Yield Farming: How to Grow Crypto Returns

When you hear Yield Farming, the practice of locking crypto assets in decentralized finance protocols to earn interest and rewards. Also known as Liquidity Mining, it has become a core way to boost crypto portfolios.

Yield Farming lives inside the broader world of DeFi, decentralized platforms that run on smart contracts without a central authority. To pull off a farm you usually need to Stake, deposit or lock tokens in a smart contract to support network operations and earn rewards. Some seasoned farmers even use Flash Loans, instant, uncollateralized loans that must be repaid within a single blockchain transaction to amplify returns or arbitrage price gaps. These three pieces—DeFi platforms, staking mechanics, and flash‑loan techniques—form the backbone of modern Yield Farming.

Key Concepts Behind Yield Farming

Understanding Yield Farming means looking at a few clear attributes. The Yield Farming reward type can be native protocol tokens, governance tokens, or a share of transaction fees. Lock periods range from a few minutes on automated market makers to several weeks on fixed‑income pools. Risk level is a function of smart‑contract security, token volatility, and the infamous impermanent loss that hits liquidity providers when market prices drift.

Another crucial player is DAO Treasury Management, the process of governing, allocating, and reporting funds in decentralized autonomous organizations. A well‑run DAO treasury can fund new farm incentives, cover insurance for smart‑contract bugs, or rebalance token allocations, directly influencing the attractiveness of a farm. For example, when a DAO decides to boost a liquidity pool’s APY, farmers flock to that pool, driving up total value locked and, consequently, the protocol’s security.

Yield Farming also intersects with Liquidity Mining, the act of providing assets to a pool and earning extra tokens as a reward for adding depth to the market. While the terms are often used interchangeably, liquidity mining emphasizes the market‑making benefit, whereas Yield Farming highlights the broader strategy of stacking multiple reward sources across platforms.

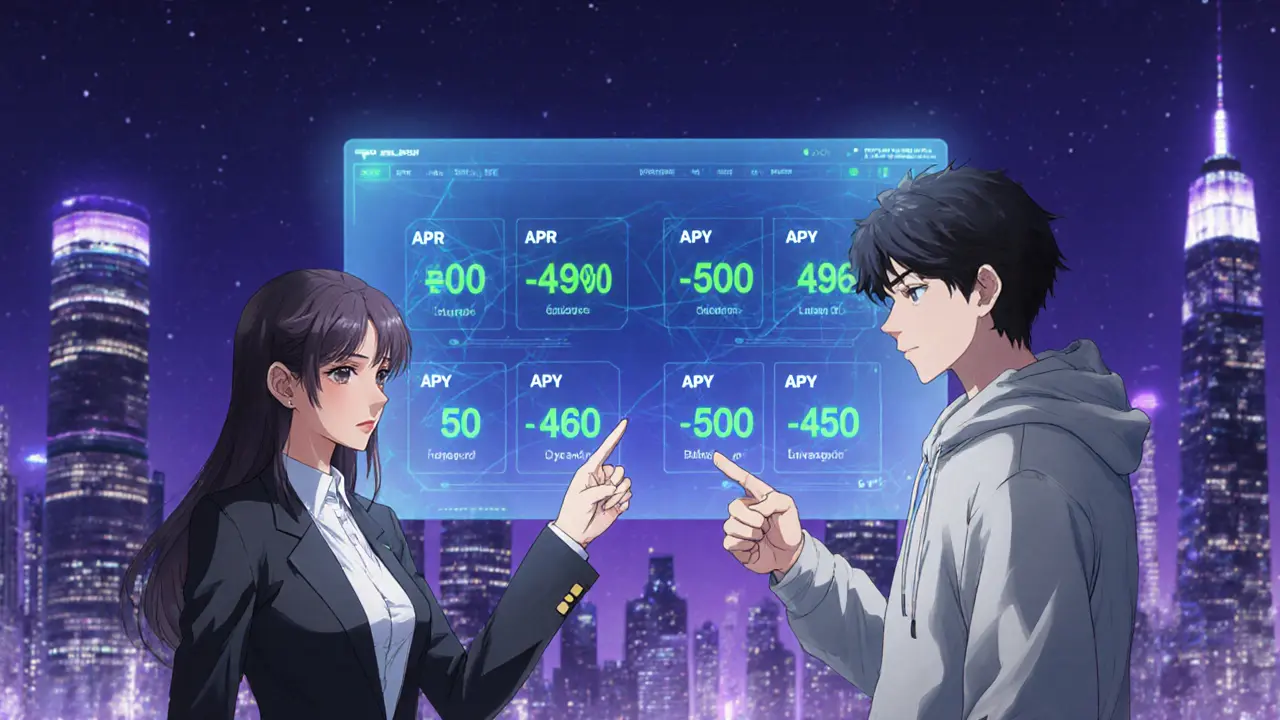

Practical steps to start include picking a reputable DeFi platform, checking its audit reports, and calculating the net APY after fees. Tools like blockchain explorers, on‑chain analytics dashboards, and DeFi aggregators help you compare farms in real time. Always keep an eye on tokenomics—how many tokens are allocated for farming, the vesting schedule, and any anti‑whale mechanisms that could affect future yields.

In short, Yield Farming sits at the intersection of DeFi innovation, staking discipline, and smart‑contract risk management. Below you’ll find a curated set of articles covering everything from flash‑loan tactics and DAO treasury best practices to deep‑dive reviews of specific farms and airdrop opportunities. Dive in to sharpen your strategy, avoid common pitfalls, and make the most of the booming crypto yield landscape.

- October 13, 2025

- Comments 22

- Cryptocurrency

APY vs APR: Decoding Yield Farming Returns

- February 2, 2025

- Comments 21

- Cryptocurrency