Bitcoin Difficulty Adjustment: How Mining Resets Itself to Keep Block Times Stable

When you mine Bitcoin, the network doesn’t care how many miners are online—it just wants a new block every 10 minutes. That’s where the Bitcoin difficulty adjustment, a automatic system that changes how hard it is to mine Bitcoin every 2,016 blocks. It’s not manual. It’s not political. It’s code running on every node, silently recalibrating to keep the rhythm steady. If miners suddenly flood the network with more power—say, after a price surge—the difficulty jumps up. If miners shut off their rigs during a crash, it drops. No one controls it. No company owns it. It just happens.

This system is built on Proof of Work consensus, the mechanism that secures Bitcoin by requiring real computational effort to add blocks. Without difficulty adjustments, blocks would come too fast when hash power rises, overwhelming the network. Too slow, and payments stall. The adjustment keeps things in balance. It’s why Bitcoin can survive massive swings in mining activity—from China’s 2021 crackdown to the 2024 Bitcoin halving. The network adapts without breaking.

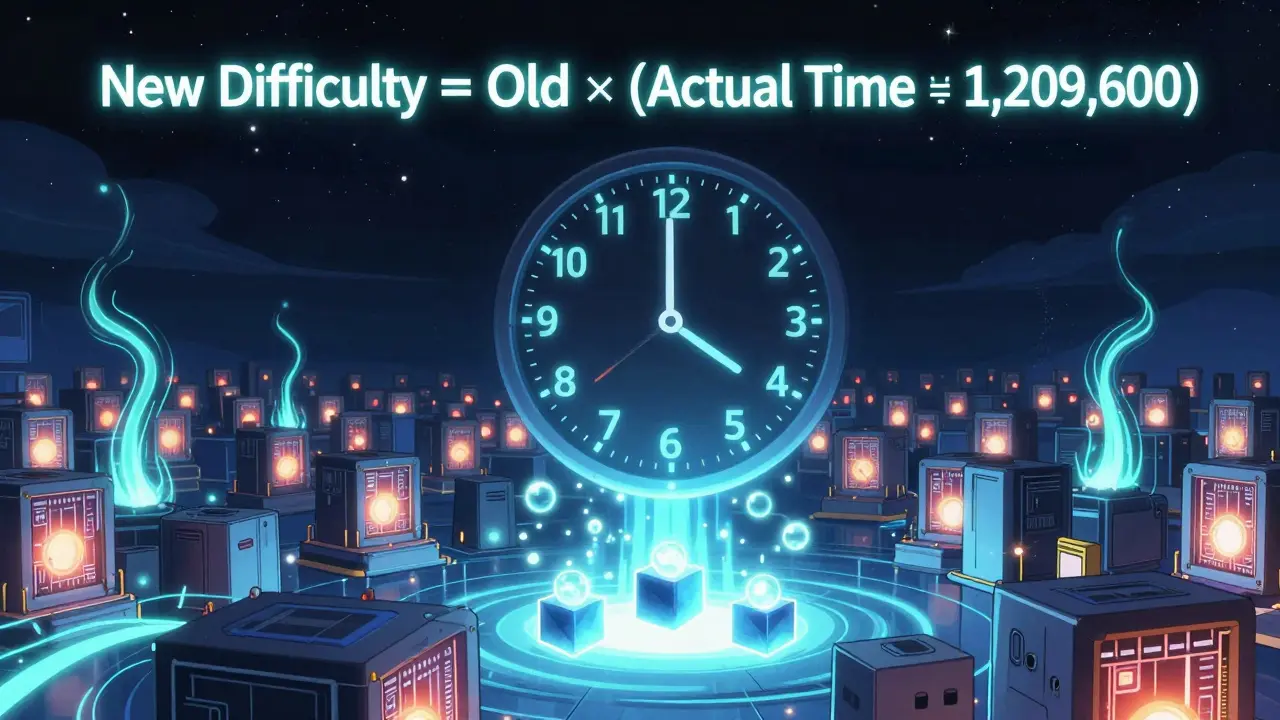

Related to this is the mining difficulty algorithm, the specific formula that calculates the next target based on the time it took to mine the last 2,016 blocks. It’s not a guess. It’s math: total time divided by 20,160 minutes (14 days). If it took 12 days, difficulty goes up 16.7%. If it took 16 days, it drops 12.5%. Simple. Predictable. Unstoppable.

What you won’t find in this collection are hype-filled guides about "crushing" the difficulty or "beating" the system. You’ll find real analysis: how Taproot changed mining efficiency, why Angola banned mining during an energy crisis, how adaptive difficulty models are being tested on other chains, and why some airdrops pretend to be tied to mining rewards when they’re not. You’ll see how security, energy use, and network health all tie back to this one quiet, automatic process.

Bitcoin’s difficulty adjustment isn’t flashy. But it’s the reason the network still works after 15 years of crashes, booms, and global crackdowns. If you understand this, you understand Bitcoin’s resilience. Below, you’ll find posts that dig into what happens when the adjustment goes wrong, how miners plan around it, and why some projects try—and fail—to copy it.

- December 8, 2025

- Comments 18

- Cryptocurrency