Bitcoin Difficulty Adjustment Calculator

Calculate how Bitcoin's mining difficulty adjusts after 2,016 blocks based on actual time taken. The system uses a fixed formula with 400% max increase and 25% min decrease caps.

Bitcoin doesn’t care how many miners join the network or how powerful their machines become. Whether there are 100 miners or 10 million, it keeps producing blocks at roughly one every 10 minutes. That’s not magic. It’s math. And that math is called mining difficulty adjustment.

Why Bitcoin Needs to Adjust Difficulty

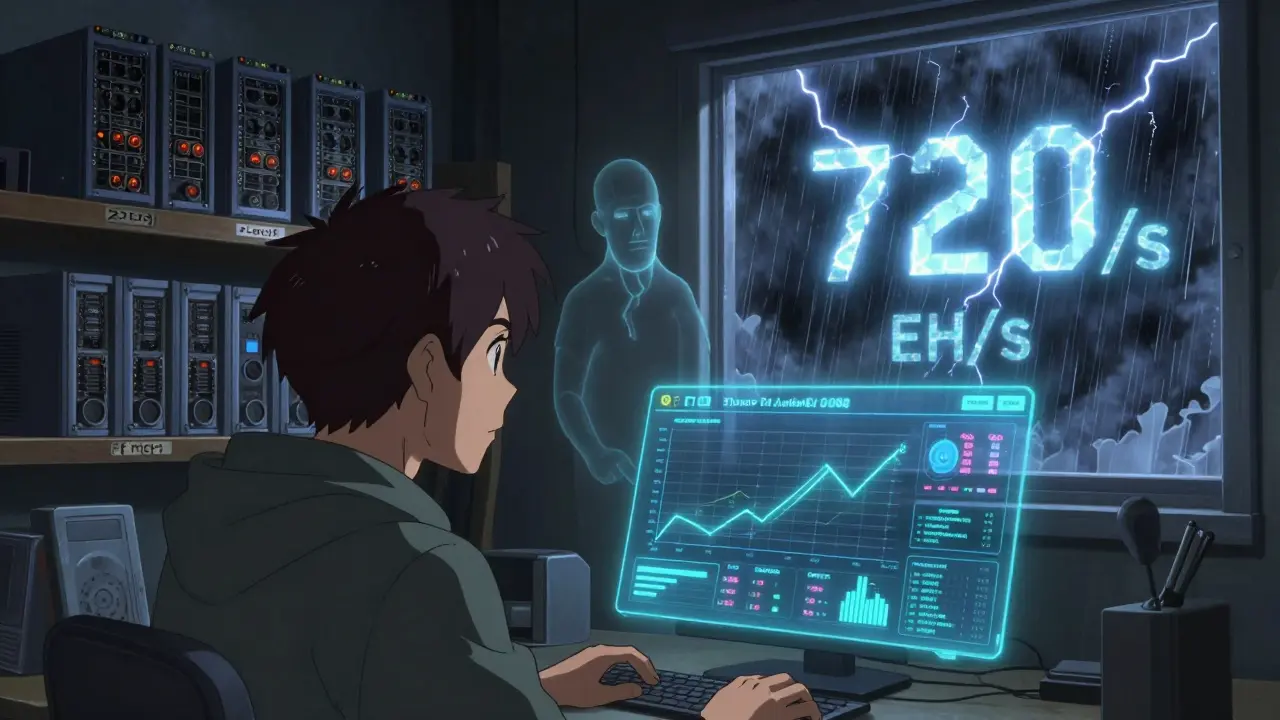

When Bitcoin started in 2009, mining was done on regular CPUs. A single laptop could find a block in hours. Today, the entire network churns through 720 exahashes per second - that’s 720 million billion calculations every second. If the difficulty stayed the same, blocks would be found in seconds, not minutes. That would break Bitcoin’s entire design. Bitcoin’s monetary supply is fixed. New coins are released every 10 minutes, on average. That’s the rhythm. If blocks came too fast, too many coins would be mined too soon. If they came too slow, transactions would pile up, and users would lose confidence. The difficulty adjustment is the invisible hand that keeps this rhythm steady, no matter how much computing power floods in or vanishes.How Often Does It Change?

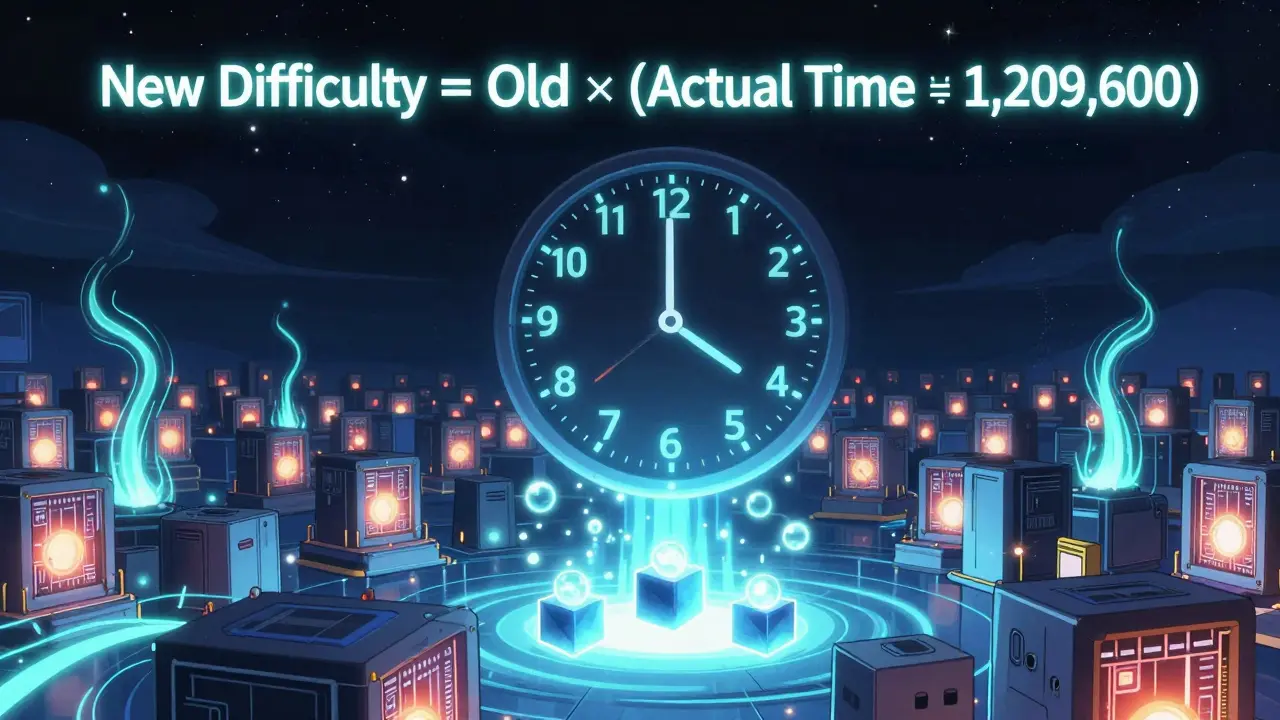

Bitcoin doesn’t adjust difficulty every hour or every day. It waits. Specifically, it waits for exactly 2,016 blocks to be mined. At that point, it looks back and asks: How long did that actually take? The ideal time for 2,016 blocks is 14 days - 10 minutes per block × 2,016 blocks = 1,209,600 seconds. If the last 2,016 blocks were mined in 13 days, the network was too fast. Difficulty goes up. If it took 16 days, the network was too slow. Difficulty goes down. This isn’t a guess. It’s a hard-coded formula:New Difficulty = Old Difficulty × (Actual Time Taken ÷ 1,209,600)

Simple. Precise. Unstoppable.But There’s a Cap - No Wild Swings

Here’s where Bitcoin shows its wisdom. It doesn’t let difficulty jump or crash too hard. Even if the network hash rate doubled overnight, difficulty can only increase by 400% - a 4x multiplier - in one adjustment. Same for drops: it can’t fall below 25% of the previous level. That’s a 75% max decrease. Why? Because sudden changes would wreck miners. Imagine your mining rig suddenly became 3x less profitable overnight. You’d shut it down. If the difficulty then dropped 75% the next cycle, you’d be left with useless hardware and no income. The cap smooths the ride. It gives miners time to react, upgrade, or exit.

Real-World Examples: When Difficulty Moved Big

The most dramatic adjustment happened in July 2021. China banned all crypto mining. Overnight, nearly half the world’s Bitcoin hash rate vanished. The network slowed down. Blocks took 15, 20, even 30 minutes to appear. When the 2,016-block cycle ended, difficulty dropped by 27.94% - the biggest cut ever. Miners who survived got a second wind. Their rigs, which were barely profitable before, suddenly became cash machines again. On the flip side, during the 2021 bull run, Bitcoin’s difficulty hit a record high of over 32 trillion. That’s 32 trillion times harder than the Genesis Block. Miners scrambled to buy the latest ASICs. Electricity contracts were renegotiated. Farms in Texas and Kazakhstan expanded. The system responded. And it still kept blocks at 10 minutes.What Happens to Miners When Difficulty Changes?

A 10% difficulty increase doesn’t just mean “harder mining.” It means your profit drops by 9.5% to 10.2%, assuming your electricity cost and Bitcoin price stay the same. That’s not a small hit. It’s the difference between making money and losing it. That’s why professional miners don’t just watch the price. They watch the difficulty trend like hawkers. They use algorithms to predict the next adjustment with 82% accuracy. They lock in cheap power deals that adjust with difficulty. Some even keep spare rigs in storage - not to mine now, but to flip on when difficulty drops. In 2022, after the Terra collapse, Bitcoin’s difficulty fell by 16%. That was a lifeline for miners with older S9 rigs. Those machines, which were costing more in electricity than they earned, suddenly turned profitable again. One miner on the Bitcoin Talk forum bought 150 used S19j Pros for $420 each during that window. He made 0.87 BTC in his first week.Is the System Perfect?

Not everyone thinks so. Some experts argue that adjusting every 2,016 blocks is too slow. With today’s volatility - big miners turning on and off in days, not weeks - the average block time has drifted from 10 minutes to about 9.97 minutes. That sounds close. But over time, those tiny deviations add up. In 2012, the average deviation was 1.2 minutes. In 2025, it’s 2.7 minutes. A proposal called Dynamic Difficulty Adjustment (DDA) suggests changing difficulty after every block. That would keep block times tighter. But miners hate it. Why? Because it would make planning impossible. If difficulty could swing wildly every 10 minutes, you couldn’t predict your costs or profits. You’d need to upgrade hardware every week. Smaller miners would get crushed. Bitcoin Core developers stand by the original design. They say: “We’ve seen no pathological cases in 16 years.” And they’re right. The system has survived a global ban, multiple bull and bear cycles, and a 320,000,000% increase in hash rate. It still works.

What’s the Bigger Picture?

This isn’t just about mining. It’s about trust. Bitcoin’s security comes from how hard it is to rewrite history. The higher the difficulty, the more computing power you need to attack the network. At 720 EH/s, a 51% attack would cost $18.7 billion - more than most countries spend on defense in a year. That’s why the difficulty adjustment is the backbone of Bitcoin’s security. It ensures that as more miners join, the network gets stronger. As miners leave, it doesn’t collapse - it just recalibrates. It’s self-correcting. Self-sustaining. And it’s done this for 16 years without a single change to the code. No patches. No updates. Just pure, unaltered mathematics.What Should New Miners Know?

If you’re thinking about mining Bitcoin today, forget the hype. Forget the “get rich quick” videos. This isn’t a lottery. It’s a business. You need to understand:- Electricity cost is your #1 expense. A $0.03/kWh rate vs. $0.08/kWh can mean profit or loss.

- Hardware efficiency matters. The latest S21 Hydros runs at 7.5 J/TH. Older S9s are over 100 J/TH. That’s a 13x difference in power use.

- Monitor difficulty trends. Use tools like Blockchain.com or BitInfoCharts to see where the curve is heading.

- Don’t buy hardware unless you’ve modeled profitability over the next 3 difficulty cycles.

- Have a plan for when difficulty rises. Can you upgrade? Can you relocate? Can you shut down and wait?

Final Thought: The Quiet Engine

Most people talk about Bitcoin’s price, its scarcity, its adoption. But the real hero is the difficulty adjustment. It’s the quiet engine that keeps everything running. It doesn’t make headlines. It doesn’t trend on Twitter. But without it, Bitcoin wouldn’t exist. It’s the reason the network still works after 16 years. The reason blocks still come every 10 minutes. The reason miners still show up, even when the price drops. The reason Bitcoin is more secure today than it was in 2009 - not because of fancy tech, but because of a simple, brilliant rule: adjust, don’t break.How often does Bitcoin mining difficulty change?

Bitcoin mining difficulty changes every 2,016 blocks, which takes about 14 days on average, assuming blocks are mined every 10 minutes. This is hardcoded into the Bitcoin protocol and happens automatically without any human intervention.

What happens if the network hash rate suddenly drops?

If the hash rate drops sharply - like after China’s 2021 mining ban - blocks take longer to mine. After 2,016 blocks, the difficulty automatically lowers by up to 75% to bring block times back to 10 minutes. This gives remaining miners a chance to stay profitable and keeps the network alive.

Can Bitcoin’s difficulty adjustment be hacked or manipulated?

No. The difficulty adjustment is calculated by every full node on the network using the same public formula. Miners can’t influence it. Even if a mining pool controlled 50% of the hash rate, they couldn’t change the difficulty calculation. It’s enforced by consensus - if a miner tries to submit a block with wrong difficulty, other nodes reject it.

Why is there a 4x limit on difficulty changes?

The 4x cap prevents sudden shocks to the mining ecosystem. Without it, a massive influx of miners could cause difficulty to spike 10x in one cycle, wiping out small miners overnight. Conversely, a sudden exit of miners could crash difficulty too fast, leading to inflationary pressure. The cap ensures gradual adjustments, giving the market time to adapt.

Does mining difficulty affect Bitcoin’s price?

Not directly. But there’s a strong indirect link. Rising difficulty usually means more miners are betting on Bitcoin’s future, which often coincides with rising prices. Conversely, falling difficulty can signal miner capitulation, which sometimes precedes price drops. But difficulty is a reaction to hash rate - not a cause of price changes.

What’s the difference between hash rate and difficulty?

Hash rate is the total computing power being used to mine Bitcoin - measured in exahashes per second (EH/s). Difficulty is a number that tells miners how hard it is to find a valid block. Difficulty adjusts based on hash rate to keep block times stable. Higher hash rate → higher difficulty. Lower hash rate → lower difficulty.

Can I calculate the next difficulty adjustment myself?

Yes. You can track the timestamp of the last 2,016 blocks using a blockchain explorer like Blockchain.com or Blockchair. Subtract the earliest timestamp from the latest to get the actual time taken. Divide that by 1,209,600 seconds (14 days). Multiply the result by the current difficulty. That gives you the projected next difficulty. Most mining pools and tools do this automatically for you.

Will Bitcoin ever change how difficulty is adjusted?

It’s unlikely. While proposals like Dynamic Difficulty Adjustment (DDA) exist, they face strong resistance from miners and core developers. The current system has worked flawlessly for 16 years, through every kind of market and technological shift. Bitcoin prioritizes stability over innovation. If it ain’t broke, don’t fix it.

Comments (18)