Bitcoin Mining Difficulty: What It Is and Why It Matters

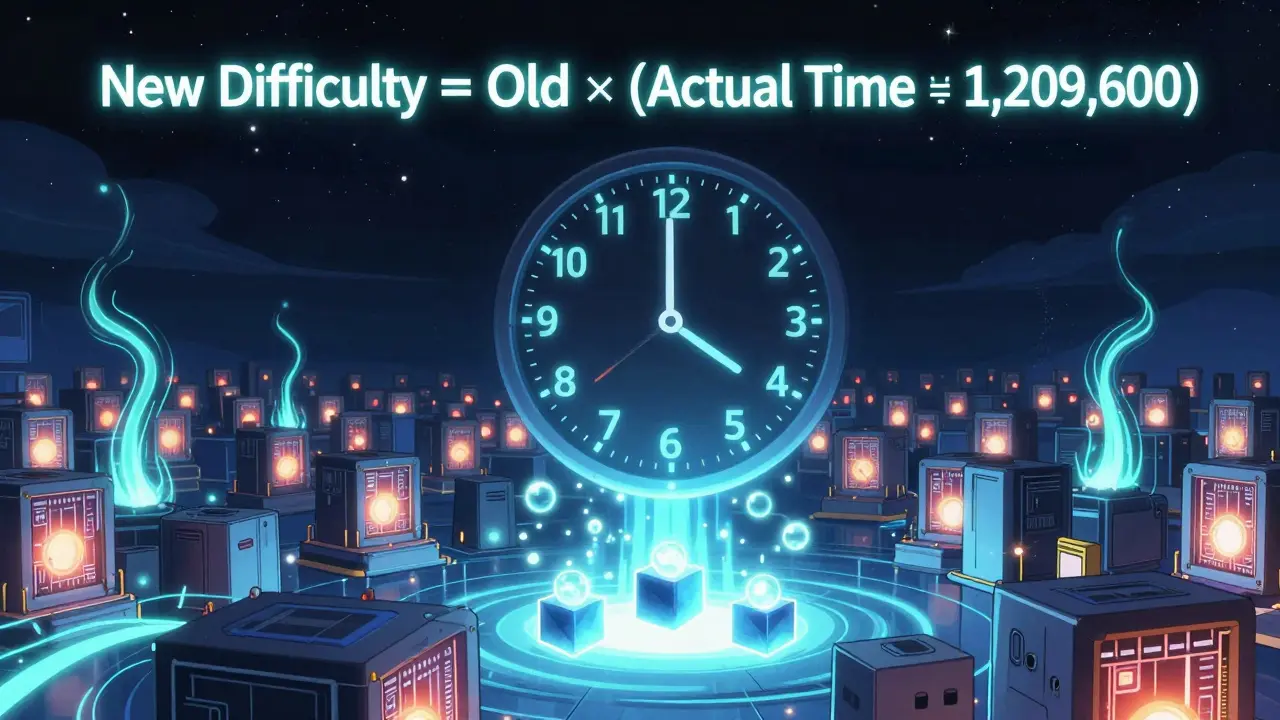

When you hear about Bitcoin mining difficulty, the measure of how hard it is to find a new Bitcoin block by solving a cryptographic puzzle. It's not just a number—it's the heartbeat of Bitcoin's security. Every two weeks, this number automatically changes to make sure a new block is found roughly every ten minutes, no matter how many miners join or leave the network. If more computing power floods in, the difficulty goes up. If miners shut off their machines, it drops. This isn’t magic—it’s code designed to keep Bitcoin stable.

This system relies on another key concept: hash rate, the total computing power being used to mine Bitcoin. As more miners join, the hash rate climbs, and the difficulty rises to match it. That’s why Bitcoin has never slowed down, even as mining moved from home PCs to massive data centers in places like Texas and Kazakhstan. The network doesn’t care who’s mining—it only cares that blocks come in on time. This constant adjustment is what makes Bitcoin resistant to centralization. If one group tried to take over, the difficulty would spike so high it would cost them more than they could earn. And that’s why Bitcoin network security, the strength of Bitcoin’s consensus mechanism against attacks—is directly tied to mining difficulty. The higher the difficulty, the more expensive it is to fake transactions or reverse payments. A 51% attack isn’t impossible, but with today’s difficulty levels, it would cost billions. That’s not a flaw—it’s the whole point. Mining difficulty also affects profitability. If you’re a miner, you need hardware that can keep up. If the difficulty jumps and your machine can’t compete, you lose money. That’s why miners watch the difficulty adjustments like weather forecasts—they plan their next move based on it.

What you’ll find below are real stories about how mining difficulty shapes everything—from the rise and fall of mining farms in Angola, to the hidden tech upgrades like Schnorr signatures that make transactions more efficient, to scams pretending to offer easy mining rewards. These aren’t theory pieces. They’re grounded in what’s actually happening on the network. Whether you’re curious why mining bans happen, how forks affect competition, or why some crypto projects vanish overnight, the answers all tie back to this one number: Bitcoin mining difficulty. It’s the invisible force holding Bitcoin together. And you need to understand it to avoid getting left behind.

- February 13, 2026

- Comments 15

- Cryptocurrency

Understanding Nonce in Bitcoin Mining

- December 8, 2025

- Comments 18

- Cryptocurrency

How Bitcoin Adjusts Mining Difficulty to Maintain Block Time

- December 4, 2025

- Comments 24

- Cryptocurrency