Blockchain History: How It All Started and Why It Matters Today

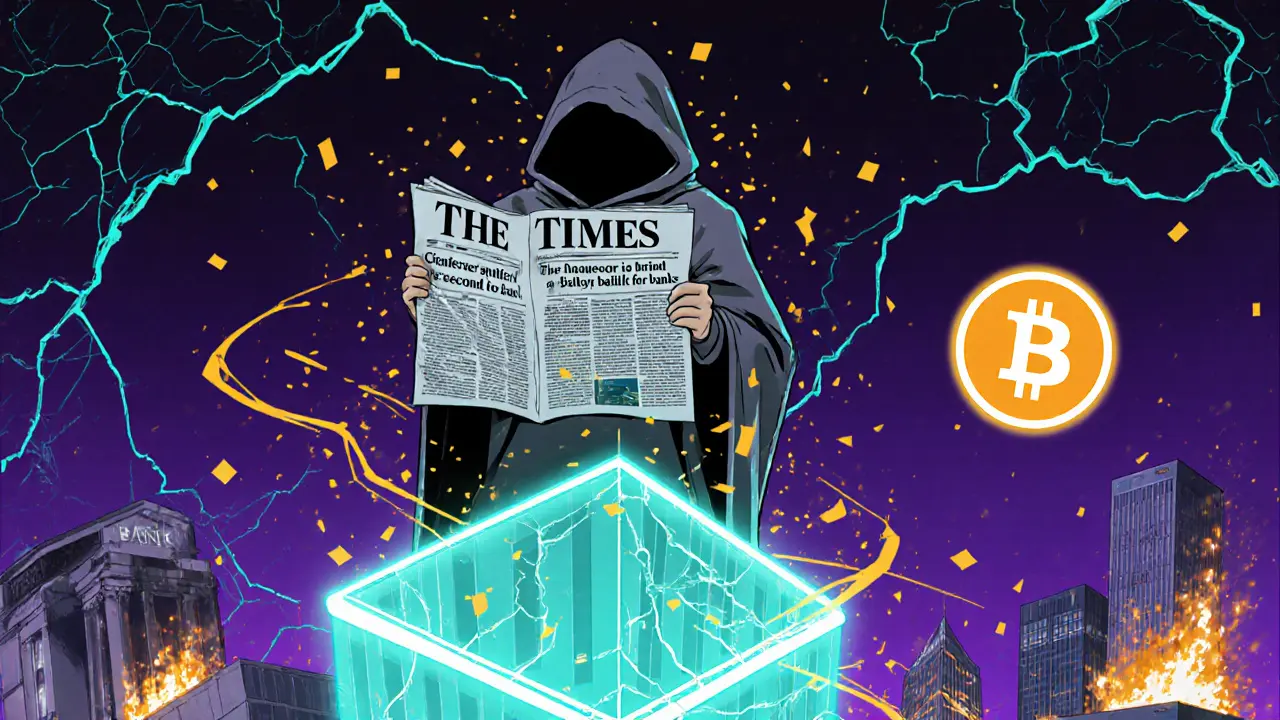

When you hear blockchain history, the timeline of how decentralized digital ledgers transformed money, trust, and data. Also known as distributed ledger technology, it began not in a lab, but as a solution to a problem no one else could fix: sending money without a bank. That problem was cracked in 2009 by someone using the name Satoshi Nakamoto, who published the Bitcoin whitepaper and launched the first blockchain. It wasn’t fancy. No investors. No press. Just a single block—Block 0—containing a message about a bailout. That was the quiet start of something that would shake finance, tech, and power structures worldwide.

Before blockchain, digital money had a fatal flaw: double-spending. You couldn’t prove someone didn’t reuse the same digital dollar. Blockchain fixed that by linking each transaction into a chain of verified blocks, spread across thousands of computers. No central server. No single point of failure. This wasn’t just a new way to store data—it was a new way to agree on truth. The Bitcoin, the first cryptocurrency built on blockchain proved it worked. But the real breakthrough came when developers realized the same system could run more than money. Enter Ethereum, a blockchain that lets developers build apps directly on top of it. Suddenly, blockchain wasn’t just for payments—it could power voting systems, supply chains, games, and even digital art. ERC-721 tokens, gas fees, DeFi protocols—all of it grew from that one idea: make the ledger programmable.

Today, blockchain history isn’t just about old news. It’s about understanding why some projects survive and others vanish. The same principles that made Bitcoin secure—decentralization, transparency, cryptographic proof—are still what separate real blockchain projects from hype. You see it in the rise of KYVE Network validating data across chains, or in how Tether Gold uses blockchain to represent physical gold. Even scams like fake airdrops and low-liquidity memecoins rely on the same tech, just twisted. Knowing the history helps you spot the difference.

What you’ll find below isn’t a textbook. It’s a collection of real stories—from how gas fees actually work, to why seed phrases matter more than passwords, to why Pakistan uses crypto as a lifeline. These aren’t abstract ideas. They’re the living results of blockchain history. And if you want to make smart moves in crypto today, you need to know where it came from.

- November 11, 2025

- Comments 25

- Cryptocurrency