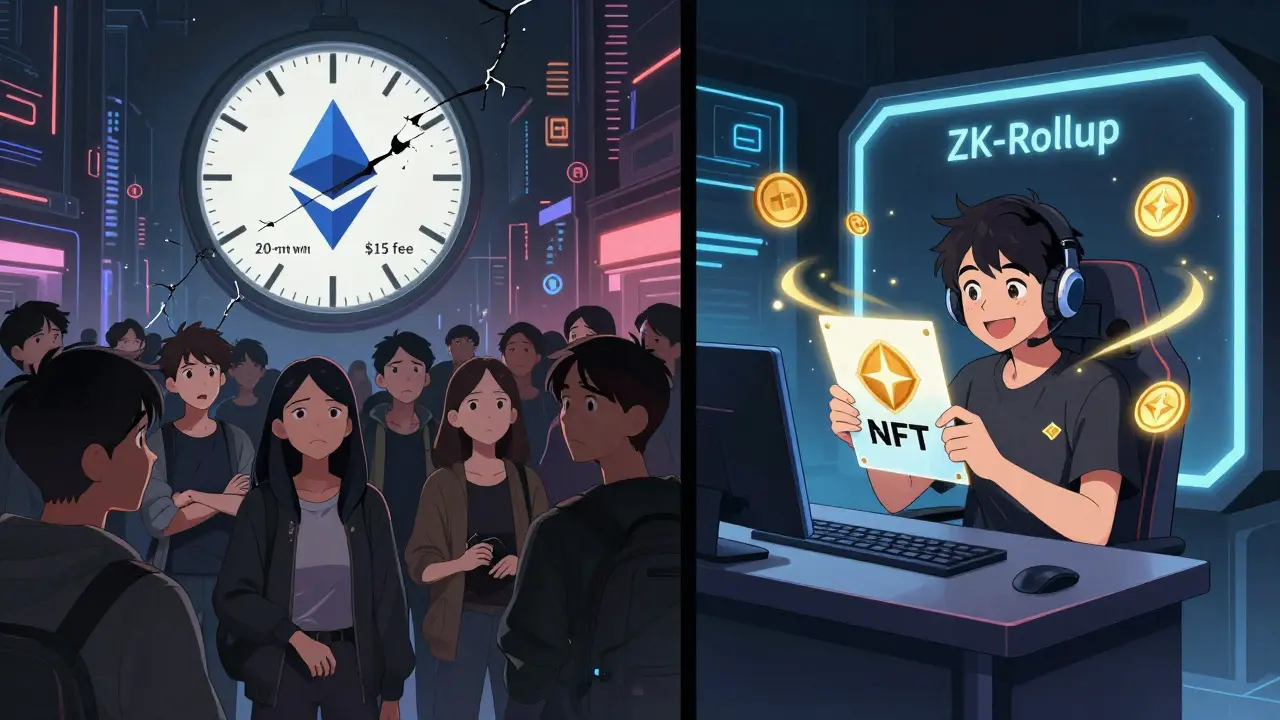

Imagine trying to send money through a blockchain during peak time-only to wait 20 minutes and pay $15 in fees. That was real for Ethereum users in 2021. Bitcoin hit $55 fees during its 2017 bull run. The problem isn’t broken tech-it’s capacity. Blockchains were never built to handle Visa-level traffic. So how do modern platforms scale without giving up security or decentralization? The answer isn’t one trick. It’s a mix of layered fixes, each with trade-offs you need to understand.

Why Scalability Matters More Than You Think

Blockchains aren’t just digital ledgers. They’re global payment systems, marketplaces, and financial engines. But if your network can only process 15 transactions per second (like Ethereum’s base layer), you’re stuck. Visa handles 65,000. Even PayPal does 193. That gap isn’t just inconvenient-it kills real-world use. Gamers can’t buy NFTs in real time. DeFi traders get frontrun. Small payments become uneconomical. Scalability isn’t a tech bonus. It’s the difference between a prototype and a working system.Layer 1: Changing the Foundation

Layer 1 solutions change the core blockchain rules. Think of it like widening a highway instead of adding exit ramps. The most famous example is Ethereum’s shift from Proof-of-Work to Proof-of-Stake in September 2022. This cut energy use by 99.95% and dropped block times from 13 seconds to a steady 12. That’s not just green-it’s faster. But it didn’t solve throughput. That’s where sharding comes in. Ethereum 2.0’s Beacon Chain, launched in December 2020, split the network into 64 shards. Each shard processes its own transactions in parallel. By 2024, that number could grow to 1,024. That’s not theory. It’s live. Cardano uses a similar approach with its Ouroboros PoS protocol, hitting 250 TPS with 20-second finality. Avalanche goes even further: 4,500 TPS with sub-second finality, thanks to its unique consensus design. These aren’t incremental upgrades. They’re architectural overhauls. But Layer 1 has a catch. Changing the base layer means a hard fork. That requires near-unanimous agreement from miners, validators, and users. Ethereum’s DAO fork in 2016 split the community and created Ethereum Classic. Hard forks are risky. They’re slow. And they need massive coordination. That’s why many projects look elsewhere.Layer 2: Building on Top

Layer 2 solutions don’t touch the base chain. They build parallel systems that settle back to it. Think of them as express lanes that only need to report final totals to the main road. The most successful? Rollups. There are two types: Optimistic and Zero-Knowledge (ZK). Optimistic Rollups, like Optimism and Arbitrum, assume transactions are valid unless someone proves otherwise. They can do 2,000-4,000 TPS. But they have a 7-day challenge window. If you withdraw funds, you wait a week. ZK-Rollups, like zkSync and StarkNet, use cryptographic proofs to verify batches instantly. They’re faster-near real-time finality-and more secure. But they’re harder to code. Developers need deep math skills. Then there’s the Lightning Network for Bitcoin. Launched in January 2018, it lets users open payment channels between each other. Transactions happen off-chain, with only the opening and closing recorded on Bitcoin. By Q3 2023, it was processing over $10.5 million daily. But it’s not perfect. Routing failures spike above $1,000. It’s great for small, frequent payments-not big transfers. Polygon, originally called Matic, is another Layer 2 powerhouse. It uses a PoS sidechain to handle 7,000 TPS at $0.001 per transaction. Over 87% of top NFT marketplaces use it. But it’s not as secure as Ethereum. If Polygon’s validators go down, users are stuck. That’s the trade-off: speed for trust.

What Works Best for Different Use Cases

Not all scaling solutions are equal. Your choice depends on what you’re doing.- DeFi and high-value assets: Stick with Ethereum mainnet or ZK-Rollups. They’re audited, secure, and trusted by institutions. 63% of all DeFi locked value stays on Ethereum.

- Gaming and NFTs: Polygon, Arbitrum, or Solana. Low fees matter more than absolute security. DappRadar shows most NFT sales happen on Layer 2.

- Microtransactions and payments: Lightning Network or Bitcoin’s Taproot Assets. You need instant, cheap transfers. Layer 2 is the only way.

- Enterprise apps: Avalanche or private blockchains. Sub-second finality matters for real-time workflows. 73% of Fortune 500 companies are testing these.

The Hidden Costs of Scaling

Scaling isn’t free. Even if you don’t pay gas, someone does. Running a Lightning node? You need 2GB RAM, 50GB storage, and a constant internet connection. Developers rate setup complexity at 7 out of 10. Exchanges like Kraken spent $2-5 million and 6-12 months to migrate to microservices. Coinbase had to hire specialists in ScyllaDB and Cassandra to shard their databases-raising staffing costs by 30-40%. Documentation is patchy. Early Plasma implementations had 68% failure rates because guides were incomplete. Ethereum’s Layer 2 docs are solid (4.1/5 on GitHub). But most alternatives? Barely usable. Community support matters. Ethereum’s research forum has 12,500+ active members. Few other ecosystems come close. And then there’s regulatory risk. The EU’s MiCA law, effective June 2024, requires exchanges to clearly explain how their scaling solutions work. Layer 2 settlement delays (like the 7-day wait on Optimism) make auditors nervous. Only 28% of traditional banks trust off-chain finality.

The Future: Hybrid Systems Are Winning

No single solution fixes everything. That’s why the smartest projects are combining them. Ethereum’s Dencun upgrade (March 2024) introduced proto-danksharding. It doesn’t fully shard the chain. Instead, it lets Rollups store data more cheaply-cutting fees by 10x to 100x. That’s Layer 1 enabling Layer 2. Polygon’s $1 billion Infinity DAO aims to link multiple ZK-Rollups into one network. Avalanche’s ‘Avalanche Connect’ lets Ethereum dApps move over with minor code changes. Even Bitcoin is getting in the game with Taproot Assets, turning its blockchain into a scalable asset issuance layer. A 2023 survey of 50 blockchain architects found 68% believe hybrid models will dominate by 2026. Only 22% think one solution will win. The future isn’t Ethereum vs. Solana. It’s Ethereum + ZK-Rollups + Lightning + Avalanche sidechains-all talking to each other.What to Watch in 2025

The market for blockchain scalability is projected to hit $34.8 billion by 2028. Growth is explosive. But adoption isn’t uniform.- Layer 2 adoption will surge in gaming, social apps, and micropayments. Expect more apps using zkSync or Scroll.

- Layer 1 innovation will focus on modular architectures. Chains like Celestia are separating consensus from execution.

- Interoperability will improve. Projects like LayerZero and Wormhole are making cross-chain transfers safer and faster.

- Regulation will tighten. Expect more audits, transparency rules, and compliance requirements for Layer 2 providers.

What’s the fastest blockchain for transactions today?

Avalanche leads in raw speed with 4,500 transactions per second and sub-second finality. For everyday use, ZK-Rollups like zkSync and StarkNet offer near-instant processing at low cost. Layer 2 solutions like Polygon and Arbitrum are faster than Ethereum’s base layer, which caps at 15-45 TPS.

Is Layer 2 safer than Layer 1?

Not always. Layer 1 chains like Ethereum are secured by thousands of global validators. Layer 2 solutions rely on fewer actors-either fraud proofs (Optimistic Rollups) or cryptographic proofs (ZK-Rollups). ZK-Rollups are nearly as secure as Layer 1. Optimistic Rollups have a 7-day window where funds could be stolen if no one challenges. Polygon’s sidechain is less secure than Ethereum’s mainnet because it has fewer validators.

Why does Ethereum still dominate DeFi if it’s so slow?

Because it’s the most trusted. Even with high fees, Ethereum’s mainnet has never been hacked at the protocol level. Over 63% of DeFi total value is locked there because institutions and developers prioritize security over speed. Layer 2s are growing fast, but they’re still seen as extensions-not replacements.

Can Bitcoin scale without a hard fork?

Yes, through Layer 2. The Lightning Network already handles millions of small transactions daily. Taproot Assets (formerly Taro), launched in late 2021, lets users issue tokens and assets on Bitcoin without changing the core protocol. These solutions keep Bitcoin’s security while adding scalability-no hard fork needed.

Should I use Polygon or Ethereum for my NFT project?

If you want low fees and fast sales, use Polygon. Over 87% of top NFT marketplaces already do. But if you’re targeting collectors who care about long-term value and security, mint on Ethereum mainnet. Many buyers still distrust sidechains. You can even use both: mint on Ethereum, then bridge to Polygon for trading.

What’s the biggest risk with scaling solutions?

Overconfidence. Many users assume Layer 2 = fully secure. But when Polygon had a 4-hour delay in 2023, users lost trades. When Crypto.com crashed in 2022, 1.5 million users couldn’t access funds. Scaling adds complexity-and complexity introduces new failure points. Always understand the trade-offs before you commit funds.

Comments (19)

Wow, this is so helpful! I always thought blockchains were just slow by design, but now I see it’s about architecture-not magic. Layer 2s are like express lanes on a highway that only report to the main road. Mind blown. 😅

One must ask: is scalability, in its current form, not merely an expression of capitalist urgency disguised as technological progress? The blockchain, in its purest essence, was meant to resist velocity-to slow down the rush of capital. Are we not betraying its ethos by chasing Visa’s throughput?

Let me tell you-this is the most balanced take I’ve read in months. Layer 1 changes like PoS? Huge win. Sharding? Still experimental but promising. But the real MVP? ZK-Rollups. They’re the quiet geniuses of scalability. zkSync and StarkNet? They’re not just fast-they’re future-proof. And yes, they’re harder to build, but that’s why the devs who do it are rockstars. If you’re building anything serious, go ZK. You’ll thank yourself in 2026.

Also, Polygon’s great for NFTs, but don’t forget: if the sidechain goes down, your NFT’s basically a JPEG in a locked drawer. Ethereum mainnet? Still the gold standard for trust.

It’s funny how we talk about speed like it’s the only metric that matters. But what’s the point of 4,500 TPS if the system feels cold, impersonal, or brittle? I think the real win isn’t just scaling-it’s scaling with soul. The fact that Ethereum’s community still has 12,500+ active researchers? That’s the heartbeat. No algorithm can replicate that.

Maybe the future isn’t faster chains. Maybe it’s chains that let us feel connected-even when transactions are instant.

Honestly? I’m just here for the memes. But also… I’ve been using Arbitrum for weeks now. Fees are pennies. Speed? Instant. And I didn’t even need to read a whitepaper. Just connect MetaMask and go. Still, I keep a little ETH on mainnet just to feel like I’m part of the ‘real’ blockchain. Like a spiritual backup. 🤷♂️

i just tried to send 5 bucks on eth last week and got charged 12$ in fees… like?? why is this a thing?? i thought crypto was supposed to be for the people?? now i just use polygon for everything and pretend i dont care about security. 🤭

Let’s be real-Layer 2s are just glorified side hustles built on Ethereum’s back. You call it ‘scaling’? I call it outsourcing risk. ZK-Rollups sound fancy, but if your cryptographic proof fails, who’s liable? The devs? The users? The SEC? And don’t get me started on Polygon’s ‘7,000 TPS’-that’s only if you ignore the fact that their validators are run by a single VC firm in San Francisco. This isn’t decentralization. It’s rebranding.

Thank you for this clear breakdown. In India, we see so much hype around Solana and BSC, but rarely do people discuss trade-offs. The point about enterprise adoption and sub-second finality? Very true. Many startups here are testing Avalanche for supply chain apps. It’s not about crypto culture-it’s about real workflow efficiency. Also, the regulatory angle is critical. MiCA will force transparency, and that’s a good thing.

The hybrid model is the only logical path forward. Ethereum as the settlement layer, ZK-Rollups for transactions, Lightning for micropayments, and sidechains for gaming-it’s like an ecosystem, not a competition. This isn’t about winning. It’s about interoperability. And honestly? The fact that Bitcoin is now enabling asset issuance via Taproot? That’s quiet genius. No fanfare. Just utility.

Everyone’s acting like ZK-Rollups are magic. They’re not. They’re computationally insane. Most devs can’t even write them. And ‘near real-time finality’? That’s marketing. The actual latency is still 3-5 seconds. And no one talks about how much GPU power it takes to generate proofs. This isn’t scaling-it’s shifting the bottleneck.

Why do people keep pretending Layer 2s are safe? Remember when Polygon had that 4-hour outage? People lost MILLIONS. And now you’re telling me to trust a sidechain with fewer validators than my local coffee shop has customers? 😂

It is a well-documented fact that the notion of ‘scalability’ as a primary objective for blockchain networks represents a fundamental misalignment with the original cryptographic principles outlined in the Bitcoin whitepaper. The emphasis on throughput, rather than censorship resistance, constitutes a systemic deviation from the foundational ethos. One must question whether the pursuit of Visa-like performance is not, in fact, an act of epistemological capitulation to centralized financial paradigms.

Been using zkSync for my small crypto payments since last year. No drama. Fees are like 1 cent. And my grandma even used it to send money to her cousin in Delhi. She didn’t need to know what a ZK-proof is. Just scanned a QR code. That’s the real win-not the TPS number, but the human access.

Oh please. ‘Hybrid systems are winning’? More like ‘Ethereum’s monopoly is winning by letting others do the dirty work’. ZK-Rollups? Built on Ethereum. Lightning? Built on Bitcoin. Everyone’s just piggybacking. The real innovation? None. Just repackaging.

For anyone new to this: don’t overthink it. If you’re just sending crypto or buying NFTs, use Polygon or Arbitrum. If you’re locking up life savings in DeFi? Stick to Ethereum mainnet. Simple. No drama. The rest is noise. And yes, fees on mainnet still suck-but at least you know your money’s safe.

So… what happens when the whole system crashes because someone forgot to update a smart contract? 😭 I just lost my entire NFT collection because of a ‘minor upgrade’ on Polygon. I’m not even mad. I’m just… confused. Why does this keep happening?!

Reading this felt like finally understanding why my phone charger has three different cables. Layer 1, Layer 2, sidechains-it’s all just different plugs for the same power grid. We’re not building one future. We’re building a bunch of adapters. And honestly? That’s kind of beautiful.

Modular blockchains like Celestia are the next frontier. Separating consensus from execution? That’s the real scalability revolution. It’s not about making one chain faster-it’s about letting chains specialize. Think of it like a car factory where one supplier makes engines, another makes tires, and another assembles. That’s the future. Not monolithic chains. Not Layer 2s as band-aids. True modularity.

This is why I love crypto-everyone’s trying to solve the same problem in different ways. In South Africa, we use crypto to bypass banking delays. Speed matters. But so does trust. That’s why I use both Ethereum and Polygon. Ethereum for value, Polygon for daily use. It’s not either/or. It’s both. 🌍❤️