

What’s the best place to buy Ethereum today?

For beginners: Coinbase. For security: Kraken or Gemini. For low fees and high volume: Binance (if you’re outside the U.S.). All support ETH/USD trading with verified identity checks. Avoid unknown platforms - stick to exchanges with public proof-of-reserves.

How do I earn interest on Ethereum now?

You stake it. Lock up 32 ETH to run a validator and earn 3.5%-5.2% annually. If you don’t have that much, use a staking service like Coinbase, Kraken, or Lido. They pool your ETH with others and pay you a share of the rewards. You don’t need to run your own node.

Is Ethereum safe to invest in?

Ethereum is the most established smart contract platform, with $2.78 trillion in monthly trading volume in Q3 2025. But like all crypto, it’s volatile. Use trusted exchanges, store your ETH in a hardware wallet, and never invest more than you can afford to lose. The technology is solid - the price is not.