Ethereum Hard Fork: What It Is, Why It Matters, and What You Need to Know

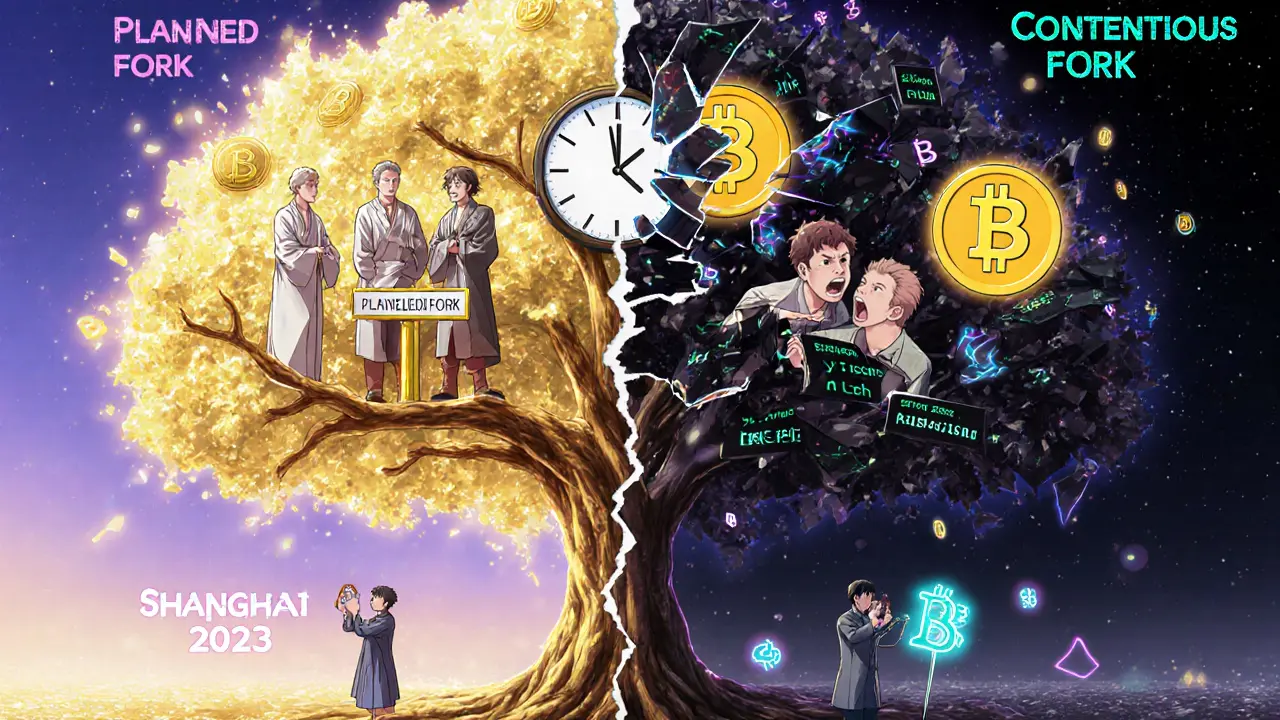

When Ethereum hard fork, a permanent split in the Ethereum blockchain that creates two separate versions of the network, often triggered by major protocol changes or security emergencies. Also known as Ethereum network upgrade, it’s not just a software update—it’s a vote among users, developers, and miners about how the network should evolve. Unlike a soft fork, which keeps everything backward-compatible, a hard fork forces everyone to upgrade or get left behind. If you hold ETH and don’t update your node or wallet, you’re stuck on the old chain—and that chain might vanish overnight.

Hard forks happen for real reasons. In 2016, after the DAO hack stole $60 million, Ethereum’s community chose to reverse the theft with a hard fork. That split created Ethereum (ETH) and Ethereum Classic (ETC). Fast forward to 2022, and the Merge wasn’t a fork—but it changed how Ethereum works forever, killing proof-of-work and slashing energy use by 99.95%. Now, future forks like the Surge or Verge aim to make Ethereum faster, cheaper, and more scalable. These aren’t theoretical ideas—they’re coded into the protocol, tested in testnets, and rolled out with real money at stake.

When a hard fork hits, your crypto doesn’t automatically double. You don’t get free ETH and ETC forever. What you get is choice: stay on the main chain, or follow the minority chain—but only if you actively move your assets. Most wallets handle it automatically, but if you’re holding ETH on an exchange or a non-custodial wallet during a fork, you need to know what’s happening. Exchanges like CoinTR or APROBIT usually support the main chain and credit you accordingly. But if you’re using a sketchy platform like Exenium, you could lose access entirely.

Hard forks also expose how fragile the ecosystem can be. When Angola banned crypto mining over blackouts, or North Korea stole billions to fund weapons, the underlying blockchain had to keep running. Ethereum’s hard forks are how the network adapts to survive—not just hackers, but regulations, energy crises, and user demands. That’s why understanding them isn’t just for devs. It’s for anyone who holds ETH, uses DeFi, or trades NFTs on Ethereum. A fork can change gas fees, break smart contracts, or even wipe out a token’s value overnight.

That’s why the posts below cover what really happens during these events. You’ll find deep dives into how Ethereum upgrades affect your wallet, why some forks fail, and how scams pretend to offer "free ETH" after a fork. You’ll also see how tools like eBTC and Alvara Protocol rely on Ethereum’s stability—and what happens when that stability gets shaken. Whether you’re new to crypto or have been holding since 2017, knowing how a hard fork works means you won’t be caught off guard when the next one drops.

- November 27, 2025

- Comments 18

- Cryptocurrency