SEC Nigeria Crypto Guidelines Explained

When working with SEC Nigeria crypto guidelines, the regulatory framework released by Nigeria's Securities and Exchange Commission that defines how crypto businesses must operate, obtain licenses, meet anti‑money‑laundering (AML) standards and pay taxes. Also known as Nigeria crypto regulation, it sets the baseline for every exchange, wallet provider and crypto‑related service provider in the country. If you’re a financial institution, a startup, or a trader, these rules determine whether you can stay in the market or face penalties. Below we break down the big pieces that make up the whole picture.

VASP Licensing and What It Means for Crypto Firms

The next key piece is VASP licensing, the Virtual Asset Service Provider licence that every crypto business must secure from the SEC before offering services like exchange, custody or payment processing. This licence is not a one‑size‑fits‑all; there are two tracks – the standard route and the Accelerated Registration and Inspection Programme (ARIP) that speeds up approval for firms with solid compliance records. The process demands a minimum capital base, audited financial statements, and a clear governance structure. Getting the VASP licence is the first step to legitimize your operation, unlock banking relationships, and gain trust from users.

Alongside licensing, AML/KYC compliance, the set of procedures that require crypto firms to verify customer identities, monitor transactions and report suspicious activity to Nigerian authorities is non‑negotiable. The SEC insists on a risk‑based approach: you must run real‑time screening, keep detailed records for at least five years, and integrate with the Financial Intelligence Unit’s reporting platform. Failure to meet these standards can trigger heavy fines or revocation of your VASP licence. AML/KYC also feeds directly into the tax engine; clean data makes it easier to calculate and remit crypto‑related taxes.

Taxation is the third pillar that ties everything together. Under the guidelines, any profit from crypto trading, staking or mining is treated as capital gains and subject to a flat rate of 10%. The SEC works with the Federal Inland Revenue Service to enforce quarterly reporting, and firms must embed tax calculations into their back‑office systems. Proper tax handling not only avoids penalties but also reinforces your AML/KYC posture, because accurate reporting proves you’re not facilitating illicit flows.

Finally, banks and other financial institutions are forced to adapt. The guidelines require them to perform enhanced due diligence on crypto customers, limit exposure to high‑risk tokens, and maintain separate accounting lines for crypto‑related funds. This creates a clearer bridge between traditional finance and digital assets, paving the way for smoother fiat‑crypto conversions. SEC Nigeria crypto compliance is therefore a multi‑layered effort that spans licensing, AML/KYC, tax filing and banking cooperation. Below you’ll find a curated collection of articles that walk you through each of these steps, share real‑world examples, and give you the actionable insights you need to stay compliant in 2025.

- November 25, 2025

- Comments 24

- Cryptocurrency

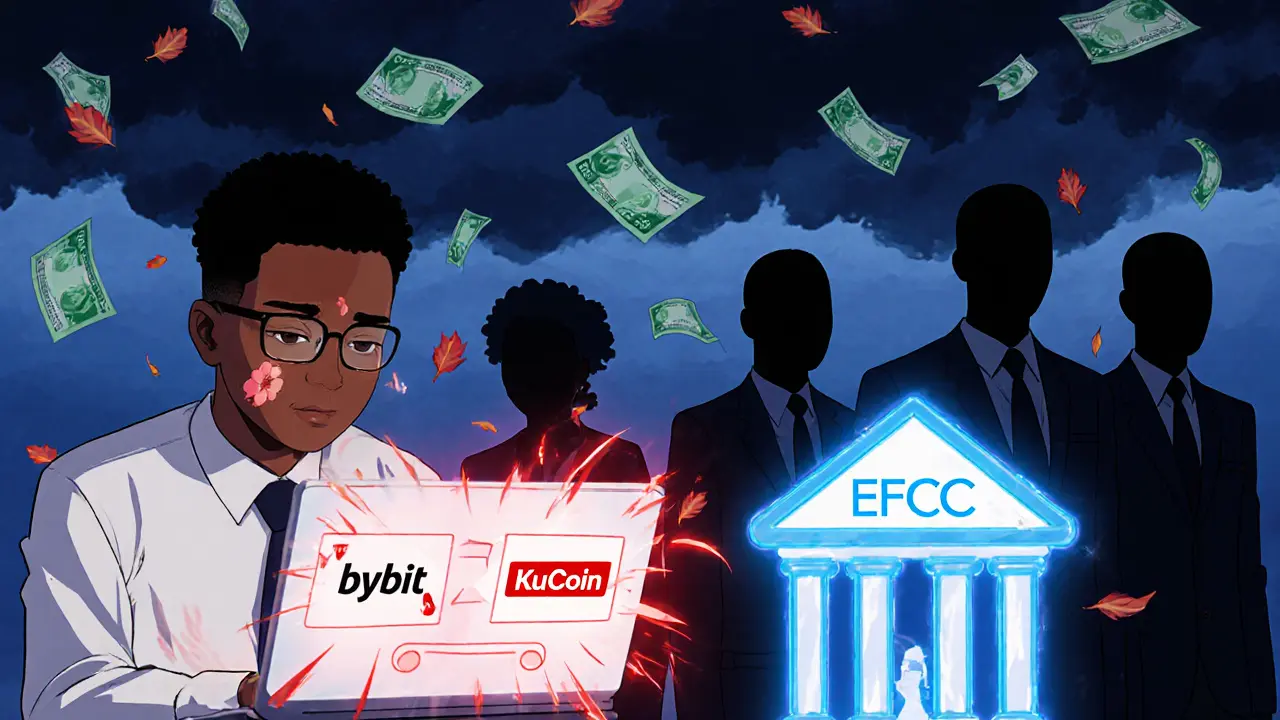

Crypto Exchanges to Avoid if You Are Nigerian in 2025

- November 23, 2024

- Comments 20

- Cryptocurrency