Blockchain Fork Type Checker

Analyze any blockchain fork scenario to determine if it was planned or contentious based on community consensus and coordination.

Fork Scenario Analysis

Answer the following questions about the blockchain fork to determine whether it was likely planned or contentious.

When a blockchain changes its rules, it doesn’t just update like a phone app. It splits. And how that split happens-whether it’s planned or fought over-determines everything: the network’s stability, its value, and even whether developers keep working on it.

What Exactly Is a Blockchain Fork?

A fork happens when the blockchain’s code changes, creating two versions of the ledger. Think of it like a tree branch splitting. One path keeps going with the old rules. The other follows the new ones. There are two main types: soft forks and hard forks. Soft forks are backward-compatible-old nodes can still read new blocks. Hard forks aren’t. They require everyone to upgrade, or they get left behind.But the real difference isn’t technical. It’s human.

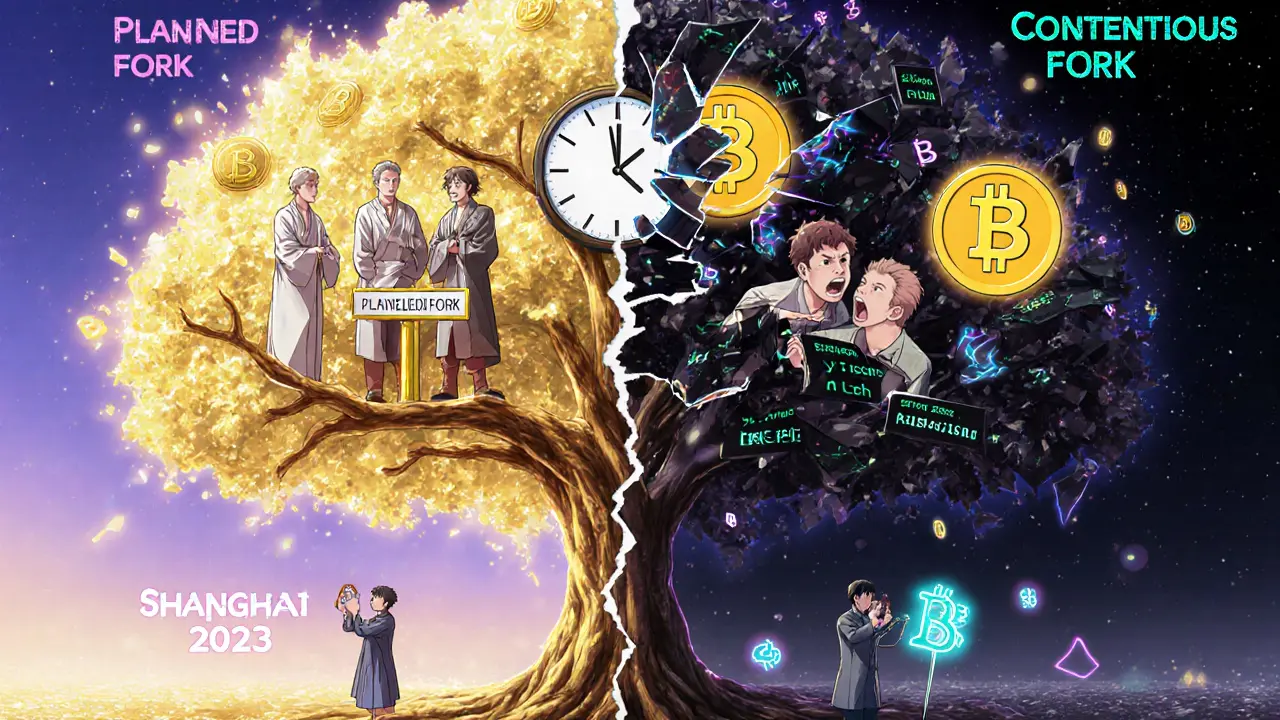

Planned Forks: The Quiet Upgrades

Planned forks are like scheduled maintenance on a highway. Everyone knows when it’s coming. Signs go up. Detours are mapped. Workers show up on time. Ethereum has done this 12 times since 2015. Each one-Byzantium, Istanbul, Shanghai-was announced months in advance. Developers, exchanges, wallet providers, miners-they all got the memo.The Shanghai upgrade in April 2023 let users withdraw staked ETH. It wasn’t flashy. No protests. No memes. Just a clean, coordinated switch at block 19,455,453. Over 99.5% of nodes upgraded within 24 hours. That’s not luck. It’s governance.

How do they pull this off? Ethereum uses EIPs-Ethereum Improvement Proposals. Anyone can submit one. But it goes through public review, testing on testnets, and votes by core developers. If it passes, it’s added to the roadmap. This process takes 12 to 18 months. It’s slow. But it works.

Result? Ethereum’s market cap grew from $18 billion before Byzantium in 2017 to over $550 billion before the Merge in 2022. No chain split. No confusion. Just steady progress.

Contentious Forks: The Public Breakup

Contentious forks are messy. They happen when people can’t agree. No vote. No consensus. Just a hard line drawn.The most famous example is Bitcoin Cash. In 2017, a group of Bitcoin miners and developers wanted bigger blocks-8MB instead of 1MB-to handle more transactions. Others said that would centralize power in the hands of big miners. The debate got ugly. Reddit threads exploded. BitcoinTalk forums filled with 12,000+ posts. On August 1, 2017, the fork happened.

Bitcoin stayed. Bitcoin Cash was born. But the split wasn’t clean. Only 55% of hash power went to Bitcoin. The rest went to Bitcoin Cash. Exchanges had to decide: which chain to support? Some listed both. Users got confused. Coinbase users complained about duplicate assets. One in three negative reviews mentioned “I lost money because I didn’t know which chain was which.”

Today, Bitcoin’s market cap is around $800 billion. Bitcoin Cash? $1.2 billion. That’s 0.15%. The original chain kept almost all the value. The fork? A ghost town. Bitcoin SV, another fork from Bitcoin Cash, processes just 1,200 transactions a day. Bitcoin does 300,000.

Contentious forks don’t just split the chain-they split the community. Developers get divided. Support teams are overwhelmed. And the new chain? It’s often abandoned within years.

Why Planned Forks Win

Planned forks aren’t just cleaner-they’re smarter.They keep the network unified. Exchanges don’t have to scramble. Wallets don’t break. Users don’t lose funds. Ethereum’s Berlin hard fork in 2021 cut transaction fees by 20-30% without a single user noticing anything wrong. That’s the gold standard.

Enterprise adoption favors planned forks too. Of the 432 Fortune 500 companies using blockchain, 92% stick to networks like Ethereum Enterprise or Hyperledger-systems built on scheduled upgrades. No one in corporate IT wants to deal with a fork that creates two versions of their ledger.

Even regulators notice. The SEC said in 2022 that tokens created by contentious forks might be new securities. That means legal risk. Bitcoin Cash faced multiple investigations. Ethereum? No issues.

What Happens When a Fork Goes Wrong?

Contentious forks don’t just fail-they drain energy.After the Bitcoin Cash fork, developers had to rewrite over 1,200 lines of code. They had to rebuild tools, wallets, explorers. And for what? A chain that now has 147 active developers-down 63% from its peak in 2018. Meanwhile, Ethereum has over 4,300 contributors.

And then there are replay attacks. When you send ETH on the Ethereum chain, the same transaction can be replayed on Ethereum Classic (after the 2016 DAO fork). That’s how $1.2 million got stolen in 2017. Planned forks avoid this because there’s only one chain.

Even the community notices. On Reddit, 87% of comments about Ethereum’s Shanghai upgrade were positive. One user wrote: “No drama, just execution.” Compare that to Bitcoin Cash’s forums in 2017-half the posts were anger, confusion, or regret.

What’s Next for Forks?

Forks aren’t disappearing. But they’re changing.Ethereum’s Merge in 2022 was the most complex planned fork ever-switching from proof-of-work to proof-of-stake. Over 99.98% of nodes upgraded. No split. No chaos.

Now, Ethereum’s roadmap includes Prague (Q2 2024), which will let users interact with wallets using usernames instead of long addresses. Again-planned. Again-coordinated.

Meanwhile, newer chains like Polkadot are trying something radical: forkless upgrades. They change code on the fly, without splitting the chain. It’s like updating Windows without rebooting. So far, they’ve done 12 upgrades without a single fork.

According to Gartner, by 2025, 90% of major blockchains will have formal governance-meaning contentious forks will drop by 75% from 2020 levels.

So What Should You Care About?

If you’re holding crypto, you need to know the difference.Planned forks mean your asset is growing. Upgrades make it faster, cheaper, more secure. You don’t have to do anything. The network handles it.

Contentious forks? They’re a red flag. They mean the project can’t agree on its future. The original chain keeps the value. The fork? It’s a gamble. Most fail. A few become niche projects. Very few thrive.

Look at the numbers. Ethereum’s ecosystem thrives because it plans. Bitcoin Cash’s ecosystem shrinks because it fought.

The lesson isn’t about technology. It’s about people. Blockchains don’t run on code. They run on trust. Planned forks build trust. Contentious forks destroy it.

What’s the difference between a planned fork and a contentious fork?

A planned fork is a coordinated upgrade agreed on by the community, with advance notice and full network support. Everyone upgrades together, and the blockchain continues as one chain. A contentious fork happens when the community splits over a disagreement-no consensus, no coordination. Two separate blockchains emerge, often with one fading over time.

Can a contentious fork ever succeed?

Rarely. Most contentious forks lose value, developers, and users over time. Bitcoin Cash, for example, started with hype but now holds less than 0.2% of Bitcoin’s market cap. The only exceptions are cases like Ethereum Classic, which preserved the original chain after the DAO hack-but even that chain has far less activity and value than Ethereum.

Why do exchanges support both chains after a contentious fork?

Exchanges often support both chains to avoid alienating users who believe in the new fork. But this creates confusion. Users might accidentally send funds to the wrong chain, or get duplicate assets they didn’t ask for. Many users complain about this, and it’s one reason why exchanges now prefer networks with planned forks.

Do planned forks cost money to implement?

Yes, but the cost is shared and planned. Developers, auditors, and infrastructure providers all contribute resources over months or years. The Ethereum Foundation funds core development. Exchanges and wallet providers prepare ahead of time. The total cost is high, but it’s predictable. Contentious forks are cheaper to start but far more expensive to maintain-because they fragment support and create ongoing technical debt.

Are soft forks the same as planned forks?

No. Soft forks are a technical type of upgrade that’s backward-compatible-old nodes can still validate new blocks. Planned forks are a governance process. Most planned forks are hard forks, but not all hard forks are planned. Soft forks can be planned (like Bitcoin’s SegWit) or even contentious (if miners disagree on signaling). The key difference is coordination, not technical type.

How can I tell if a blockchain uses planned or contentious forks?

Check its history. If it’s had multiple major upgrades without chain splits-like Ethereum, Cardano, or Solana-it’s likely planned. If you see multiple competing chains (Bitcoin, Bitcoin Cash, Bitcoin SV), it’s had contentious forks. Also look at governance: projects with public GitHub proposals, developer forums, and upgrade roadmaps are planned. Projects with sudden, unannounced splits are contentious.

Comments (18)

Let’s be real-planned forks are just corporate propaganda dressed up as decentralization. Ethereum’s ‘governance’ is a cabal of Vitalik’s inner circle voting on EIPs like it’s a boardroom at Goldman Sachs. Where’s the real decentralization? Nowhere. It’s centralized control with a blockchain veneer. The ‘99.5% upgrade rate’? That’s because exchanges and miners are forced to comply or get delisted. This isn’t progress-it’s authoritarian efficiency.

bitcoin cash was the real deal. they wanted more txs, you wanted your crypto to be a store of value like digital gold. who cares if it’s 0.15% market cap? at least we kept the original vision. ethereum is just a glorified smart contract platform for wall street bots. you call that progress? i call it surrender.

I’ve watched this space for nearly a decade, and the real lesson here isn’t about code-it’s about community. Planned forks work because people listen. They don’t just shout louder. Ethereum didn’t win because it was technically superior-it won because it gave space for dissent, tested ideas, and built consensus even when it was slow. That’s rare in any system, digital or human. We need more of that kind of patience.

just wanted to say thank you for writing this. i’ve been holding eth since 2020 and never really understood why forks mattered until now. the shanghai upgrade was so smooth i didn’t even notice. that’s the kind of magic you don’t get from drama. keep it simple, keep it steady.

One must distinguish between technical architecture and sociotechnical governance. The hard fork as a mechanism is neutral; its outcome is determined by the epistemic community’s capacity for coordination. Ethereum’s EIP process exemplifies a Hayekian spontaneous order emerging through iterative feedback loops, whereas Bitcoin Cash’s fork reflects a Hobbesian rupture-where power, not protocol, dictates legitimacy. The market cap differential is not merely economic-it is a metric of institutional trust.

This is one of the clearest explanations I’ve read on blockchain forks. The comparison to highway maintenance is spot on. I come from Nigeria where we’ve seen too many political ‘forks’-no coordination, just chaos. Seeing a technical system manage change so calmly gives me hope. Thank you for this.

planned forks = less stress

contentious forks = more headaches

simple as that

It’s funny how we think technology is the hero here. But really, it’s the human willingness to delay gratification, to wait, to listen-that’s what made Ethereum survive. We’re so used to instant upgrades, instant wins. But real stability? That’s built slowly. And honestly? That’s the most revolutionary thing here.

Let me break this down with real numbers and context. Ethereum’s planned forks are not just about code-they’re about ecosystem alignment. Every EIP goes through 3 stages: discussion on GitHub, testing on Goerli/Sepolia testnets for 4-6 months, then a 6-week activation window where validators and exchanges are notified via multiple channels including Discord, email, and even community AMAs. This isn’t magic-it’s engineering discipline. Compare that to Bitcoin Cash, where the fork was announced on a single Reddit thread by a miner with 300k hash power. No testnet. No audit. Just a ‘we’re doing it’ tweet. That’s why 80% of the developers left within a year. Also, the replay attack risk? Real. I lost $1,200 in 2017 because I didn’t know which chain my wallet was on. Don’t let anyone tell you forks are ‘just technical.’ They’re financial landmines.

man i remember when btc cash dropped. everyone was losing their minds. i just sat back and watched. now i laugh. the original chain kept the value, the new one got the noise. same story every time.

oh please. ‘planned forks build trust’? yeah right. ethereum’s ‘planned’ upgrades are just a way to make you feel safe while they quietly drain your liquidity with gas fees and MEV. they’re not building trust-they’re building a cult of compliance. and you’re all drinking the Kool-Aid.

thanks for sharing this. i used to think forks were just tech stuff. now i see how much emotion and trust is involved. it’s kind of beautiful, actually. like a team deciding how to move forward together.

forks are not the problem. bad people are. if you can’t agree, you shouldn’t be on the same chain. simple.

the quiet upgrades are the real win. no headlines. no drama. just better tech. that’s how you build something that lasts.

planned forks? more like planned control. they say ‘everyone upgrades’ but what if you don’t have the resources? what if you’re a small node operator? they don’t care. they just want you to obey. this isn’t freedom. it’s corporate blockchain with a smiley face.

The philosophical underpinning here is profound. A blockchain is not merely a ledger-it is a social contract encoded in mathematics. Planned forks represent the maturity of that contract: the willingness of a community to evolve without rupture. In contrast, contentious forks reveal the fragility of consensus. This mirrors the evolution of democratic institutions: the most resilient systems are those that adapt through deliberation, not revolution. Ethereum’s governance model, flawed as it may be, demonstrates a rare capacity for collective self-correction-a trait we should cherish in an age of fragmentation.

oh wow, so ethereum is the ‘good’ blockchain now? because it’s boring? congratulations, you’ve just described the most expensive bank in history. next you’ll tell me ‘proof of stake is green’-as if mining energy is the only thing that matters. what about the carbon cost of 4,300 devs pushing EIPs? or the fact that 92% of Fortune 500 companies use private chains? this isn’t innovation-it’s branding.

Planned forks are a trap. The Ethereum Foundation controls the roadmap. The ‘community votes’ are curated. The testnets are run by their partners. The ‘99.98% upgrade rate’? That’s because nodes are forced to upgrade via centralized infrastructure providers like Infura and Alchemy. This isn’t decentralization. It’s a controlled demolition of alternatives. Watch what happens when they fork again to ban privacy tools. The ‘trust’ they speak of? It’s manufactured.