Cryptocurrency Origin: How It All Started and What It Means Today

When we talk about cryptocurrency origin, the birth of digital money that operates without banks or central control. Also known as digital currency, it began not in a boardroom, but in a whitepaper posted by someone named Satoshi Nakamoto in 2008. That paper wasn’t just about money—it was a fix for a broken system. Before Bitcoin, digital payments relied on trusted third parties: banks, PayPal, credit card networks. If they failed, you lost your money. Cryptocurrency changed that by letting people send value directly to each other, verified by a global network of computers, not a single company.

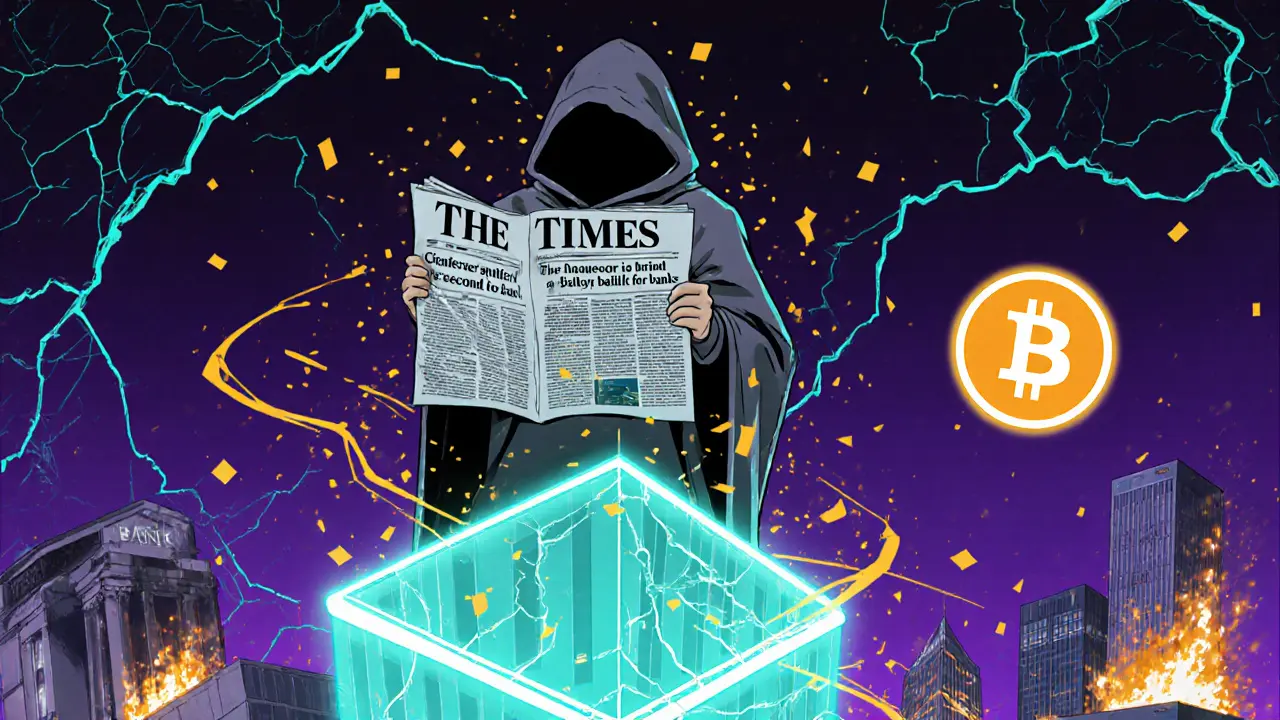

The first block of Bitcoin, called the Genesis Block, the very first transaction on the Bitcoin blockchain, mined on January 3, 2009, contained a hidden message: "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks." That wasn’t random. It was a statement. Cryptocurrency wasn’t meant to be a better version of traditional finance—it was meant to replace its weakest parts. Since then, the idea spread. New blockchains emerged, each trying to improve on Bitcoin’s design. Some focused on speed, others on privacy, others on smart contracts. But they all carried the same core idea: trustless, decentralized exchange.

Today, the blockchain history, the timeline of how digital ledgers evolved from Bitcoin to thousands of networks is full of experiments, failures, and breakthroughs. You’ve heard of Ethereum, Solana, Cardano—but they’re all children of that original Bitcoin idea. Even stablecoins like Tether Gold or tokens like KYVE, which power data storage on chains, trace their roots back to that first decentralized ledger. The digital currency evolution, how money moved from physical notes to encrypted tokens on global networks didn’t happen overnight. It was built by developers, skeptics, and early adopters who believed in a different kind of financial system.

Why does this matter to you? Because if you don’t understand where crypto came from, you won’t know what to look for today. A lot of coins promise the moon, but only a few are built on real principles from the origin. The ones that survive aren’t the ones with the flashiest websites or the loudest influencers—they’re the ones that solve real problems without relying on centralized control. That’s the thread connecting every post here: from gas fees and 2FA to airdrops and exchange scams. Every tool, risk, and opportunity in crypto today is shaped by that original idea: trust no one, verify everything.

Below, you’ll find real breakdowns of coins, exchanges, security mistakes, and scams—all rooted in the same truth: crypto didn’t start as a get-rich-quick scheme. It started as a rebellion. And if you want to navigate it safely, you need to know where it came from.

- November 11, 2025

- Comments 25

- Cryptocurrency