Bitcoin Hash Rate: What It Is, Why It Matters, and How It Shapes Crypto Security

When you hear Bitcoin hash rate, the total computational power being used to mine Bitcoin and secure its network. It's not just a number—it's the heartbeat of Bitcoin's security. Every second, billions of calculations happen across thousands of machines trying to solve complex puzzles. The higher the hash rate, the harder it is for attackers to take over the network. This isn't theory—it's what keeps your Bitcoin safe from double-spending and 51% attacks.

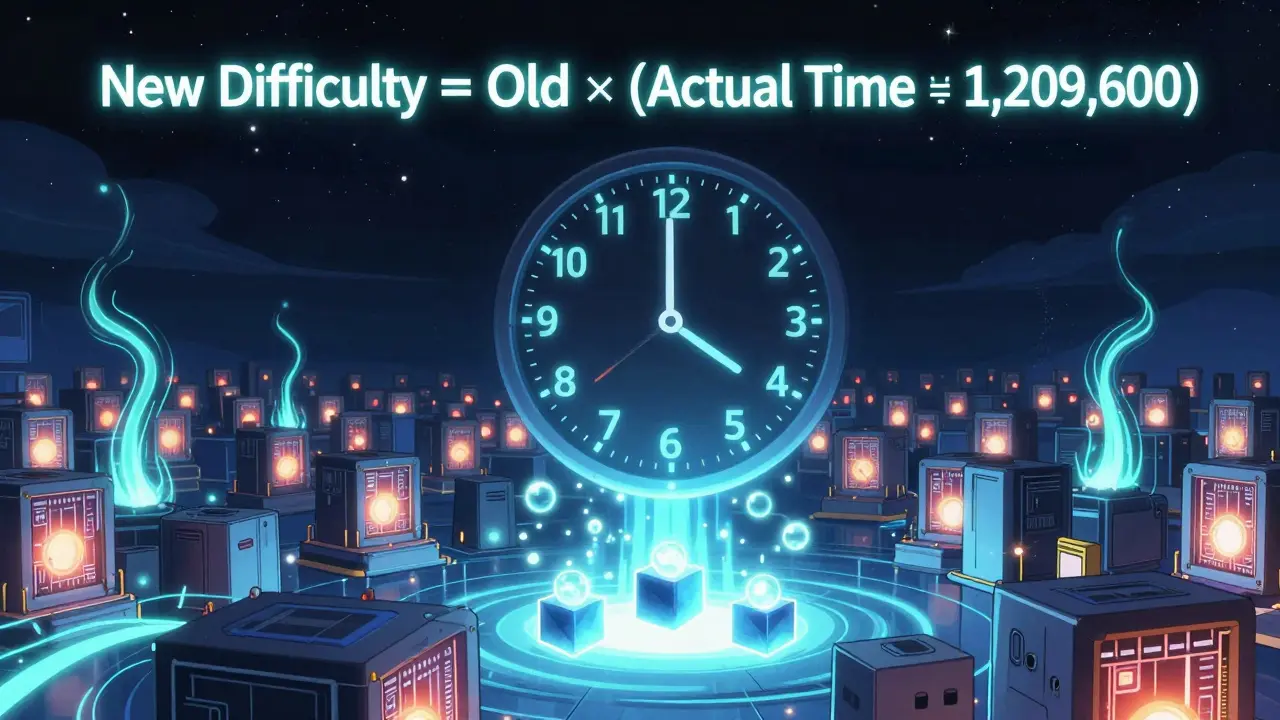

That hash rate doesn’t exist in a vacuum. It’s directly tied to mining difficulty, how hard the network makes the puzzles miners must solve. Every two weeks, Bitcoin adjusts this difficulty based on how much total power is online. If miners leave, difficulty drops. If new machines flood in—like when Bitcoin hits a new price high—difficulty spikes. That’s why Proof of Work, the consensus mechanism that powers Bitcoin’s security through computational effort is so energy-intensive. It’s designed that way: the more power you throw at it, the more secure it becomes.

And here’s the catch: when hash rate drops, the network gets vulnerable. That’s what happened in 2024 when Angola banned crypto mining to stop blackouts. Suddenly, Bitcoin’s global hash rate dipped by 10% overnight. It didn’t break—but it reminded everyone that security isn’t automatic. It’s bought with electricity, hardware, and stable policy. The same logic applies when mining becomes too expensive. If miners can’t profit, they shut off. Hash rate falls. Risk rises. That’s why tracking hash rate isn’t just for miners—it’s for every Bitcoin holder. A rising hash rate means stronger security. A falling one? That’s a red flag.

You’ll find posts here that dig into how hash rate connects to real-world events: from the Taproot upgrade that made transactions more efficient to adaptive mining difficulty systems that respond in real time. You’ll also see how scams and shutdowns—like Angola’s crackdown or dead projects like Bird Finance—can ripple through the network’s stability. These aren’t random stories. They’re all pieces of the same puzzle: how Bitcoin stays secure, who keeps it running, and what happens when the power goes out.

- December 8, 2025

- Comments 18

- Cryptocurrency