Mining Difficulty Formula: How Bitcoin and Crypto Networks Adjust Mining Complexity

When you hear about mining difficulty formula, the algorithm that controls how hard it is to mine new blocks on Proof of Work blockchains like Bitcoin. It’s not a fixed number—it changes automatically to keep block times steady, no matter how many miners join or leave the network. Without this formula, Bitcoin blocks would take minutes to mine during a hash rate boom, or hours during a crash. That’s not just inconvenient—it breaks the whole system.

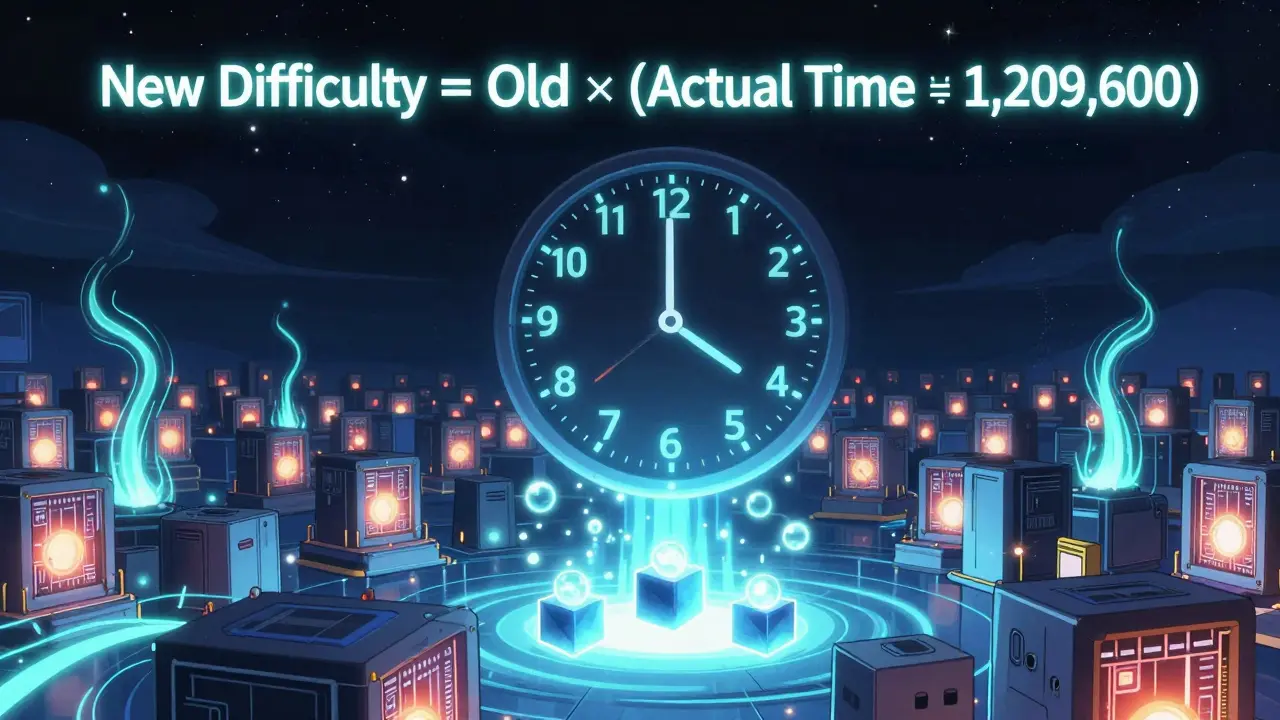

The Proof of Work consensus, the method that secures Bitcoin and other blockchains by requiring computational work to validate transactions relies on this balance. Every 2,016 blocks (roughly every two weeks), Bitcoin checks how long it took to mine those blocks. If it took less than two weeks, the mining difficulty adjustment, the process that increases or decreases the target hash value miners must solve goes up. If it took longer, it drops. This isn’t guesswork—it’s math. The formula uses a simple ratio: new difficulty = old difficulty × (actual time taken / expected time). Simple, but powerful.

It’s not just Bitcoin. Most major Proof of Work chains—like Litecoin, Bitcoin Cash, and even older Ethereum versions—use variations of this same formula. The goal is always the same: block time stability. If you’ve ever wondered why Bitcoin blocks come every 10 minutes even when mining rigs pop up overnight, that’s the formula doing its job. It’s why miners can’t just flood the network with hardware and take over. The system pushes back.

But here’s what most people miss: the formula doesn’t care who mines. It doesn’t care if it’s a farm in Texas or a warehouse in Kazakhstan. It only cares about total hash rate. That’s why sudden drops—like Angola’s mining ban in 2024—can trigger a sharp difficulty drop. And when hash rate surges, like after a new ASIC chip launches, difficulty climbs fast. The network adapts in real time, even if users don’t notice.

Some newer chains are experimenting with blockchain difficulty algorithm, real-time or dynamic difficulty adjustments that update much more frequently than every two weeks. These aim to smooth out volatility even more, especially during sudden market shifts or large-scale mining migrations. But Bitcoin sticks with its classic formula—not because it’s perfect, but because it’s proven.

What you’ll find below aren’t just technical deep dives. These posts show you how mining difficulty impacts real-world outcomes: why some airdrops failed because their chains couldn’t handle hash rate swings, how exchange security changes when mining becomes unprofitable, and why a sudden drop in difficulty can be a red flag—not a bonus. This isn’t theory. It’s the hidden engine behind every Bitcoin transaction, every miner’s paycheck, and every network’s survival.

- December 8, 2025

- Comments 18

- Cryptocurrency